JPX Monthly Headlines

JPX group companies undertake various initiatives and disseminate information with the aim of providing the most attractive markets to all users.

Every month, we showcase the highlights of these efforts in short and concise summaries just for you.

November

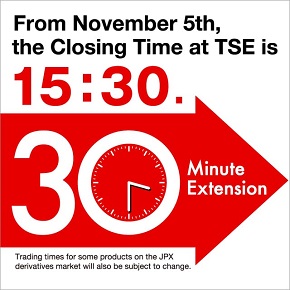

Nov. 5: Extension of Trading Hours and Introduction of a Closing Auction Session in the Cash Market

In order to respond to changes in the market environment and the diversifying needs of investors, Tokyo Stock Exchange (TSE) upgraded its cash trading system (through the operational launch of “arrowhead 4.0”) on November 5, 2024. It also extended trading hours by 30 minutes (changing the closing time of the cash market from 3:00 p.m. to 3:30 p.m.), changing the trading hours of the derivatives market accordingly. Further, to improve the transparency of the formation of closing prices, a closing auction session was introduced in which orders are not executed for a five-minute period from 3:25 p.m., followed by an Itayose at 3:30 p.m.

TSE will continue to implement various measures to contribute to improving the convenience of all investors.

Nov. 11: Tradeweb and Tokyo Stock Exchange Collaborate to Expand Liquidity in Japanese ETFs

Tokyo Stock Exchange (TSE) and global operator of electronic marketplaces Tradeweb Markets LLC (Tradeweb) have announced their collaboration to offer institutional investors enhanced access to liquidity in ETFs listed on TSE.

The launch of a new direct link between TSE's ETF request-for-quote (RFQ) platform, CONNEQTOR, and Tradeweb will enable institutional investors around the world to easily access the TSE ETF market via Tradeweb. We will continue to improve the liquidity and convenience of the ETF market so that all investors, not only domestic but also overseas, using the TSE ETF market can trade “ETFs, faster and cheaper.”

Nov. 21: Publication of “Cases Where Companies Are Not Aligned With Investors’ Perspectives”

Since March 2023, Tokyo Stock Exchange, Inc. (TSE) has been requesting that all listed companies on the Prime and Standard Markets take action to promote “Management that is Conscious of Cost of Capital and Stock Price,” and many listed companies have started to take action.

Therefore, we have published a new set of “Cases Where Companies Are Not Aligned With Investors’ Perspectives” for companies to use as a reference when reviewing and improving their own initiatives. In addition, we have expanded the key points and examples in “Key Points and Examples Considering the Investor’s Point of View,” which was released in February, 2024, based on recent feedback from investors.