Market Manipulation

Market Manipulation

Market manipulation is the act of consciously and artificially causing price changes in the market, misleading others by making it look like those prices are formed by natural supply and demand, and taking advantage of such market fluctuations for one's own benefit. Such activities hinder fair price formation and cause unexpected losses for investors, and are therefore prohibited under the Financial Instruments and Exchange Act. Violators are subject to criminal prosecution or recommendation for an administrative monetary penalty payment order by the Securities and Exchange Surveillance Commission.

Examples of Market Manipulation

False transactions and collusive transactions (Article 159, Paragraph 1 of the Financial Instruments and Exchange Act)

False transaction: A transaction in which a sell order and a buy order are placed and executed at the same time by the same participant, without intent to transfer the rights.

Collusive transaction: A transaction like the above where a seller and a buyer work together.

Spoofing (Article 159, Paragraph 2, Item 1 of the Financial Instruments and Exchange Act)

An act in which a participant places an order that they have no intention of executing in order to move the market by triggering orders from third parties, thereby enabling buying or selling at a price favorable to the participant.

Reference

For recent examples of market manipulation, please see the below.

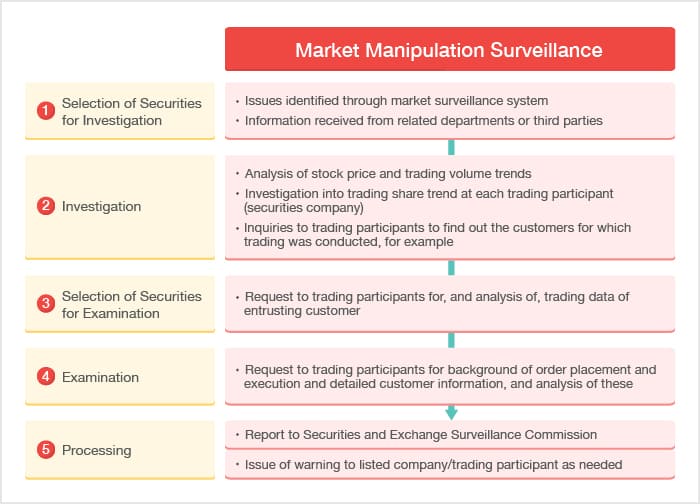

Monitoring of Market Manipulation

In order to check for unfair trading practices such as market manipulation in the cash market (Tokyo Stock Exchange) and derivatives market (Osaka Exchange), Japan Exchange Regulation (JPX-R) analyzes trading trends on a daily basis, targeting issues that have experienced sudden fluctuations in share price or trading volume, or issues for which information is provided by parties inside and outside JPX Group. All trades that are suspected of being unfair are reported to the Securities and Exchange Surveillance Commission.

This approach is referred to as "market surveillance.“ JPX-R uses a dedicated market surveillance system to identify a wide range of trades and orders that may lead to unfair trading such as market manipulation, and then conducts a detailed analysis to narrow down trades that are suspected of being unfair.

Transactions that Could Lead to Unfair Trading

The following are examples of transactions and order types that JPX-R closely monitors as those that could lead to unfair trading such as market manipulation.

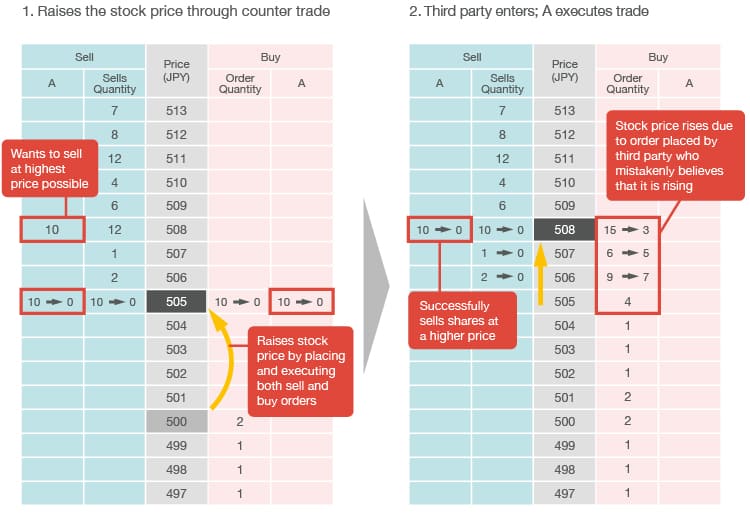

Counter trades to raise stock prices

The current price of a stock is JPY 500, but Investor A wants to sell his stocks at as high a price as possible. To achieve this:

1. He raises the stock price to JPY 505 by placing both a sell order and buy order for 10 units at JPY 505. At the same time, he places a sell order for 10 units at JPY 508, JPY 8 higher than the current price.

2. Seeing the stock price rise due to A's counter trade, a third party, mistakenly believing that the stock price will continue to rise, places a buy order, meaning A succeeds in selling his stock at a higher price (JPY 508).

POINT: We see acts that try to move the price of a stock by intentionally countering buy and sell orders from the same participant as acts that could lead to unfair trading, and therefore monitor them closely.

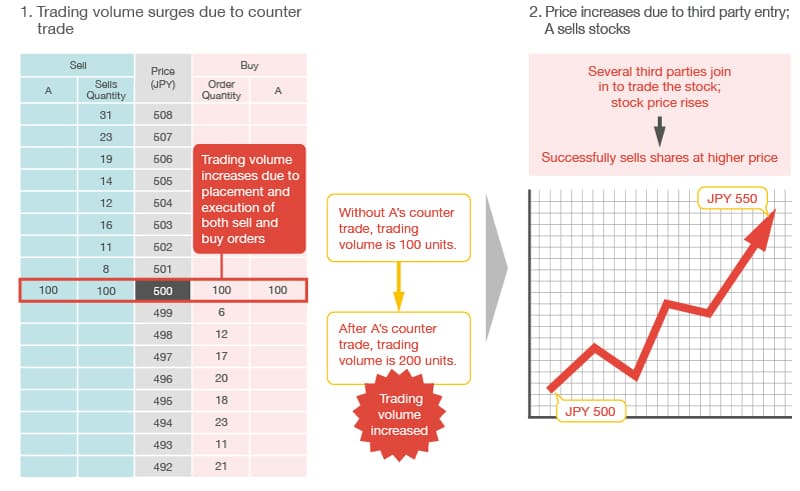

Counter trades to simulate active trading

The current price of a stock is JPY 500, but Investor A wants to sell her stocks at as high a price as possible. To achieve this:

1. She raises the trading volume by placing both sell and buy orders for 100 units at JPY 500 and executing them (a counter trade).

2. Seeing the increase in trading volume due to A’s counter trade, several third parties mistakenly believe that trading is active and come in to trade the stock, and when the stock price rises, A successfully sells her stocks at a higher price (JPY 550).

POINT: We consider acts that increase trading volume by intentionally countering buy and sell orders from the same participant as acts that may lead to unfair trading, and therefore monitor them closely.

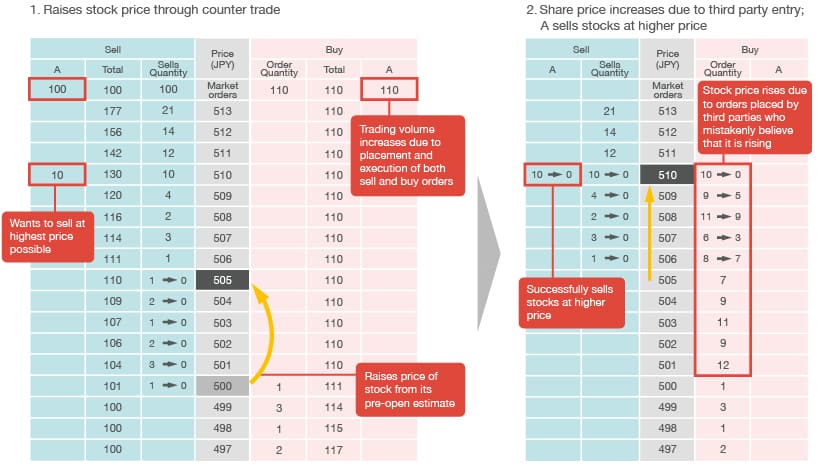

Counter trades with an unbalance between buy and sell

The pre-auction estimate opening price is JPY 500. Given this, Investor A:

1. Places a market sell order for 100 units and a market buy order for 110 units and executes them at market open (a counter trade), thereby increasing the trading volume and raising the opening price to JPY 505 (effectively buying only the difference of 10 units at JPY 505).

2. Seeing the stock price rise due to A's counter trade, third parties mistakenly believe that the stock price will continue to rise and place buy orders, sending the stock price higher. A successfully sells the 10 units he purchased at market open at a higher price (JPY 510).

POINT: We consider acts that try to move the price of a stock by intentionally countering buy and sell orders from the same participant as acts that could lead to unfair trading, and therefore monitor them closely.

Counter trades after raising the closing price

With the repayment date for a margin trade approaching, Investor A wants to make a counter trade at a higher price to roll her position. To achieve this, she:

1. Places, just before market close, a buy order for 10 units at JPY 505, JPY 5 higher than the current price, and executes it, setting the closing price at a higher price (JPY 505) and thereby raising the base price for the next day.

2. Places a sell order and a buy order (both market orders for 100 units) prior to the next day's market open and executes them at market open, thereby enacting a counter trade at the raised base price (JPY 505).

POINT: We consider acts that intentionally move the stock price in relation to counter trades as acts that could lead to unfair trading, and therefore monitor them closely.

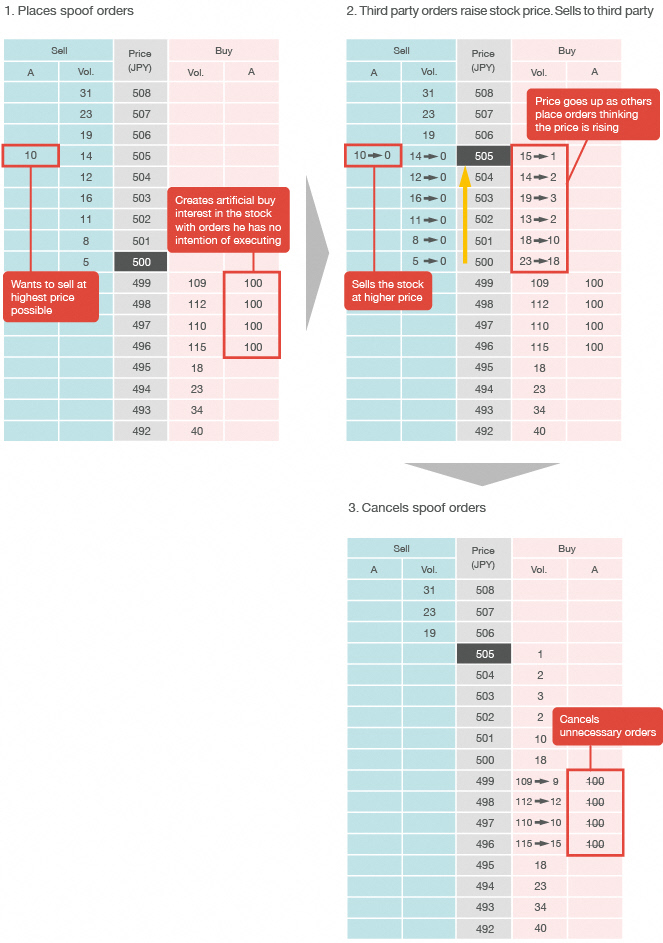

Spoofing

The current price of a certain stock is JPY 500, but Investor A wants to sell his stocks at as high a price as possible. To achieve this:

1. He makes it look like there is healthy buy interest in the stock by placing 400 units of spoof buy orders (orders which he has no intention of executing) ranging from JPY 496 to JPY 499. He also places a sell order of 10 units at the higher price of JPY 505.

2. This series of buy orders misleads others into buying stocks, thinking that the stock price will go up. This enables Investor A to sell his stock at the higher price of JPY 505.

3. Then Investor A cancels the unnecessary buy orders.

POINT: We see "spoof" orders which the trader has no intention of executing as acts which could lead to unfair trading, and therefore monitor them closely.

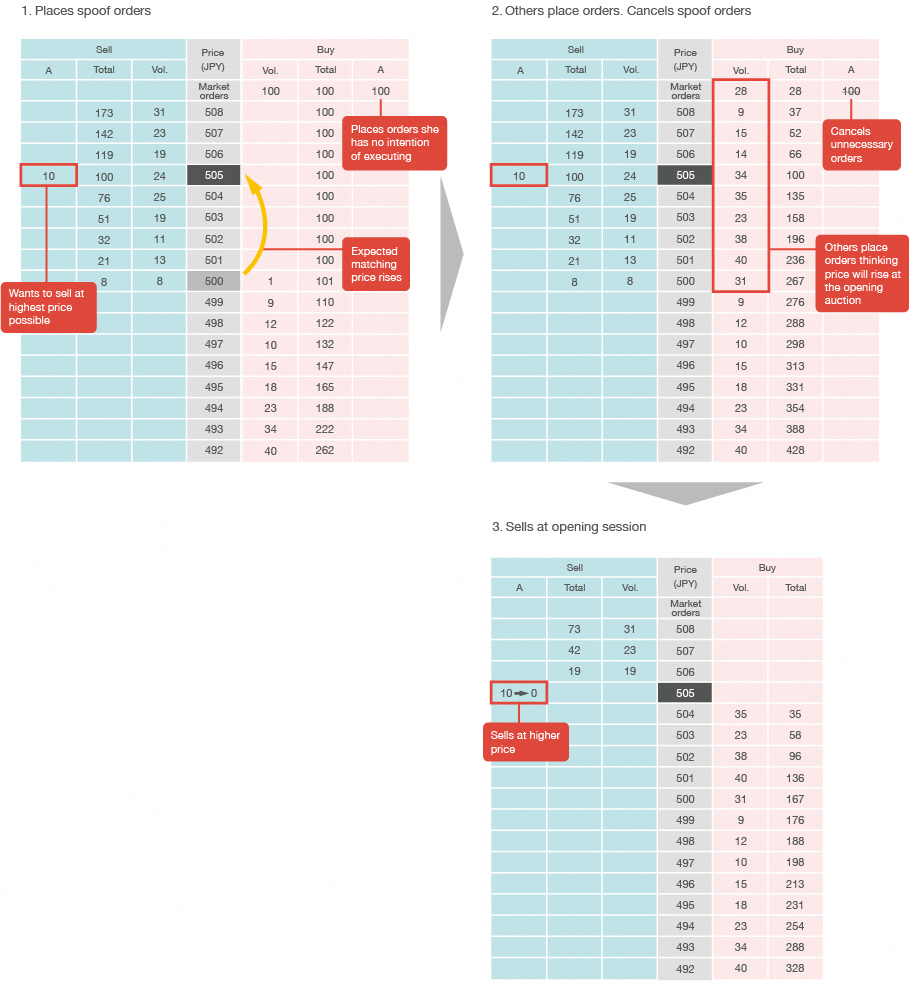

Spoofing before the opening auction

The expected matching price before the opening auction is JPY 500, but Investor A wants to sell her stock at as high a price as possible. To achieve this:

1. She raises the expected matching price to JPY 505 by placing 100 units of a "spoof" market buy order (an order which she has no intention of executing) before the opening auction. She also places 10 units of a sell order at JPY 505, JPY 5 higher than the original expected matching price.

2. Investor A's market buy order (a spoof order) misleads others into buying the stock, thinking that the stock price will go up. Investor A then cancels the unnecessary market buy order immediately before the opening auction.

3. This enables Investor A to sell her stock at JPY 505 at the opening auction.

POINT: We consider "spoof" orders which the trader has no intention of executing and acts with the intention of fluctuating the expected matching price as acts which could lead to unfair trading, and therefore monitor them closely.

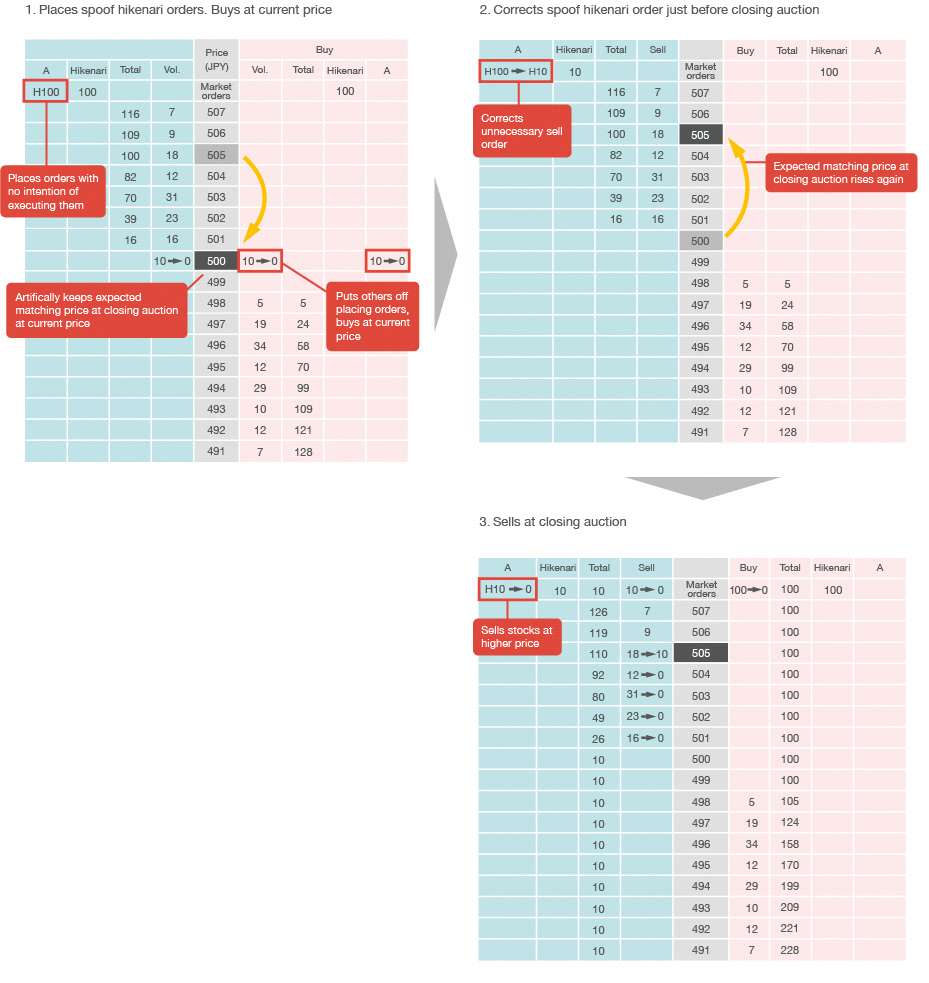

Spoofing intended to discourage orders

The price of a certain stock is JPY 500, but due to another investor's hikenari order (a market order to be executed at the closing auction), the expected matching price at the closing auction is expected to rise to JPY 505. Seeing this, Investor A:

1. Artificially keeps the expected matching price at the closing auction at the current price of JPY 500 by placing 100 units of a "spoof" hikenari order (an order which he has no intention of executing). This puts other investors off placing orders. Investor A buys 10 units of the stock at the current price, JPY 500.

2. Investor A then corrects his spoof hikenari sell order of 100 units to 10 units, and the expected matching price at the closing auction goes up to JPY 505 again.

3. This enables Investor A to sell his 10 units of the stock at the higher price of JPY 505.

POINT: We consider "spoof" orders which the trader has no intention of executing and acts which are intended to fluctuate the expected matching price as acts which could lead to unfair trading, and therefore monitor them closely.

FAQ on Market Manipulation

The following are frequently asked questions about market manipulation and artificial market formation. For questions about insider trading, please see the linked pages below.

-

Q1.

Market Manipulation

What is market manipulation? -

A1.

The following are the main acts prohibited as "market manipulation" by Article 159 of the Financial Instruments and Exchange Act:

- Conducting a series of trading that mislead other investors into thinking that trading of a certain listed security is active, with the purpose of creating an environment in which other investors want to trade said security (intention to solicit). Also, conducting a series of trades to influence the market price of said security for the same purpose.

- Making trades without intending to affect a transfer of rights (wash sales), or conspiring with others on certain trades (collusive trading) with the purpose of misleading other investors regarding the overall trading environment, such as leading them to believe that trading is active.

One incident that occurred with regards to market manipulation involved Cats, Inc., which was previously a TSE-listed issue. (From "Activity Status of Securities and Exchange Surveillance Commission," August 2004)

The former president (A), current president (B), the president of another company (C), an executive of this other company (D), and two others conspired on the following regarding the shares of Cats, Inc.:

-

With the intention of inviting trading of the company's stock to raise its price, under the name of the company managed by C and others, they used a securities company as an intermediary for:

a) Making a series of trades to purchase a total of around 2.45 million shares of Cats, Inc. stock and sell a total of around 1.47 million shares of the same stock, pushing up the high price through multiple market orders or high-price limit orders, among other methods, and

b) Commit so-called price manipulation by consigning a purchase of around 210,000 of the company's shares through methods such as placing a large number of orders at the low price to support it and cause the price to jump from JPY 3,290 to JPY 3,970 -

Also, with the purpose of leading others to falsely believe that trading was active and otherwise misleading others with regards to the trading conditions of the company's stock,

a) C affected wash sales during this period where he did not intend to transfer share ownership, as he sold a total of approximately 580,000 of the company's shares while simultaneously purchasing the same shares, and

b) C and one other outside person conducted collusive trading during this period, as they conspired beforehand for the outside person to purchase or sell the shares sold or purchased by C at the same price, for a total of around 350,000 shares.

As a result, A was given a sentence of 3 years in prison, 5 years of probation, and fined JPY 310 million (Tokyo District Court, March 11, 2005); B, C, and D were given a sentence of 2 years 6 months in prison, 4 years of probation, and fined JPY 310 million in total (Tokyo District Court, February 8, 2005).

-

Q2.

Price Ratcheting

If I make a purchase of a certain issue through a limit order that closely follows the highest quote resulting in a stock price increase, does that constitute market manipulation? -

A2.

Determining whether or not a simple purchase that closely follows the highest quote constitutes market manipulation is impossible. Japan Exchange Regulation (JPX-R) determines if the trading is problematic based on a comprehensive analysis of facts such as whether these types of purchases continue to be replicated, whether the execution times are concentrated at the end of auction trading, and whether the quantity is excessive in consideration of the liquidity and other unique characteristics of the issue.

Purchases that closely follow the highest quote fall under a typical trading pattern that is suspected of market manipulation. Among those trades thought to be made to intentionally control the price of a security held to increase its value, many instances of this type of trading have been found.

As such, JPX-R verifies if the order placement or execution is problematic whenever one of these purchases is made, and through the securities company, reviews whether or not circumstances show that the person who placed the order has manipulated the price.

Typical trading patterns that are suspected suspicious of market manipulation have been outlined in the midterm report of the Securities Exchange Commission Special Committee on Unfair Transactions (Jan. 20, 1992) as follows:

- Placing limit bids before the beginning of trading at a price higher than the closing price of the previous day

- Placing limit bids at a price higher than the most recent quotation as determined by the zaraba method and/or revising the remainder of a limit bid upwards

- Placing successive limit orders one after another, with each JPY 1 higher than the last

- Making a wash sale at a relatively high price

- Making trades to halt the decline of a stock's price through limit bids

- Continuously making a series of bids, etc. that instantaneously keep pace with a rise in the market

- A suspicious level of involvement in the market

- Suspicious involvement around the time of the closing price - the most significant period of the day

- Multiple trades in a certain issue during the day

-

Q3.

Purchases at the Closing Price

When I made an at-the-close purchase on the last day of the earnings period (March 31), I was given a warning by my securities company. Does this constitute market manipulation? -

A3.

As the closing price is used to appraise a listed company's shares, fair determination of this price is very important.

Accordingly, securities companies pay close attention to whether or not the closing price has been pushed up as a result of certain orders whenever it is higher than the immediately preceding price.

Of course, not all at-the-close purchases constitute market manipulation, but if a particular person continuously makes multiple purchases and seems to have the intention of raising or supporting a stock's price, this may suggest market manipulation.

Also, due to accounting processing and other factors, an issuing company's large shareholders have a strong incentive to boost the appraised value of the shares that they possess.

Special attention is therefore paid to closing prices at the end of the earnings period.

-

Q4.

Collusive Trading

For a certain issue, I made a sale and an acquaintance made a purchase at the beginning of trading on day X, and my acquaintance made a sale and I made a purchase at the beginning of trading on day X+1. Is this prohibited under the Financial Instruments and Exchange Act as collusive trading? -

A4.

Whether this falls under collusive trading or not is determined based on whether there is prior arrangement with the acquaintance, and if there was intention to mislead other investors into believing that trading is active from the way orders are placed and executed, etc.

As such, if both parties trade through the same securities company, among other things, the securities company will confirm their intentions when it receives the orders. The company also pays attention to points such as whether or not these types of inter-client trades are made multiple times, and if there was any intentional involvement in the stock price before and after these trades.

-

Q5.

Deliberate Market Price Formation

How does "deliberate market price formation" differ from market manipulation? -

A5.

As a behavior regulation for securities companies, the Financial Instruments and Exchange Act prohibits "deliberate market price formation" trades in order to prevent market manipulation before it happens.

Specifically, the employees and executives of a securities company are prohibited from making trades with the intention of influencing or fixing the price of a security, as well as knowingly accepting such orders from clients.

Unlike market manipulation, in these cases, the intention to draw trading from other investors is not necessary. Making trades to intentionally create a certain advantageous margin transaction cross-over price, issue price for new shares, or other price is prohibited.

One example of administrative punishment imposed on a securities company for deliberate market price formation involved a securities company that accepted and executed purchase and other orders from a client with the knowledge that the client was intentionally trying to raise the price of the issue. Over the course of 2 months, this client used methods such as placing limit bids at a price higher than the immediate preceding price for a certain stock in order to lift the price.

As a result of these actions, the branch office of this securities company that accepted the client's orders was prevented from conducting equity trading brokerage services for two weeks.

-

Q6.

Misegyoku(fake order)

What is a Misegyoku (fake order)? -

A6.

Misegyoku (fake order) is the practice of making bids or offers with no intention of executing the orders, for the purpose of drawing bids or offers from other investors in order to create a more advantageous stock price (raising the price in the case of inducing bid executions and lowering the price in the case of inducing offer executions).

Orders made with this intention may fall under the definition of "a series of trades made in order to influence the price of a security" as outlined by Article 159, Paragraph 2, Item 1 of the Financial Instruments and Exchange Act.

With regards to the criteria for determining whether an order is a fake order, the Securities and Exchange Surveillance Commission indicated the following points within supplementary documents for a disciplinary advisory against a security company's dealings dated June 23, 2003:

- One cancels all bids (offers) immediately after the execution of his/her offers (bids).

- The price range or quantity of limit orders makes the purchase (sale) side of the order book look larger, having the effect of drawing bids (offers) from other market participants.

- Conducting the above trades multiple times

- One places an excessive amount of orders when compared with the normal scale of his/her dealings.

- A day trader who holds no overnight positions places limit orders that become market orders at the closing auction if not already executed.

The following is an example of administrative disciplinary action taken against the proprietary trading division of a securities company (from "Securities and Exchange Surveillance Commission Activities," August 2005)

Over a period of 10 months, a dealer in this securities company, after executing his own proprietary purchases or sales, induced bids / offers from other investors by placing a large series of limit bids / offers with no intention of execution in order to move the price of certain issues to his advantage.

After the prices of these issues rose or fell, the dealer then placed offers / bids offsetting the original purchases or sales. When these orders were executed at a price advantageous to him, the dealer immediately canceled the above series of limit orders.

As a result of these actions, the securities company was prevented from performing equity trades on its proprietary account for 10 days.

-

Q7.

Short Selling

I would like to place a sell order for 10,000 shares (100 units) on margin.

If I split the order into two orders of 5,000 shares (50 units) each, will it be exempt from the short selling price restrictions? -

A7.

When an individual investor, etc. places a sell order on margin, the short selling price rule does not apply if the quantity of the order is 50 units or less, but this "quantity of the order" is the quantity that said investor has indicated in a single order.

In this case, although it depends on the specifics of the order to be split into two, simply splitting an order for the same issue at the same price into 50 units or less cannot be regarded as placing separate orders even if the order times are different, and therefore the order cannot be assumed to be exempted from the price rule.

Securities firms are also required to adequately remind their customers that intentionally splitting an order into 50 units or less for the purpose of circumventing the price restrictions is not one of the types of sales that can be assumed to be exempt from the price restrictions (Comprehensive Guidelines for Supervision of Financial Instruments Business Operators, etc., IV-3-2-3 Exercise of Checking Function against Investors (1) (iii) A.).

In the case where the price differs, for example between a market order of 50 units or less and a limit order of 50 units or less, or where an order is placed with a single instruction for 50 units each at before close and on close, these can be considered separate orders and can be assumed be exempted from the price rule.

-

Q8.

Padding Orders

What is a "Padding Order"? -

A8.

When it is almost certain that an allocation at the price limit will be carried out for a certain stock at the end of the afternoon session, an order that is placed with no intention of being executed in order to receive a larger allocation is known as a "padding order."

Padding orders can distort the supply-demand relationship and impede the fairness of the market, and can also impede fairness among investors because the right quantities will not be allocated to other investors as they should. JPX-R believes that padding orders are an abuse of the allocation at price limit system, which was established to realize fair allocation based on actual demand. Furthermore, a securities company placing padding orders for its own orders is considered to be an act that violates the just and equitable principles of trade as stipulated in Rule 42 of the Trading Participant Regulations (a fraudulent act, dishonest or improper conduct, or extremely careless or negligent business practices).

In addition, in the case that an order is executed that exceeds the quantity the investor intended to buy or sell, this could pose many problems from a risk management perspective for the securities company that accepts the order, since they may be unable to take delivery.

For this reason, securities companies pay attention to whether customer orders are padding orders. The securities company may check whether, looking from the outside, the order quantity is significantly larger than the customer's normal order quantities and amounts, or whether the order quantity has suddenly increased compared to the customer's other orders that day; if the order is a purchase, whether the purchase order exceeds the customer's assets in custody; or if the order is a sale, whether the number of shares to be sold exceeds the number of shares placed in custody or received in advance.

However, even if a purchase order is within the amount of assets held in custody or the number of shares held in custody or received in advance, if the order is one that the customer has placed with no intention of executing for the purpose of receiving a larger allocation of shares, then it is considered a padding order.

Therefore, a securities company may confirm with the customer that it does intend to execute the entire amount of the order and that the order is not a padding order.

-

Q9.

Spreading Rumors

What does it mean to spread rumors? -

A9.

Spreading rumors implies disseminating information about a securities transaction or listed company that is inconsistent with the facts and/or has no rational basis, for the purpose of trading or influencing the price of a security.

Some information that can be considered rumors about listed companies or securities trading have been seen recently on various internet message boards, chat rooms, and newsletters.

These activities may fall under "spreading rumors" as prohibited by the Financial Instruments and Exchange Act.

In many cases, this information is posted for amusement or personal profit, and depending on the situation, making investment decisions based on this information alone may lead to unexpected losses.

For this reason, it is essential to not simply trust information circulating on the internet when making investment decisions, but to verify its authenticity through other sources such as the securities report and materials published by the listed company.

- Q10. What is an example of rumor spreading?

-

A10.

The following example was an incident (November 29, 2002) prosecuted by the Securities and Exchange Surveillance Commission (from "Activity Status of Securities and Exchange Surveillance Commission," August, 2003).

Person A sent out an e-mail recommending trading of Company B's shares to members previously recruited over the internet. The e-mail contained false information and was designed to alter the price of the stock.

The e-mail sent out to 10s of members by A stated, "some negative news having an impact on the company's existence will be announced tomorrow, so please place sell orders at the beginning of trading tomorrow." The next day, A sent out another e-mail that said the negative news was false and advised the members to buy back the shares.

By doing this, A made several hundred thousands of yen in profit by selling the 10 odd shares he held when the stock price increased.

The incident was uncovered when the member investors who suffered losses brought information to the Securities and Exchange Surveillance Commission, and as a result of the trial, A was fined JPY 300,000 and paid JPY 360,000 in additional charges.

Guidelines on Prevention of Unfair Trading

These guidelines summarize the activities that JPX-R primarily monitors in order to ensure that trading is conducted appropriately in accordance with the purpose of the market manipulation rules in various situations such as acquisition of treasury stock and trading of financing stocks.