Follow-up of Market Restructuring

With the expiration of the transitional measures, the regular continued listing criteria are being applied from record dates of decisions on the continued listing criteria (hereinafter referred to as "record dates") that fall on or after March 1, 2025.

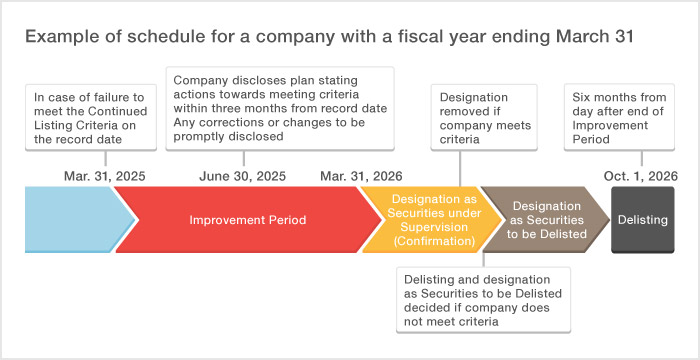

If a company falls into a situation where it fails to meet the continued listing criteria, it will enter an improvement period of one year in principle (six months for trading volume criteria), and if it fails to meet the criteria within this period, it will be delisted after a period of designation as a Security Under Supervision/Security to be Delisted (six months in principle).

Please note that after delisting, a company's stocks are no longer available for trading on the TSE markets.

- ・However, as of March 31, 2023, if a company has disclosed a plan to meet the continued listing criteria (“Conformance Plan”) with an end date that goes beyond the first record date that falls on or after March 1, 2026, the company’s securities shall be designated as Securities Under Supervision after the end of the improvement period and said designation shall continue until the company is confirmed to meet or not meet the criteria at the end of its plan.

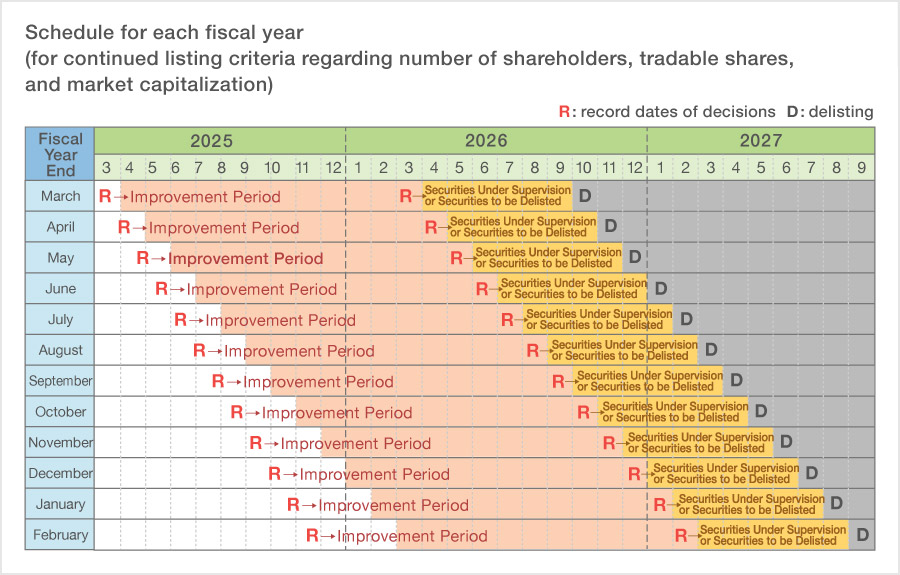

Schedule for each fiscal year (for continued listing criteria regarding number of shareholders, tradable shares, and market capitalization)

Companies in an Improvement Period

Please refer to the following page for the list of companies that failed to meet the regular continued listing criteria and fall under an improvement period.

- ・Companies with a business year end date of the end of March will be included in the list sequentially from around mid-April to mid-June.

Securities Under Supervision/Securities to be Delisted

Please see the below page for a list of issues that have reached the end of their improvement periods and been designated as Securities Under Supervision, or as Securities to be Delisted after delisting is decided.

- ・Companies with a fiscal year ending in March will be designated as Securities Under Supervision (Confirmation) from April 1. Confirmation of whether they meet the continued listing criteria will then be made around mid-April to mid-June. At this point, if the criteria are met, the designation will be lifted, and if the criteria are not met, delisting will be decided and they will be designated as Securities to be Delisted. (This does not apply to companies that have disclosed a Conformance Plan.)

- ・If a listed company has applied for a segment transfer as of the last day of its improvement period, it will be designated as a Security Under Supervision (Examination) from the day after the improvement period to the end of the examination. At this point, if it meets the criteria for segment transfer, it will be transferred, and if it does not, delisting will be decided and it will be designated as a Security to be Delisted.

FAQ Regarding Expiration of Transitional Measures

For answers to frequently asked questions from investors regarding the expiration of transitional measures, please see this document.

Information for Listed Companies

Please see the below for an explanation of procedures for Prime Market or Growth Market listed companies wishing to transfer to the Standard Market.

Reference: Continued Listing Criteria in Each Market Segment

| Prime Market | Standard Market | Growth Market | ||||

|---|---|---|---|---|---|---|

| Regular Criteria | Under Transitional Measures | Regular Criteria | Under Transitional Measures | Regular Criteria | Under Transitional Measures | |

| Number of Shareholders | 800 or more | No transitional measures | 400 or more | 150 or more | 150 or more | No transitional measures |

| Number of tradable shares | 20,000 units or more | 10,000 units or more | 2,000 units or more | 500 units or more | 1,000 units or more | 500 units or more |

| Tradable share market capitalization | JPY 10 billion or more | JPY 1 billion or more | JPY 1 billion or more | JPY 0.25 billion or more | JPY 0.5 billion or more | JPY 0.25 billion or more |

| Tradable share ratio | 35% or higher | 5% or higher | 25% or higher | 5% or higher | 25% or higher | 5% or higher |

| Trading Value/Volume | Daily average trading value: 20 million yen or more |

Monthly average trading volume: 40 units or more |

Monthly average trading volume: 10 units or more |

No transitional measures | Monthly average trading volume: 10 units or more |

No transitional measures |

| Market Capitalization | - | - | - | - | JPY 4 billion or more (applicable from 10 years after initial listing) | JPY 0.5 billion or more (applicable from 10 years after initial listing) |

For more information on each of the listing maintenance criteria, please refer to the following page.