JPX Monthly Headlines

JPX group companies undertake various initiatives and disseminate information with the aim of providing the most attractive markets to all users.

Every month, we showcase the highlights of these efforts in short and concise summaries just for you.

October

Oct. 7: Provision of Content for Expanding English Disclosure

Tokyo Stock Exchange, Inc. (TSE) has, from the viewpoint of supporting listed companies, provided reference content for the practical application of English disclosure initiatives.

Considering that some English language disclosure of financial results and timely disclosure information will become obligatory for Prime Market-listed companies in April 2025, we made the following enhancements to the content to assist in simultaneous Japanese and English disclosure and have provided it to all listed companies.

(1)Revision of the Practical Handbook for English Disclosure

(2)Creation of English Sample Disclosure Forms (Excerpts or Summaries)

(3)Creation of the “Questions and Answers Regarding Expansion of English Disclosure in the Prime Market (October 2024 Update)”

We at TSE look forward to seeing listed companies implementing initiatives to improve on English disclosure going forward, as well as, with translating documents into English as a starting point, begin engaging in constructive dialogue with overseas investors, attracting their investment, and ultimately enhancing their corporate value over the medium- to long-term.

Oct. 11: Celebrating the First Anniversary of the Carbon Credit Market

The Carbon Credit Market at Tokyo Stock Exchange (TSE) has celebrated its first anniversary.

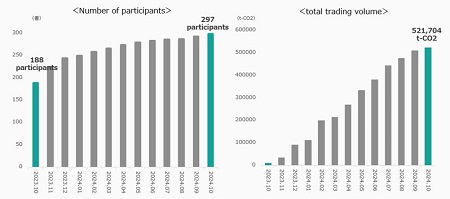

Since its opening, the market has continued to steadily grow in terms of both the numbers of market participants and trading volume, with 297 participants registered as of October 10, 2024 and a cumulative trading volume of 521,704t-CO2 (daily average of 2,129t-CO2).

In addition, TSE has also revised trading categories and introduced a market-maker scheme in order to improve market functions. In November this year, trading of GX credits under the Green Transformation Emissions Trading Scheme (GX-ETS) is also scheduled to begin. Japan Exchange Group will continue to contribute to the realization of carbon neutrality in Japan through the operation of the Carbon Credit Market.

Oct. 16: Outline of JSCC-DTCC Proof of Concept in Digital Asset Field Announced

The Depository Trust & Clearing Corporation (DTCC, a U.S. company and the world’s largest clearing and settlement institution), which has long been a global leader in the new technology field of distributed ledger technology and blockchains, and Japan Securities Clearing Corporation (JSCC) have collaborated on a proof of concept for collateral use cases involving digital assets. An overview of the project has been published on the DTCC website.

In this proof of concept, JSCC designed and developed a collateral ecosystem that crosses industry and product boundaries, making the most of the DLT environment “DTCC Digital Launchpad” provided by DTCC and open-source software (OSS).

As clearing houses are among the largest recipients of collateral due to their nature of centrally managing risk and contributing to market robustness, JSCC believes that there is significance in conducting future-oriented proof of concept experiments that involve collaboration between such financial market infrastructures around the world.

Oct. 29: Announcement of Earnings for Q2 FY2024

Japan Exchange Group, Inc. has announced its earnings for the second quarter of fiscal year 2024.

Operating revenue increased by JPY 8.4 billion (+11.5%) to JPY 81.8 billion, mainly due to a year-on-year increase in cash equity trading value that resulted in an increase in revenue related to trading and clearing services linked to market conditions.

Operating expenses increased by JPY 600 million (+2.0%) year-on-year to JPY 35.0 billion, mainly due to an increase in personnel expenses and system maintenance and operation expenses.

As a result, operating income increased by JPY 3.2 billion year-on-year (+7.2%) to JPY 47.7 billion, and net income (attributable to owners of the parent company) increased by JPY 800 million year-on-year (+2.8%) to JPY 32.3 billion.