Details of Continued Listing Criteria

Number of Shareholders

"Number of Shareholders" refers to the number of persons who own one or more units of shares, etc.

An examination of status as of the last day of the fiscal year is conducted annually.

Number of Shareholders in Continued Listing Criteria

| Number of Shareholders | |

| Prime Market | 800 or more |

| Standard Market | 400 or more |

| Growth Market | 150 or more |

- When a listed company does not meet the Continued Listing Criteria within one year after failing to meet the Continued Listing Criteria, the listed company becomes subject to the Delisting Criteria.For the details of Delisting Criteria, please see the pages below.

Delisting Criteria

- Transitional measures regarding continued listing criteria will expire and the regular continued listing criteria will be applied from record dates of decisions on the continued listing criteria that fall on or after March 1, 2025. For the details of the the expiration of transitional measures, please see the pages below.

The Expiration of Transitional Measures

Calculation Method

- An examination is conducted by reviewing the "Table of Distribution of Stocks, etc." and the "Annual Securities Report" as of the last day of the fiscal year.

- The number of shareholders shall be calculated by taking into account share split, gratis allotment of shares, share consolidation, or a change in the number of shares constituting one unit when TSE deems necessary to do so.

- When a resolution is passed for the disposition of treasury shares transferred to a specific person, the number of shareholders shall be calculated on the premise that such person holds such treasury shares.

- When stocks whose beneficiaries are bank-operated trust businesses are included in an investment trust managed under instructions from the settlor or corporate investment fund, and a listed company submits a document stating matters specified by TSE within three months following a record date, etc., trustees can be treated as shareholders holding stocks pertaining to such investment trust or investment fund.

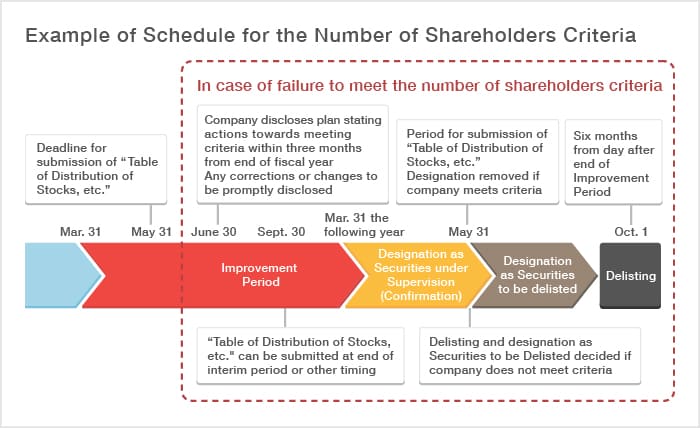

Example of Improvement Period Schedules (for a company whose fiscal year ends in March)

If a company fails to meet the continued listing criteria, it will enter an improvement period, and if it fails to meet with the standards within the improvement period, it will be assigned to Securities Under Supervision or Securities to be Delisted and then delisted.

In addition, the companies that failed to meet the continued listing criteria are required to disclose their plans to meet the continued listing criteria and the timing of implementation of actions to do so within three months of the record date.

- ・However, as of March 31, 2023, if a company has disclosed a plan to meet the Continued Listing Criteria (“Conformance Plan”) with an end date that goes beyond the first record date that falls on or after March 1, 2026, the company’s securities shall be designated as Securities Under Supervision after the end of the improvement period and said designation shall continue until the company is confirmed to meet or not meet the criteria at the end of its plan.

Please see the “List of Companies in an Improvement Period” for companies that fall under the improvement period and the “List of the End Dates of Conformance Plan” for companies disclosing the conformance plan with an end date that goes beyond the first record date that falls on or after March 1, 2026.