RFQ Platform

Overview of RFQ Platform "CONNEQTOR"

Background

Tokyo Stock Exchange (TSE) introduced a Market Making Scheme for ETFs in 2018 with the aim of improving ETF liquidity, and has continued to make improvements to it since. In addition, to facilitate large-scale transactions that are difficult to execute in auction sessions, TSE began considering the provision of an RFQ (request-for-quote) function in October 2019.

TSE has decided to begin development of this service for use on the market now that the realization of the technology is in sight, having completed the design process with the kind cooperation of many of the institutional investors who will become users and confirmed their needs.

The platform for using this RFQ function is named CONNEQTOR, which incorporates TSE's wish to make ETF trading more efficient by connecting institutional investors, securities companies, and market makers more closely.

Outline of RFQ Function/Trade Flow

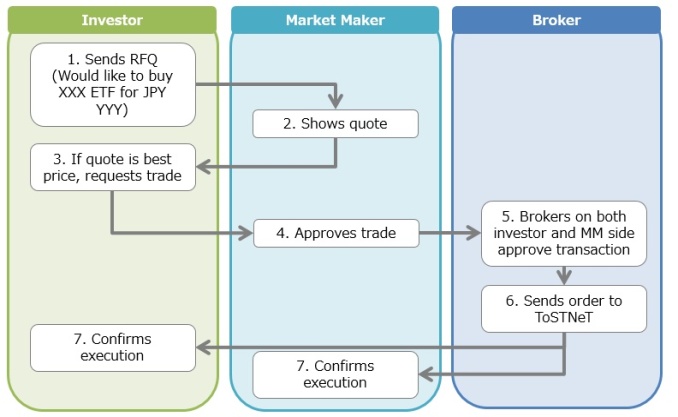

The RFQ function enables institutional investors who want to trade a particular ETF at a particular quantity, etc. to send out a request for a quote to a large number of market makers. They can then trade at a price individually offered by a market maker. In CONNEQTOR, although the quotes are shown anonymously, the process is highly transparent, and investors are able to trade only at the best price offered. The trading flow using the RFQ function is as follows:

1. An investor submits a request to "buy XXX ETF for JPY YYY" on CONNEQTOR.

2. Market makers show prices.

3. The investor requests a trade if the quote shown is the best price (the best price will always be shown).

4. The market maker who offered the best price confirms and accepts the proposed trade.

5. The brokers designated in advance by the investor and the market maker approve the trade.

6. The authorized trade is cleared and settled via ToSTNeT as an on-exchange trade.

7. Investors can obtain logs for the trade flow, operations flow, and quotes shown.

Information for using CONNEQTOR

CONNEQTOR Service Overview

Please refer to the following documents for an overview of our services for investors.

We will update the details of the features and services as they become available.

If you have any questions, please contact us at the address below.

Securities companies available to institutional investors

Institutional investors can trade ETFs using CONNEQTOR through the following securities companies.

New applications from securities companies will be announced on this page. If you would like to use CONNEQTOR, please contact your preferred securities companies.

- ・As of September 1, 2025

- ・In Japanese alphabetical order.

| SMBC Nikko Securities Inc. |

| OKASAN SECURITIES CO.,LTD.1 |

| Goldman Sachs Japan Co.,Ltd. |

| Shin-Ogaki Securities Inc.2 |

| Shinkin Securities Co.,Ltd.1 |

| JPMorgan Securities Japan Co.,Ltd. |

| Daiwa Securities Co. Ltd. |

| Tokai Tokyo Securities Co., Ltd.1 |

| TOYO SECURITIES CO.,LTD.1 |

| NAGANO SECURITIES Co.,LTD.2 |

| Nomura Securities Co.,Ltd. |

| Barclays Securities Japan Limited |

| HIROTA SECURITIES CO.,LTD. |

| BNP Paribas Securities Japan, Ltd.1 |

| BTIG, LLC3 |

| Phillip Securities Japan, Ltd.1 |

| North Pacific Securities Co.,Ltd. |

| Marusan Securities Co.,Ltd.1 |

| Mizuho Securities Co.,Ltd. |

| Mitsubishi UFJ Morgan Stanley Securities Co.,Ltd.1 |

| Mito Securities Co.,Ltd.1 |

| Morgan Stanley MUFG Securities Co.,Ltd. |

- Institutional investors can trade ETFs using CONNEQTOR through these securities companies over the phone.

- These securities companies are available only by phone.

- This securities company is available only for overseas investors by phone or chat.

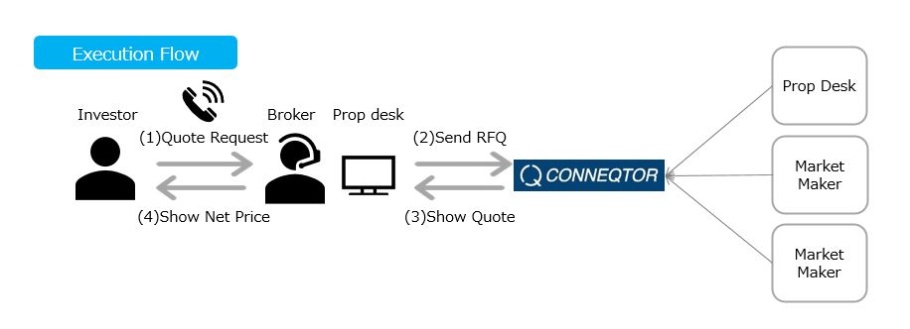

Net Price is Available over the Phone

Net price(comission included price) is available by calling to Okasan Securities or Tokai Tokyo Securities. These securities companies show net price using CONNEQTOR to the investor.

Please refer to the flow as bvelow in details.

(1)(2)(3) Props trade on CONNEQTOR using investor function.

(4) Props show commission included price to investors.

→ Investors can trade by net price (commission included price).

Connection to CONNEQTOR via dedicated lines used for QUICK's services

Users of QUICK's terminals (QUICK Workstation) will be able to connect to CONNEQTOR via dedicated lines used for QUICK's existing financial information services. Connections made via QUICK will incur no additional fees, and both initial and monthly fees will remain free.

- ・Monthly information fees will apply for new addition of QUICK Workstations.

How to Apply

For information on how to apply, please refer to the link below.

Request for Brochure / Inquiry

For information and inquiries, please refer to the following link.