Details of Continued Listing Criteria

Trading Value / Trading Volume

Trading Value in the Continued Listing Criteria

| Daily Average Trading Value | |

| Prime Market | JPY 20 million or more |

- When a listed company does not meet the Continued Listing Criteria within one year after failing to meet the Continued Listing Criteria, the listed company becomes subject to the Delisting Criteria. For the details of Delisting Criteria, please see the pages below.

Delisting Criteria

- Transitional measures regarding continued listing criteria will expire and the regular continued listing criteria will be applied from record dates of decisions on the continued listing criteria that fall on or after March 1, 2025. For the details of the the expiration of transitional measures, please see the pages below.

The Expiration of Transitional Measures

- ・Please see the below "Trading Volume in Continued Listing Criteria" for the details of "monthly average trading volume."

Calculation Method of Trading Value

- The daily averages of trading values on TSE throughout the year up to the last day of December every year will be examined.

- The trading value (one month total) of each issue is available in the Monthly Quotations (Stock Quotations) published on the JPX website.

Monthly Quotations

- ・In order to determine whether or not the continued listing criteria have been met, please refer to the "Auction" column of "Trading Value" in the “Monthly Quotations (Stock Quotations),” as the trading value of auction trading at TSE is used for such determinations. However, since "Auction” does not include the traded value of when-issued transactions, if there are any such transactions, please add the traded value shown in “When-Issued Transactions Quotations" for the calculation. (Calculation formula: "Auction" + “When-Issued Transactions Quotations")

When referring to “Monthly Quotations (Stock Quotations)” in and/or before February 2023, subtract "ToSTNeT trading value" and traded value of off-auction distributions and add traded value of when-issued transactions to the traded value shown in "Trading Value". (Calculation formula: "Trading value" - "ToSTNeT trading value" - "Off-auction distributions" + "When-issued transactions") - ・ The daily average is the trading value divided by the number of business days of the TSE.

Trading Volume in the Continued Listing Criteria

| Average Monthly Trading Volume | |

|---|---|

| Standard Market | 10 units or more |

| Growth Market |

- When a listed company does not meet the Continued Listing Criteria within six months after failing to meet the Continued Listing Criteria, the listed company becomes subject to the Delisting Criteria.

Calculation Method of Trading Volume

- Monthly averages of trading volumes in auction trading at TSE for the six months up to the last days of June and December every year will be examined.

- Trading volume (one month total) of each issue is available in the Monthly Quotations (Stock Quotations) published on the JPX website.

Monthly Quotations

- ・In order to determine whether or not the continued listing criteria have been met, please refer to the "Auction" column of "Trading Volume" in the “Monthly Quotations (Stock Quotations),” as the trading volume of auction trading at TSE is used for such determinations. However, since "Auction” does not include the traded volume of when-issued transactions, if there are any such transactions, please add the traded volume shown in “When-Issued Transactions Quotations" for the calculation. (Calculation formula: "Auction" + “When-Issued Transactions Quotations")

When referring to “Monthly Quotations (Stock Quotations)” in and/or before February 2023, subtract "ToSTNeT trading volume" and traded volume of off-auction distributions and add traded volume of when-issued transactions to the traded volume shown in "Trading Volume". (Calculation formula: "Trading volume" - "ToSTNeT trading volume" - "Off-auction distributions" + "When-issued transactions")

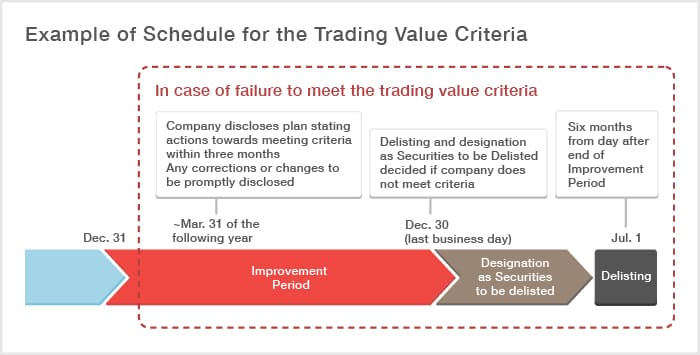

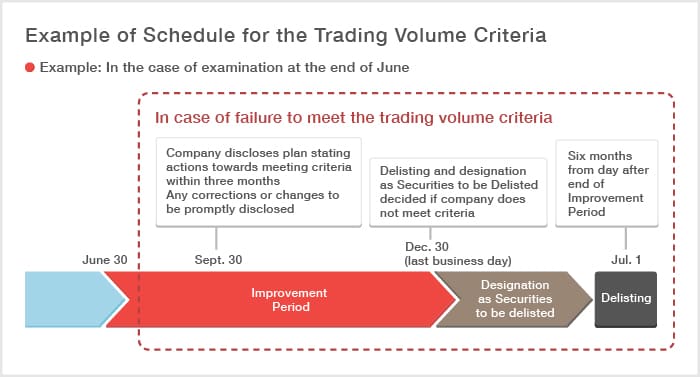

Example of Improvement Period Schedules

If a company fails to meet the continued listing criteria, it will enter an improvement period, and if it fails to meet with the standards within the improvement period, it will be assigned to Securities Under Supervision or Securities to be Delisted and then delisted.

In addition, the companies that failed to meet the continued listing criteria are required to disclose their plans to meet the continued listing criteria and the timing of implementation of actions to do so within three months of the record date.

- ・However, as of March 31, 2023, if a company has disclosed a plan to meet the Continued Listing Criteria (“Conformance Plan”) with an end date that goes beyond the first record date that falls on or after March 1, 2026, the company’s securities shall be designated as Securities Under Supervision after the end of the improvement period and said designation shall continue until the company is confirmed to meet or not meet the criteria at the end of its plan.

Please see the “List of Companies in an Improvement Period” for companies that fall under the improvement period and the “List of the End Dates of Conformance Plan ” for companies disclosing the conformance plan with an end date that goes beyond the first record date that falls on or after March 1, 2026.