Canceling Executed Transactions

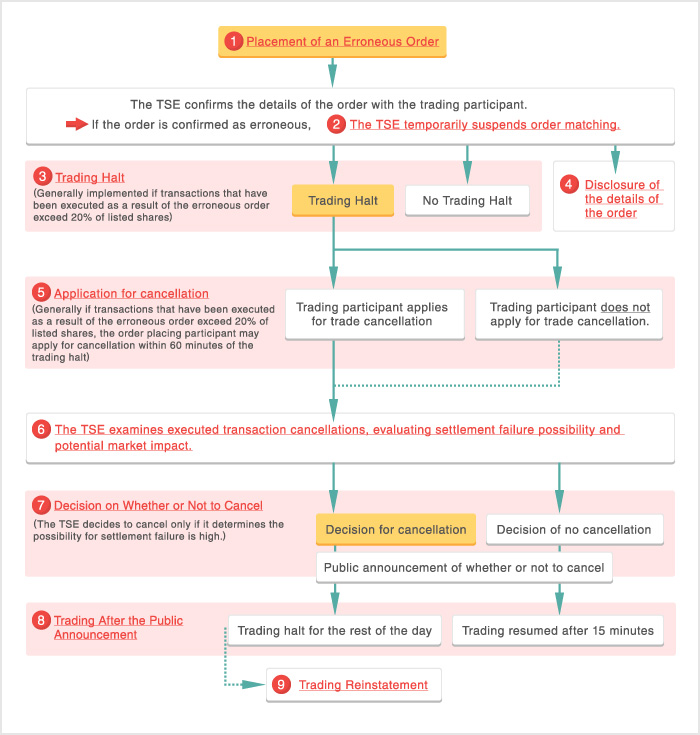

An outline of the whole process of the Rules for Canceling Executed Transactions

Placement of an Erroneous Order

If TSE identifies an order that is for more than 5% but 30% or less of the number of listed shares, TSE will confirm the details of the order with the trading participant who has placed the order.

- TSE's trading system is designed to reject any orders exceeding 30% of the listed shares.

Temporary Suspension of Matching Orders

In the event that such an order is confirmed erroneous and it is anticipated to be executed, or if the trading participant who placed the order (hereinafter the "order-placing trading participant") requests TSE to do so, TSE will temporarily suspend the matching of orders (including a display of special quotes) for the stock. TSE will then request the order-placing participant to cancel the order.

Trading Halt

If an erroneous order of more than 10% of listed shares has been executed, TSE will halt trading in order to disseminate information on the possibility that such transactions will be canceled.

- Even in case the transactions do not meet the above criteria, TSE may halt trading to disseminate information about the cancellation possibility if it deems specifically necessary.

- With regard to foreign stocks (dually-listed issues) and convertible bonds (hereinafter "CBs"), TSE will halt trading if transactions have been executed for over 20,000 units of the former or JPY 2 billion of the latter.

Disclosure of Information on the Erroneous Order

In order to prevent market disruption due to erroneous orders, in the following two cases TSE will confirm the erroneous order with the order-placing trading participant and then promptly disclose the situation as urgent market information.

- If TSE has temporarily suspended order-matching of the erroneous order

- If TSE has deemed that the erroneous order will impact the market significantly

- ・Specifically,

a) In the event that a placed erroneous order exceeds 5% of listed shares,

b-1) When the execution of the erroneous order had a volume of more than 5% of the number of listed shares, or

b-2) As a general rule, when the erroneous order has been executed, at a price exceeding 7% of the last traded price

TSE will disclose the following information as urgent market information on its website.

[ Contents of urgent market information on the erroneous order disclosed by TSE ]

- Name of the issue

- Details of the order (sell or buy, price, the number of shares)

- Progress (Time of the order-placement, time of cancellation, etc.)

- Name of the order-placing trading participant

In addition, after TSE has discloses its own urgent market information, the order-placing trading participant will also promptly disclose information on the details of the erroneous order.

Application for Canceling Executed Transactions

As a general rule, an order-placing trading participant is able to apply to cancel executed transactions within 60 minutes of the implementation of the trading halt.

The trading participant is able to apply to cancel executed transactions, as a general rule, in cases where transactions exceed 20% of the number of listed shares and may lead to extreme difficulties in the settlement of transactions.

- With regard to foreign stocks (dually-listed issues) and CBs, the application for cancellation is permitted only if transactions of over 20,000 units for the former or JPY 2 billion for the latter have been executed.

- In the event that TSE has received an application for canceling executed transactions from an order-placing trading participant, or a notice to the effect that the participant will not cancel them, TSE will immediately disclose such facts. Moreover, even in case TSE does not receive any application from the order-placing trading participant, etc. within 60 minutes of the implementation of the trading halt, TSE will disclose this fact.

- In cases where TSE recognizes circumstances that will make the settlement of transactions especially difficult, the order-placing participant may file an application to cancel executed transactions in certain cases even when executed transactions are more than 10% but 20% or less of the number of listed shares.

Examination Regarding the Application for Canceling Executed Transactions

When TSE receives an application to cancel an executed transaction, TSE conducts hearings with the order-placing trading participant about the participant's capability to procure funds or securities for settlements and examine the possibility of settlement failure.

- Through these hearings TSE will confirm the following items to examine the possibility of settlement failure:

- Positions held by the trading participant and its affiliate companies

- Details of the negotiation process and the forecast of borrowing stocks from major shareholders, etc.

- Details of the negotiation process and the forecast of fund procurement with financial institutions, etc.

- Forecast of fund or securities procurement by market transactions, etc.

Decision on the Cancellation of Executed Transactions

Decision on the Cancellation of Executed Transactions

TSE cancels executed transactions only if, as a result of its examination, it estimates that there is a high possibility of settlement failures.

If the transactions executed based on the erroneous order do not exceed 20% of the number of listed shares, TSE will cancel the transactions only when the relevant stock is recognized as being in extraordinary circumstances. (note)

- ・For example, a situation where a takeover bid has been offered which will limit floating shares extremely and make it difficult to borrow stocks from major shareholders.

- Even when an order placing participant does not apply for the cancellation of an executed transaction, in cases where it is extremely difficult to settle executed transactions due to an erroneous order, and it is deemed necessary to avoid disruption in the market, TSE will, in certain instances, conduct hearings with the participant about these circumstances and procurement capabilities and decide to cancel a transaction.

Public Announcement on Whether or Not to Cancel Executed Transactions

If it decides to cancel an executed transaction, TSE will promptly make a public announcement of the details of the cancellation. The details of such announcement are as follows.

[ Details of public announcement made by TSE with regard to the cancellation of executed transactions ]

- Name of the issue

- Transactions will be canceled because the erroneous order makes settlements extremely difficult

- Information on the transactions to be cancelled (Time of execution, executed amount, execution serial numbers, etc.)

In addition, if TSE halts trading to disseminate information about the possibility of canceling an executed transaction, but does not recognize any extreme difficulties in the settlement of the transactions based on an erroneous order, TSE will decide not to cancel the transaction and then make a prompt public announcement on the matter.

Range and Effects of the Cancellation of Transactions, Etc.

The transactions that will be cancelled shall be all transactions executed during the period from the first transaction based on the erroneous order to the trading halt.

Transactions that are cancelled are treated as if they were never executed at all.

The rights and duties between customers and trading participants regarding cancelled transactions are also treated as if they were never consummated at all.

Trading after the Decision on Whether or Not to Cancel a Transaction and make a Public Announcement

In cases where a transaction is cancelled and a public announcement is made

Trading of the stock will be halted for the rest of the day on the decision and will be resumed the following day. When trading is resumed, the stock's base price will be the last price executed immediately before the execution of the first transaction based on the erroneous order (including the special quote and the base price of the resuming day).

In cases where a transaction is not cancelled and a public announcement is made

TSE will resume trading 15 minutes after the public announcement of no-cancellation is made.

- If TSE deems there is abnormality or possibility of such in the trading conditions after resuming trading, TSE may take regulatory measures with regard to trading.

Trading Reinstatement

In the event that TSE cancels a transaction, it may, as a special measure, grant the requests of appropriate investors to reinstate certain canceled transactions. However, this reinstatement is limited to cases where the cancellation of executed transactions causes a failure to procure funds and securities for the settlement of any transactions which took place during a set period of time after the cancellation.

Reinstating Transactions

If orders of a customer has been canceled, with prior approval from TSE, a trading participant may execute reinstatement transactions with the order-placing participant acting as a counterparty. This transaction may be conducted at the same price that was used for the canceled transaction.

The conditions of TSE's approval for reinstatement transactions are as follows.

[ Conditions for trading reinstatement approval ] (All conditions must be met.)

- The customer executed "sequence transaction" (*Note) from the first trade based on the erroneous order was executed to the trade halt to disseminate information about the possibility of canceling executed transactions was enforced.

- The canceled transactions may not be based on a discretionary trading contract or a proprietary account of a financial instruments trader

- The canceling of the executed transactions is causing a failure to settle a sequence transaction(s).

(note) "Sequence transaction" refers to any of the following transactions.

- (1) A purchase made using the proceeds from the original sale of the canceled transactions, or (2) a sale of securities made after the original purchase of the canceled transaction. Moreover, this purchase or sale must have been made through the same trading participant who accepted the order for the transaction that was canceled.

- Settlement transactions for margin trading (limited to settlement on the cutoff day for deferred settlements)

- Settlement transactions for stock trading made by exercising an single stock option

Upper Limit on Trading for Reinstatement

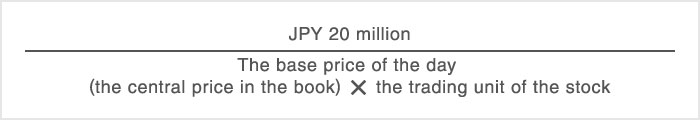

The upper limits on trading reinstatement per customer are as follows. Reinstatement will be not permitted over these limits.

[ Upper limits on trading reinstatement (Units) ]

- Figures under 10 units are rounded up.

Procedure for reinstatement trading

TSE will approve reinstatement transactions based on the application filed by a trading participant. The trading participant must submit an application for those customer transactions which, from among the cancelled trades, are believed to meet the conditions for reinstatement approval. This application must be submitted to TSE by 1:00 pm of the next day of the execution.

In the event that an executed transaction has been canceled and is believed to meet the conditions for reinstatement approval, investors hoping to have their trades reinstated are advised to promptly contact the trading participant to whom they ordered.