Details of Continued Listing Criteria

Tradable Shares

Tradable Shares in the Continued Listing Criteria

| Prime Market | Standard Market | Growth Market | |

| Number of Tradable Shares | 20,000 units or more | 2,000 units or more | 1,000 units or more |

| Tradable Share Market Capitalization | JPY 10 billion or more | JPY 1 billion or more | JPY 0.5 billion or more |

| Tradable Share Ratio | 35% or higher | 25% or higher | 25% or higher |

- An examination is conducted by reviewing the "Table of Distribution of Stocks, etc." and the "Annual Securities Report."

- The status as of the last day of each fiscal year is examined. (Normally, the examination is conducted annually and not during the year.)

- For a listed company whose fiscal year-end date differs from the record date of shareholders, etc. (the record date pertaining to the status of major shareholders that is stated in the Annual Securities Report), the status as of the record date of shareholders, etc. shall be examined instead of the end date of the fiscal year.

- When a listed company does not meet the Continued Listing Criteria within one year after failing to meet the Continued Listing Criteria, the listed company becomes subject to the Delisting Criteria.

However, for tradable share ratio, when a third party holds a certain amount of listed shares, etc. to support business revitalization and TSE deems that the listed company is likely to meet the Continued Listing Criteria within five years, this period shall be five years since the day after the last day of the fiscal year subject to the examination (or, when TSE deems this as inappropriate, a period TSE deems appropriate). For the details of Delisting Criteria, please see the pages below.

Delisting Criteria

- Transitional measures regarding continued listing criteria will expire and the regular continued listing criteria will be applied from record dates of decisions on the continued listing criteria that fall on or after March 1, 2025. For the details of the the expiration of transitional measures, please see the pages below.

The Expiration of Transitional Measures

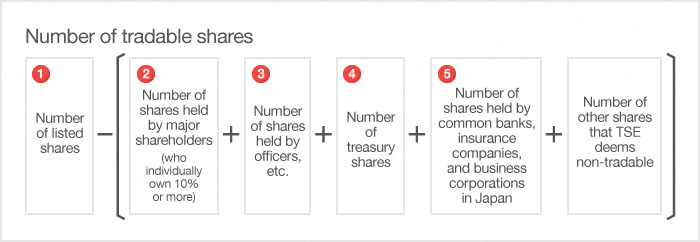

Definition of Number of Tradable Shares

- The number of listed shares includes the number of treasury shares.

- Among these, those listed below "Handling of Shares Held by Those Who Individually Own 10% or More of the Number of Listed Shares" are included in tradable shares.

- "Officers" refers to directors, accounting advisors, auditors, and in the case of a "company with three committees," executive officers, and includes officers' shareholding associations. Executive officers of a company adopting an executive officer system who are not directors are excluded. However, interested parties other than officers are included. "Interested parties" refers to 1. a spouse of an officer of a listed company and relatives within the second degree of kinship, 2. a company in which an officer or a person listed in 1. above holds a majority of voting rights, and 3. affiliates of listed companies and their officers.

- When a resolution to dispose of treasury shares has been passed, the number of treasury shares to be disposed of shall be excluded.

- Among these, those listed below "Handling of Shares Held by Common Banks, Insurance Companies, and Business Corporations in Japan" are included in tradable shares.

Handling of Shares Held by Those Who Individually Own 10% or More of the Number of Listed Shares

Of shares held by those who individually own 10% or more of the listed shares, shares deemed to be included in "tradable shares" are as follows.

| Shares Deemed to Be Included in Tradable Shares | Documents to Be Submitted |

| Shares that are invested in investment trusts or pension trusts | "Summary of a stock portfolio of investment trust, etc." sent from a shareholder service agent |

| Shares included in trusts to be invested based on other discretionary investment contracts, etc. | Certificate issued by the nominee trust bank to prove stocks are those described in the left column |

| Among shares held by securities finance companies or financial instruments business operators, those pertaining to margin transactions | Certificate issued by the nominee trust bank to prove stocks pertain to margin transactions |

| Stocks of a beneficiary depository relating to a depository receipt | Certification from a manager of a trustee institution, etc. and documents relating to beneficiaries |

- ・The definition of "Tradable Shares" is set out in Article 8 of the Enforcement Rules for Securities Listing Regulations, so please refer to the following rules for details.

Handling of Shares Held by Common Banks, Insurance Companies, and Business Corporations in Japan

Of shares held by common banks, insurance companies, and corporations in Japan, those deemed to be included in "tradable shares" are as follows.

- When the most recent large shareholding report states that shares are held for pure investment purposes, etc. and shows the transaction history within the past five years

- When shareholding status report is submitted and states that shares are held for pure investment purposes, etc. and shows the transaction history within the past five years

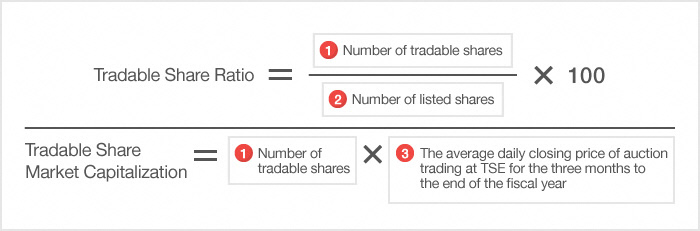

Definition of Tradable Share Ratio / Tradable Share Market Capitalization

- Definition of the number of tradable shares is the same as the preceding item.

- The number of listed shares includes the number of treasury shares.

- For details, please see the below "Calculation method of tradable share market capitalization".

Calculation method of tradable share market capitalization

- Tradable share market capitalization is calculated by multiplying the number of tradable shares by the average daily closing price of auction trading at TSE for the three months to the end of the fiscal year.

- The average closing price (one-month average of closing prices) is available in the Monthly Quotations (Stock Quotations) published on JPX website.

Monthly Quotations

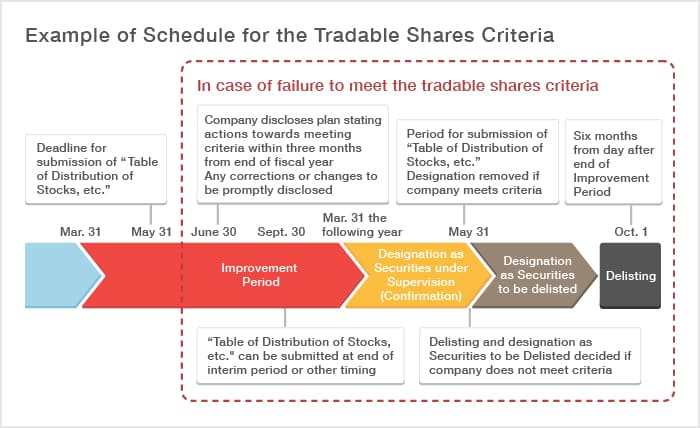

Example of Improvement Period Schedules (for a company whose fiscal year ends in March)

If a company fails to meet the continued listing criteria, it will enter an improvement period, and if it fails to meet with the standards within the improvement period, it will be assigned to Securities Under Supervision or Securities to be Delisted and then delisted.

In addition, the companies that failed to meet the continued listing criteria are required to disclose their plans to meet the continued listing criteria and the timing of implementation of actions to do so within three months of the record date.

- ・However, as of March 31, 2023, if a company has disclosed a plan to meet the Continued Listing Criteria (“Conformance Plan”) with an end date that goes beyond the first record date that falls on or after March 1, 2026, the company’s securities shall be designated as Securities Under Supervision after the end of the improvement period and said designation shall continue until the company is confirmed to meet or not meet the criteria at the end of its plan.

Please see the “List of Companies in an Improvement Period” for companies that fall under the improvement period and the “List of the End Dates of Conformance Plan ” for companies disclosing the conformance plan with an end date that goes beyond the first record date that falls on or after March 1, 2026.