JPX Monthly Headlines

JPX group companies undertake various initiatives and disseminate information with the aim of providing the most attractive markets to all users.

Every month, we showcase the highlights of these efforts in short and concise summaries just for you.

January

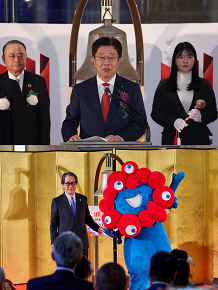

Jan. 6: Ceremonies on the First Trading Day of the Year

Japan Exchange Group, Inc. (JPX) recently held its annual ceremonies to commemorate the first trading day of the year at its venues in Tokyo and Osaka.

At our Tokyo venue, we welcomed Minister of Finance, Kato Katsunobu, who gave a speech. At our Osaka venue, the official character of the Kansai Expo, “Myaku-myaku,” made an appearance.

A traditional hand-clapping ceremony was held at the Tokyo venue. At the Osaka venue, a large hand-clapping ceremony featuring a vocal performance from Imamiya Ebisu Shrine’s “Fukumusume” (goddess of good fortune) was held to pray for the prosperity of the securities market.

Both ceremonies can be viewed on JPX’s official YouTube channel.

(Photo: Tokyo Venue/Osaka Venue)

Jan. 15: Global Standardization of Regulatory Reporting Leveraging DRR & CDM

Leveraging the new standardized framework for regulatory reporting based on ISDA’s globally promoted “Digital Regulatory Reporting (DRR)” solution and the FINOS open source managed “Common Domain Model (CDM),” Japan Securities Clearing Corporation (JSCC) is actively working on the promotion of a new global standardization framework for regulatory reporting and the creation of an open-source ecosystem from a medium- to long-term perspective.

With production parallel from June 2025, JSCC will begin comparative verification against its production data from the current system for IRS (interest rate swaps) transaction reporting to FSA and CFTC. JSCC will furthermore add CDS (credit default swaps) to its DRR/CDM based regulatory reporting and incrementally expand the DRR functionality (together with ISDA’s plans to increase the number of target regulatory authorities).

Jan. 15: TSE Signs MOU With Authentic Indication, K.K.

On January 15,, 2025, Tokyo Stock Exchange Inc. (TSE) signed an MOU with Authentic Indication, K.K., which works in improving the execution environment for block trades through provision of IOI services.

By using the IOI platform provided by Authentic Indication, investors can research demand for block trades without disclosing their own demands to other market participants. When a counterparty is found, orders can be executed on the ToSTNeT market at the mid-price within the TSE auction market at that time. This approach minimizes market impact and preserves the confidentiality of the involved parties. Through supporting these initiatives, TSE aims to further improve the convenience of market users.

Jan. 15: TSE Has Published a Revised List of Companies That Have Disclosed Information Regarding “Action to Implement Management That is Conscious of Cost of Capital and Stock Price.”

Tokyo Stock Exchange (TSE) has been publishing its List of Companies That Have Disclosed Information Regarding “Action Implement Management That is Conscious of Cost of Capital and Stock Price” since January 2024. TSE has revised and begun publishing a new list in order to better support listed companies that are proactively working to implement said management.

Contents of the Revision

1. Added a “Date of Disclosure Update” column for companies that have disclosed updates to the status of their initiatives.

2. Added columns for companies that wish to be contacted by institutional investors.

3. Set a time limit for “Under Consideration” status and required companies “Under Consideration” to explain their status.

In addition, we have also started to compile a list of companies that wish to be contacted more actively by institutional investors in order to support the IR activities of listed companies in the Growth Market.

TSE Has Published a List of Companies Listed on the Growth Market That Wish to Have More Active Contact from Institutional Investors

Jan. 15: Signing Ceremony to Commemorate the License Agreement to List Shanghai Natural Rubber Futures on OSE

Osaka Exchange (OSE) plans to list Shanghai Natural Rubber Futures, which are cash-settled futures whose underlier is the price of Natural Rubber Futures listed on the Shanghai Futures Exchange (SHFE) on May 26, 2025. On January 15, SHFE and OSE held a signing ceremony for a License Agreement regarding the Shanghai Natural Rubber Futures Delivery Settlement Prices between SHFE and OSE in Shanghai.

OSE believes that by introducing this product, it can provide hedging tools to manage price fluctuation risks with Japanese and overseas corporations holding natural rubber inventories in the People's Republic of China as well as new arbitrage trading ecosystems between Japanese and Chinese rubber futures markets.

Jan. 21: Japan-Southeast Asia Market Forum 2024 Event Report

An event report on the Japan-Southeast Asia Market Forum 2024, an international economic forum organized by Japan Exchange Group, Inc. and the Japan External Trade Organization held in Singapore last November, was published in the international media. This year's forum, the third of its kind, featured prominent speakers from government agencies, financial institutions and start-ups in the region to provide overseas investors, entrepreneurs, and others with an overview of Japan’s current state of affairs. The 400 attendees at the forum expressed their expectations for growing interest the innovation sector in Southeast Asia, its mid/long-term market trends, and the potential for further cooperation between Japan and Southeast Asia.

Jan. 30: Financial Results for Q3 FY2024

Japan Exchange Group, Inc. (JPX) has published its consolidated earnings report for Q3 FY2024.

Operating revenue increased by JPY 9.9 billion (+8.9%) year-on-year to JPY 121.5 billion due to an increase in revenue related to trading and clearing services linked to market conditions amidst an increase in the value of cash equities transactions compared to the same period of the previous year.

Operating expenses increased by JPY 1.6 billion (+3.3%) to JPY 53.1 billion due to factors such as an increase in personnel expenses, as well as system maintenance and operating expenses.

As a result, operating income increased by JPY 3.3 billion (+5.1%) to JPY 69.4 billion, and net income (attributable to owners of the parent company) increased by JPY 0.3 billion (+0.8) to JPY 46.9 billion.