JPX Monthly Headlines

JPX group companies undertake various initiatives and disseminate information with the aim of providing the most attractive markets to all users.

Every month, we showcase the highlights of these efforts in short and concise summaries just for you.

July

Jul. 10: Listing of ETF Tracking TOPIX 100 on the Stock Exchange of Hong Kong

Hang Seng Japan TOPIX 100 Index ETF (management company: Hang Seng Investment Management Limited), which tracks the TOPIX 100 Total Return Index, was listed on the Hong Kong Stock Exchange.

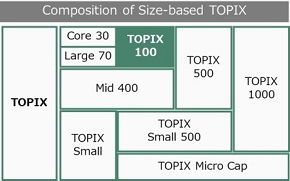

JPX Market Innovation & Research, Inc. offers market capitalization-weighted indices based on size, which classify TOPIX constituents by market capitalization and liquidity (trading value), in order to meet investors' various needs for benchmarks and investment targets.

The TOPIX 100 consists of the 100 stocks with the highest market capitalization and liquidity among those listed on TOPIX. It covers approximately 66% of the TOPIX market capitalization (free-float adjusted market capitalization coverage, as of June 28, 2024).

Jul. 19: End of Proof of Concept Testing for HTML Disclosure of Earnings Reports (Kessan Tanshin)

JPX Market & Innovation Research Inc. (JPXI) has announced the status of its project for Proof of Concept (PoC) testing for HTML disclosure of earnings reports as of the end of May 2024. It has also announced the end of said PoC testing.

Based on the deliberations of the “Council of Experts Concerning the Revision of the Quarterly Disclosure System,” listed companies are required to submit HTML files of annual and quarterly earnings reports for accounting periods starting on and after April 1, 2024. Accordingly, the PoC testing ended with the transition to the new system in July 2024.

JPXI would appreciate your consideration of using the HTML files of earnings reports.

Jul. 22: Earnings Reports, Etc. Now Available in HTML via Listed Company Search

Regarding annual and quarterly earnings reports disclosed by listed companies, summary information and attached documents (qualitative information and financial statements) have been available in HTML format via the Listed Company Search since July 21, 2024.

Click the icon to open the document directly in a web browser.

These HTML files can be copied in text format, which enables users to utilize the text information and overseas investors to view it in multiple languages by using their browser's translation function or other features.

Jul. 24: TSE to Launch Study Group on Small-Size Investments

Tokyo Stock Exchange, Inc. (TSE) has been working to lower investment units with the purpose of creating an environment in which retail investors can easily invest in Japanese stocks, including indicating that the desirable investment unit level should be less than JPY 500,000 and requesting listed companies to transition to and maintain that level. In order to advance such efforts , TSE has decided to establish a "Study Group on Small-Size Investments" to discuss related issues and measures to be taken to achieve this goal.

Jul. 26: Publication of “Tokyo Stock Exchange Official Guide Pricing Mechanism of arrowhead – Second Edition”

Tokyo Stock Exchange (TSE) plans to revise the cash market trading system in November 2024, including the introduction of a Closing Auction.

In line with this review, TSE has published a corresponding second edition of the book “Tokyo Stock Exchange Official Guide Pricing Mechanism of arrowhead” (published in 2021), which explains the TSE's price formation logic in detail. In this revised edition, eight new example questions on the Closing Auction and special execution have been added, and a summary of answers to each is included at the end of the book. Please make reference to it to better understand the changes in the trading rules.

Jul. 30: Announcement of Earnings for Q1 FY2024

Japan Exchange Group, Inc. has announced its earnings for the first quarter of fiscal year 2024.

Operating revenue increased by JPY 3.3 billion (+9.1%) year on year to JPY 40.3 billion, mainly due to a year-on-year increase in cash equity trading value that resulted in an increase in revenue related to trading and clearing services linked to market conditions.

Operating expenses increased by JPY 0.3 billion (+2.2%) year on year to JPY 17.5 billion, mainly due to an increase in personnel expenses and system maintenance and operation expenses.

Operating income, however, decreased by JPY 1.7 billion (-7.0%) year on year to JPY 23.2 billion, and net income (attributable to owners of the parent company) decreased by JPY 1.9 billion (-11.1 %) year on year to JPY 15.7 billion, due to a drop back down from the previous year, when profits were recorded on the sales of some assets.