Indicative NAV/PCF (ETFs)

ETF Current Price, Indicative NAV, PCF

The current price, comparison to previous day, indicative NAV, trading volume, sponsor name and PCF information for TSE ETFs are available as below.

- The website distributes indicative NAV and PCF information calculated by ICE Data Services.

- The website distributes indicative NAV and PCF information calculated by Solactive AG. Currently, indicative NAV and PCF information for issues managed by Global X Japan are available, with the exception of issue code 2858, 179A, 180A, 380A, 404A, 502A.

- The website distributes indicative NAV and PCF information calculated by S&P Global. Currently, indicative NAV and PCF information for issues managed by Amova Asset Management, Daiwa Asset Management, Nissay Asset Management, and Norinchukin Zenkyoren Asset Management(Code:2086,2087,2088,2089,2090,2091,2092) are available.

What is Indicative NAV?

Indicative NAV is the estimated value per unit of assets held in an ETF (Net Asset Value, NAV) during trading hours. Traditionally, ETFs, like investment trusts, publish their NAV once a day, however, in order to stimulate trading activity, we have decided to start publishing indicative NAV so that investors can easily grasp the net asset value of ETFs during trading hours.

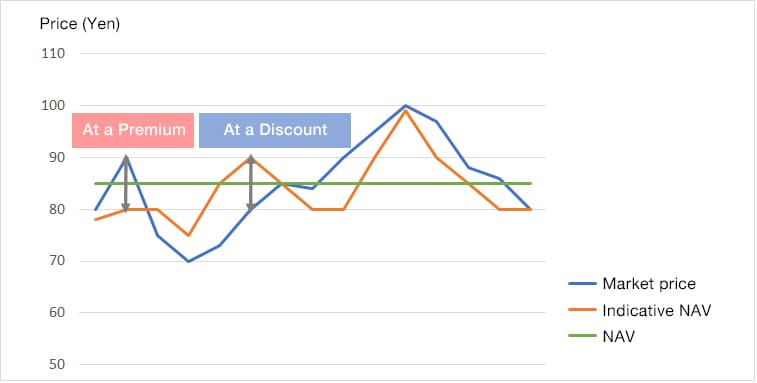

ETFs have three prices: the NAV, which is calculated based on the previous day's closing price of the assets held; the indicative NAV, which is calculated based on the current value of the assets held; and the market price. By using indicative NAV, investors can determine whether an ETF is being bought at a premium (indicative NAV < market price) or sold at a discount (indicative NAV > market price) relative to its net asset holdings. This allows for more efficient trading.

| Calculation Frequency | Remarks | |

| NAV | Once a day (Disclosed daily) | Price calculated based on the closing price of assets, etc. held by the ETF on the previous day |

| Indicative NAV | Every 15 seconds during trading hours (Note) | Price calculated based on the current value of assets, etc. held by the ETF |

| Market Price | Real time during trading hours | Price when trading in the market |

- ・ETF current prices and indicative NAV on the above website are displayed in up to 15-second intervals.

What is PCF?

PCF stands for "Portfolio Composition File" and is a file that lists the number of shares and open interest in futures contracts for each issue held by an ETF. Originally, PCF is a calculation file used for indicative NAV, but if investors can obtain stock prices in real time, they can calculate indicative NAV on their own.