JPX Monthly Headlines

JPX group companies undertake various initiatives and disseminate information with the aim of providing the most attractive markets to all users.

Every month, we showcase the highlights of these efforts in short and concise summaries just for you.

September

Sep. 2: Publication of JPX Report 2024

Japan Exchange Group Inc. (JPX) has published the JPX Report 2024.

With the aim of giving an overview of the company’s value creation to various internal and external stakeholders, JPX produces this integrated report to explain its strategies for realizing its corporate philosophy and co-creation with stakeholders relating to important financial and non-financial information. We hope this report helps people deepen their understanding of the company.

We would also like to ask for your cooperation in filling out a brief survey on our website for further improvements.

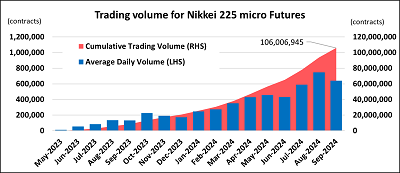

Sep. 12: Cumulative Trading Volume of Nikkei 225 Micro Futures Exceeds 100 Million Contracts

Nikkei 225 micro Futures, which was listed on Osaka Exchange (OSE) on May 29, 2023, has steadily expanded its trading volume against the backdrop of growing demand for smaller-lot investments. On September 12, its cumulative trading volume since listing surpassed 100 million contracts.

OSE continues to aspire to provide investors with products and services tailored to their needs.

Sep. 26: JSCC Awarded “Clearing House of the Year” at Asia Risk Awards 2024

Japan Securities Clearing Corporation (JSCC) was awarded “Clearing House of the Year” at the Asia Risk Awards 2024, hosted by Asia Risk magazine. It is the fourth time JSCC has received the award, which is presented to the clearing house that shows the most results in the pursuit of innovation in the provision of risk management and services around derivatives trading.

This award was given in recognition of the sophistication of risk management brought by and smooth transition to the “VaR Method,” a new method of calculating margin for futures and options transactions in exchange-traded clearing operations, which was introduced in November last year, and the reduction of collateral burden in interest rate swap clearing operations through the addition of 3-Month TONA Futures to products eligible for cross-margining, which was implemented this March.

Japan Securities Clearing Corporation will continue to strengthen its basic functions as a clearing organization by improving risk management and the convenience and reliability of clearing and settlement, as well as pay close attention to the needs of its users and provide clearing services to meet any new needs that should arise.

Sep. 30: Tokyo Stock Exchange Official Guide: Pricing Mechanism of arrowhead -Second Edition Now on Sale

Tokyo Stock Exchange (TSE) is planning revisions to the trading rules of the cash market in November 2024, including the introduction of Closing Auction.

In accordance with these revisions, TSE has published a second edition of their book on price formation logic, “Tokyo Stock Exchange Official Guide: Pricing Mechanism of arrowhead,” to add example questions on Closing Auction and Special Execution.

In addition to the Japanese version, the English version is now available for purchase in e-Book form as of Sep. 27, 2024.