JPX Monthly Headlines

JPX group companies undertake various initiatives and disseminate information with the aim of providing the most attractive markets to all users.

Every month, we showcase the highlights of these efforts in short and concise summaries just for you.

March

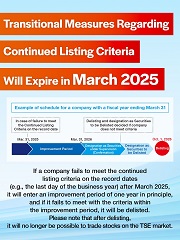

Mar. 1: Expiration of Transitional Measures Regarding Continued Listing Criteria

In April 2022, when Tokyo Stock Exchange, Inc. restructured the market, some of the continued listing criteria were made stricter than those of the previous market. Therefore, for companies listed before the market restructuring, relaxed criteria have been applied as a transitional measure.

From the record dates falling on or after March 1, 2025, the regular continued listing criteria will be applied.

If a company fails to meet the continued listing criteria, it will enter an improvement period of one year in principle (six months for trading volume criteria), and if it fails to meet the criteria within the improvement period, it will be assigned to Securities Under Supervision or Securities to be Delisted (six months in principle), then be delisted.

Mar. 7:JPX Data Services to be Offered on Snowflake

JPX Market Innovation & Research, Inc. announced that J-Quants Pro datasets will be offered on Snowflake's data cloud later in March 2025.

J-Quants Pro is a service that offers corporate users with Japanese financial market data.

In addition to existing API and SFTP, subscribers will be able to access datasets via Snowflake at no additional cost.

Moving forward, users can expect an expanding array of JPX data services available on Snowflake.

Mar. 8: JPX Once Again Supports “Ring the Bell for Gender Equality”

March 8 is designated as International Women’s Day by the United Nations and every year, exchanges around the globe hold a "Ring the Bell for Gender Equality" ceremony. This year, JPX held a bell-ringing ceremony together with the event’s organizers and JPX executives and employees.

At this year’s bell-ringing ceremony, Moriyuki Iwanaga, President and CEO of Tokyo Stock Exchange, gave welcome remarks, and in addition to messages from the organizers, there was a panel discussion with Toshiyuki Imamura, Managing Director, Responsible Investment & Start-up Investment at Nomura Asset Management Co., Ltd./Women in ETFs Japan Chapter; Atsuko Kakihara, Director at Kawasaki Heavy Industries, Ltd.; Atsuko Itoh, Executive Director at East Japan Railway Company; and Masanori Yoshida, Executive Officer at JPX.

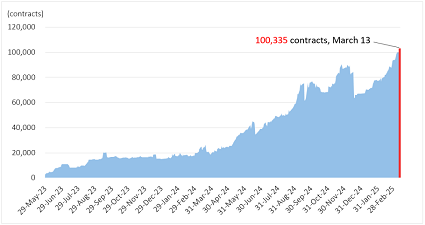

Mar. 13: 3-Month TONA Futures Open Interest Surpasses 100,000 Contracts, Setting a New Record

3-Month TONA Futures, which started trading on Osaka Exchange (OSE) on May 29, 2023, achieved an open interest milestone of more than 100,000 contracts on March 13, 2025. Following changes in monetary policy, JPY interest rates are once again on the move. The investor base is expanding with more domestic and international financial institutions entering the market to hedge against further interest rate hikes. Trading and clearing fees for 3-Month TONA Futures will be half-off until September 30, 2025.

Mar. 26: Formulation of Medium-Term Management Plan 2027

We at Japan Exchange Group (JPX) have decided on our "Medium-Term Management Plan 2027," which covers the three years from fiscal year 2025. Looking ahead to 2030, we have set a long-term vision to "contribute to sustainable societal and economic development by evolving into a global, comprehensive finance and information platform which provides solutions for a wide range of societal issues, centered on the ability to raise and circulate capital." We consider the three years from fiscal year 2025 as the second stage in achieving this long-term vision.

In our "Medium-Term Management Plan 2027," we will strictly maintain our customer-oriented, "market-in" approach based around societal issues and user needs and continue to actively venture into new fields while developing the foundations we have built in the first stage (Medium-Term Management Plan 2024). Additionally, as a core infrastructure of Japan's financial and capital markets, we will aim to increase the value we provide to society, such as by providing strong support for the promotion of Japan as a leading asset management center, while enhancing trust in the market and in JPX Group.