Educational Activities for Preventing Unfair Trading

J-IRISS Registration Status

At least 92% of companies listed on the Tokyo Stock Exchange (TSE) Prime Market and at least 89% of all TSE listed companies are registered.

(As of July 31, 2022)

What is J-IRISS?

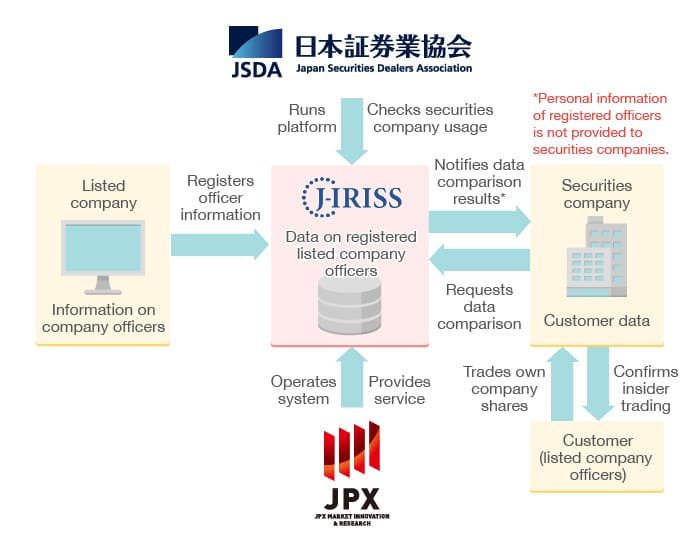

J-IRISS (Japan-Insider Registration & Identification Support System) is a highly secure system operated by the Japan Securities Dealers Association (JSDA) to prevent unfair trading by having listed companies register their own officer information in a database and having securities companies periodically check the database against their own customer information.

Securities companies are required by the rules of JSDA to use this system at least once a year to check their own customer information against the information registered in the J-IRISS database. Accounts that are confirmed to be those of officers and employees of listed companies as a result of this check will be registered by the securities companies and used to prevent unfair trading such as insider trading.

By working to prevent insider trading, J-IRISS is a highly effective system in terms of maintaining not only the fairness of the securities market but also the reputation and credibility of listed companies in the securities market. For this reason, JPX-R requests that listed companies register with the system. Most recently, in June 2022, JPX-R sent a notification to listed companies asking them to register with J-IRISS and update their officer information.

The J-IRISS system is developed and managed by JPX Market Innovation & Research, entrusted by JSDA, and the system is rigorously designed to ensure security and to prevent the leakage of personal information. The checking process by securities firms is performed by transmitting their own customer information to the system, so it is not possible for securities firms to obtain information on anyone other than their own customers or to view the information of officers and employees registered in the system.

For other information on J-IRISS, including an overview, list of registered companies, registration procedures, and Q&As, please refer to the JSDA website.

Benefits of Registration

For listed companies, the following benefits can be expected from registering with J-IRISS.

Prevention of Unintentional Unfair Transactions by Officers of Listed Companies

When a securities company receives an order from a customer registered with J-IRISS for their own company's stock, the securities company can prevent unintended unfair trading by, for example, confirming whether or not the customer is aware of material facts about their company.

(Please note that this does not mean uniformly rejecting orders from customers registered with J-IRISS.)

Preventing Violations of Laws and Regulations Pertaining to Securities Transactions by Officers of Listed Companies

- Reporting of trading of "specified securities, etc." (Article 163 of the Financial Instruments and Exchange Act)

When an officer of a listed company buys or sells the company‘s stock, they are required to report the transaction to the Prime Minister. By having correct customer information through J-IRISS, securities companies can prevent violations of the law due to failure to report.

- Return of short-term trading profits (Article 164 of the Financial Instruments and Exchange Act)

If an officer of a listed company has traded the company‘s shares and made a profit within the short term (the past 6 months), the listed company may request that the amount of profit be returned. By having the correct customer information through J-IRISS, a securities company should be able to confirm whether the order in question fits this criterion and announce whether or not the return will be made.

Video on J-IRISS

- We created an animated video to guide listed companies on how to register with J-IRISS. It provides an easy-to-understand explanation of the structure and benefits of the system. We hope that those who are considering registering, but also those who have already registered, can enjoy watching it.

Additional Uses

Some of the listed companies that have registered with J-IRISS have registered information not only on their officers, but also on a wider range of officers and employees who handle material facts. By registering not only officers, but also information on managers in administrative divisions, for example, where material facts occur more frequently, listed companies can more effectively prevent insider trading.

Registrations with J-IRISS will be published on the JSDA website (only if requested), meaning that registration can also be used to show that the company is actively working to prevent insider trading.

How to Register

Information on how to register with J-IRISS is available on the JSDA website. Please see the below page.

Current Application Status

3,471 companies (as of July 25, 2022)

(note)

- ・These figures are published by the JSDA and include companies listed on markets other than TSE.

![]() Close

Close![]() Close

Close