Osaka Exchange, Inc. (OSE) and Tokyo Commodity Exchange, Inc. (TOCOM) launched holiday trading in our derivatives market on September 23, 2022 (Autumnal Equinox Day), from the perspective of further convenience for investors through provision of hedging opportunities during national holidays. Derivatives products such as Nikkei 225 Futures and Platts Dubai crude oil Futures can be traded on holidays.

Derivatives Holiday Trading Days

Derivatives holiday trading days in 2024 and the scheduled derivatives holiday trading days in 2025 are as follows.

| Eligible Holidays *1,2 |

Markets |

Finalized or Scheduled |

| 2024 |

| January 2 |

Tue. |

New Year Holidays |

Not Open *3 |

Finalized |

| January 3 |

Wed. |

New Year Holidays |

Open |

Finalized |

| January 8 |

Mon. |

Coming of Age Day |

Not Open *4 |

Finalized |

| February 12 |

Mon. |

Substitute Holiday of National Foundation Day |

Open |

Finalized |

| February 23 |

Fri. |

Emperor's Birthday |

Open |

Finalized |

| March 20 |

Wed. |

Vernal Equinox Day |

Open |

Finalized |

| April 29 |

Mon. |

Showa Day |

Open |

Finalized |

| May 3 |

Fri. |

Constitution Memorial Day |

Open |

Finalized |

| May 6 |

Mon. |

Substitute Holiday of Children's Day |

Open |

Finalized |

| July 15 |

Mon. |

Marine Day |

Open |

Finalized |

| August 12 |

Mon. |

Substitute Holiday of Mountain Day |

Not Open *5 |

Finalized |

| September 16 |

Mon. |

Respect for the Aged Day |

Not Open *5 |

Finalized |

| September 23 |

Mon. |

Substitute Holiday of Autumnal Equinox Day |

Open |

Finalized |

| October 14 |

Mon. |

Health and Sports Day |

Open |

Finalized |

| November 4 |

Mon. |

Substitute Holiday of Culture Day |

Not Open *6 |

Finalized |

| December 31 |

Tue. |

New Year's Eve |

Not Open *3 |

Finalized |

| 2025 |

January 2 |

Thu. |

New Year Holidays |

Not Open *3 |

Finalized |

| January 3 |

Fri. |

New Year Holidays |

Open |

Finalized |

| January 13 |

Mon. |

Coming of Age Day |

Not Open *7 |

Finalized |

| February 11 |

Tue. |

National Foundation Day |

Open |

Finalized |

| February 24 |

Mon. |

Substitute Holiday of Emperor's Birthday |

Open |

Finalized |

| March 20 |

Thu. |

Vernal Equinox Day |

Open |

Finalized |

| April 29 |

Tue. |

Showa Day |

Open |

Finalized |

| May 5 |

Mon. |

Children's Day |

Open |

Finalized |

| May 6 |

Tue. |

Substitute Holiday of Greenery Day |

Open |

Finalized |

| July 21 |

Mon. |

Marine Day |

Open |

Scheduled |

| August 11 |

Mon. |

Mountain Day |

Open |

Scheduled |

| September 15 |

Mon. |

Respect for the Aged Day |

Not Open *8 |

Scheduled |

| September 23 |

Tue. |

Autumnal Equinox Day |

Open |

Scheduled |

| October 13 |

Mon. |

Health and Sports Day |

Open |

Scheduled |

| November 3 |

Mon. |

Culture Day |

Open |

Scheduled |

| November 24 |

Mon. |

Substitute Holiday of Labor Thanksgiving Day |

Open |

Scheduled |

| December 31 |

Wed. |

New Year's Eve |

Not Open *3 |

Scheduled |

- In principle, all current non-business days (excluding Saturdays, Sundays, and January 1) will be eligible for holiday trading.

- In principle, the eligible holiday trading days (scheduled) for the following year are scheduled to be announced in February of each year, and the eligible holiday (finalized) for the first and second half of the following year are in June and December, respectively.

- December 31 and January 2 will not be eligible for holiday trading for the time being.

- Markets will not be opened on January 8, 2024 (Coming of Age Day) due to a JPX Group-wide BCP testing (disaster recovery testing) of FY 2023 which is planned to be implemented for January 6 through 8.

- Market will not be opened on August 12, 2024 (Substitute Holiday of Mountain Day) and September 16, 2024 (Respect for the Aged Day) due to derivatives system’s (J-GATE) participation to the migration rehearsal test of arrowhead 4.0 from August 10 to August 12 and from September 14 to September 16.

*…Please be noted that the handling has been changed from the notice to the trading participants, "Derivatives Holiday Trading Days (Scheduled) in 2024".

- Markets will not be opened on November 4, 2024 (Substitute Holiday of Culture Day) since TSE shall go through migration process for Arrowhead 4.0 from November 2 to November 4.

*…Please be noted that the handling has been changed from the notice to the trading participants, "Derivatives Holiday Trading Days (Scheduled) in 2024".

- Markets will not be opened on January 13, 2025 (Coming of Age Day) due to a JPX Group-wide BCP testing (disaster recovery testing) of FY 2024 which is planned to be implemented for January 11 through 13.

- Markets will not be opened on September 15, 2025 (Respect for the Aged Day) due to a JPX Group-wide BCP testing (disaster recovery testing) of FY 2025 which is planned to be implemented for September 13 through 15.

Please refer to the following file for a list of finalized holiday trading days including past days.

Eligible Products

The eligible products for holiday trading are Index Futures, Index Options, Commodity Futures and Options on Commodity Futures. JGB Futures, Options on JGB Futures, Interest Rate Futures and Securities Options are not eligible.

| Products |

Eligible/Ineligible |

| Index Futures |

Eligible |

| Index Options |

| Commodity Futures |

| Options on Commodity Futures |

| JGB Futures |

Ineligible |

| Options on JGB Futures |

| Interest Rate Futures |

| Securities Options |

Trading Rules

In principle, the same trading rules as for weekdays (excluding eligible holidays; the same shall apply hereinafter) apply to the holiday trading, but please note that there are some differences as follows.

Eligible Trading

Auction trading and off-floor trading (J-NET trading) are available as on weekdays.

Trading Hours/Trading Days

Trading hours are as follows, except for some products as on weekdays.

| |

Day Session |

Night Session |

| Trading Hours |

8:45a.m.∼3:15p.m. |

4:30p.m.∼6:00a.m. |

- Day session for Nikkei 225 VI Futures and Rubber Futures starts at 9:00a.m.

- Night session for Nikkei 225 VI Futures, Rubber Futures and Electricity Futures ends at 7:00p.m.

- TAIEX Futures are only available for day session.

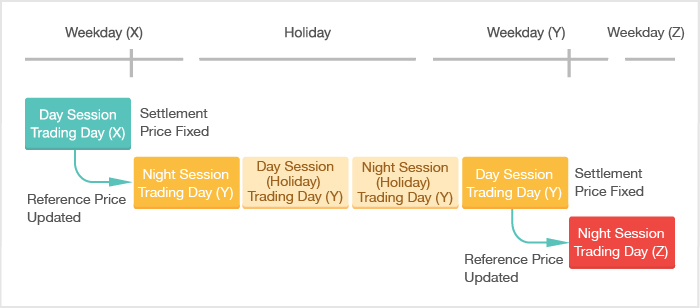

The trading day of holiday trading shall be the same as that of the night session which begins on the weekday preceding the holiday trading day (hereinafter referred to as a “business day before the holiday”) and the day session which begins from the weekday following the holiday trading day (hereinafter referred to as a “business day after the holiday”).

(note)

- ・Non-Cancel periods will be applied in the same manner as weekdays.

- ・Clearing and settlement will be conducted on a trading day basis, combining trades executed on weekdays and holidays.

Contract Months/Strike Prices

Holiday trading days will not fall on the trade-starting day, the last trading day or the SQ day of each contract month (including flexible trading). And new/additional strike prices (including on-demand strike prices) will not be set on holiday trading days.

For more details, please refer to the following page.

Reference Prices

The reference price for the price limits on holiday trading days shall be the same as that for the night session of the business day before the holiday, and the reference price will not be updated during holiday trading. In addition, the reference price for the day session of the business day after the holiday shall be the same as that for the night session of the business day before the holiday.

Price Limits/ Static Circuit Breaker Rule

Static Circuit breakers (SCB) are triggered during holiday trading day as well as weekdays. If the SCB is triggered during the night session of the business day before holiday or during holiday trading day, and the price limits are expanded, the expanded price limits will be applied until the day session of the business day after the holiday.

Order Types, etc.

In principle, the same as on weekdays. However, in the event of holiday trading , Good till Date/Good till Cancel orders (GTC/GTD) will expire between the end of holiday trading and the start of the day session on the business day after the holiday, regardless of whether the products are eligible for holiday trading.

(note)

- ・If the brokerage does not support holiday trading, your GTC/GTD orders will expire immediately before the opening of holiday trading.

Dynamic Circuit Breaker (DCB)

The time of trading halt due to DCB is longer than on weekdays. The suspension time for each product is as follows;

| Products |

Trading Suspension Time |

| Index Futures |

60 seconds

(30 seconds on weekdays) |

| Commodity Futures |

| Options on Commodity Futures |

| Index Options |

30 seconds

(15 seconds on weekdays) |

Market Maker Program

From the viewpoint of ensuring the smooth trading opportunity, Market Maker Program is applied on holiday trading days as weekdays.

Handling of Publication

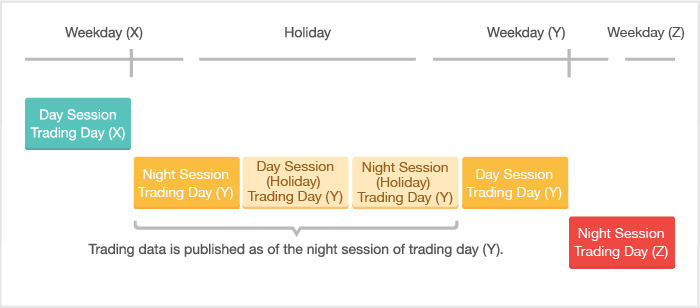

Trading volume and other statistics such as opening/high/low/close during holiday trading will be published after aggregated with those of the night session of the business day before the holiday. We will not publish those statistics separately just for the holiday trading day.

(note)

- ・Methods of compilation and publication by information vendors may differ from ours.

![]() Close

Close![]() Close

Close