Details of Continued Listing Criteria

Amount of Net Assets

Amount of Net Assets in the Continued Listing Criteria

|

Net Assets |

| Prime Market |

The amount of net assets is a positive figure. |

| Standard Market |

| Growth Market |

- "Amount of net assets" refers to the amount of net assets calculated based on a consolidated balance sheet plus capital surplus or provisions specified by law (Article 45-2, Paragraph 1 of the Regulations on Consolidated Financial Statements) minus minority interests. When consolidated financial statements are not prepared, the amount of net assets refers to the amount of net assets calculated based on the balance sheet plus capital surplus or provisions specified by law (Article 54-3, Paragraph 1 of the Regulations on Consolidated Financial Statements.)

However, when a company is voluntarily adopting IFRS or provisions of Article 94 or Article 95 of the Regulations on Consolidated Financial Statements, the amount of net assets refers to an amount equivalent to net assets calculated based on the respective consolidated financial statement (if no consolidated financial statement is prepared, the amount of net assets calculated based on a balance sheet.)

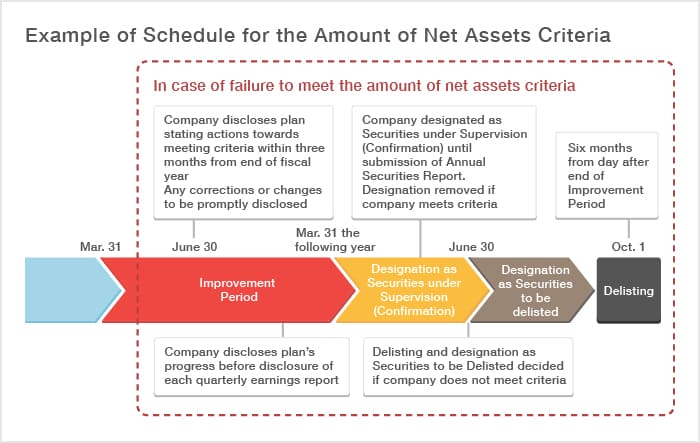

- When a listed company does not meet the Continued Listing Criteria within one year after failing to meet the Continued Listing Criteria, the listed company becomes subject to the Delisting Criteria.

However, companies will be given a timeframe TSE deems appropriate in situations applicable to the following a. or b., or will be given until the last day of the first fiscal year immediately following four years from listing in situations applicable to c.

- When average market capitalization of the three months up to the last day of the fiscal year is JPY 100 billion or more

- When the amount of net assets is expected to turn positive due to rehabilitation or reorganization procedures based on the provisions of the law and business revitalization based on the specified certified dispute resolution procedures stipulated in Article 2, Paragraph 16 of the Act on Strengthening Industrial Competitiveness or workouts based on the "Guidelines for Multi-Creditor Out-of-Court Workouts" formulated by the Study Group on Multi-Creditor Out-of-Court Workouts

- When the amount of net assets turns negative within three years after listing (applicable only to companies listed on the Growth Market)

- For the details of Delisting Criteria, please see the page below.

Delisting Criteria

When the Amount of Net Assets is Expected to Turn Positive due to Legal Reorganization, Business Revitalization ADR System or Private Reorganization

When the amount of net assets is expected to turn positive due to rehabilitation or reorganization procedures based on the provisions of the law and business revitalization based on the specified certified dispute resolution procedures stipulated in Article 2, Paragraph 16 of the Act on Strengthening Industrial Competitiveness or workouts based on the "Guidelines for Multi-Creditor Out-of-Court Workouts" formulated by the Study Group on Multi-Creditor Out-of-Court Workouts, TSE will examine whether or not delisting is appropriate. The examination will be conducted within three months from the last day of the fiscal year subject to the examination for listed companies announcing a reorganization plan, based on the reorganization plan and subsequent documents submitted by the listed companies.

| Procedure Type |

Documents to Be Submitted |

| Rehabilitation or Reorganization Procedures Based on Legal Provisions |

- A document to certify that a court approved the relevant restructuring plan as a rehabilitation plan or reorganization plan

- A document containing a statement by certified public accountants, etc. that significant matters, etc., based on which the plan was established are reviewed by said certified public accountants and others who conduct audit attestation of financial statements, etc.

|

| Business Revitalization Based on the Specified Certified Dispute Resolution Procedures Stipulated in Article 2, Paragraph 16 of the Act on Strengthening Industrial Competitiveness |

- A document to certify that the relevant restructuring plan has been established in accordance with said procedures

- A document containing a statement by certified public accountants, etc. that significant matters, etc., based on which the plan was established are reviewed by said certified public accountants and others who conduct audit attestation of financial statements, etc.

|

| Reorganization based on the "Guidelines for Multi-Creditor Out-of-Court Workouts" Formulated by the Study Group on Multi-Creditor Out-of-Court Workouts |

- A document containing a statement by creditors that the relevant restructuring plan has been established in accordance with said guideline

- A document containing a statement by certified public accountants, etc. that significant matters, etc. based on which the plan was established are reviewed by certified public accountants and others who conduct audit attestation of financial statements, etc.

|

Example of Improvement Period Schedule (for a company whose fiscal year ends in March)

(Note)

- ・For companies subject to the transitional measures, the regular Continued Listing Criteria shall be applicable from record dates relating to decisions made regarding the Continued Listing Criteria that fall on or after March 1, 2025.