Real Time Market Data

OSE provides market data concerning OSE and TOCOM markets, such as current/open/high/low prices and trading volume of listed issues, as a paid service.

Data Contents

Data Obtainable via J-GATE

| Item | Contents (Broadcast) | Contents (Multicast) |

| Auction Trading Infomation | Basic issue info (Code (Genium codes), names, etc.), Current/open/high/low prices,Trading volume, Trading value, Number of executions, Best quotes, Multiple quotes, Regulatory info, Base price, Price limits, Update info, Settlement price |

Basic issue info (Code (Genium codes), names, etc.), Session info,Execution notice with partial price info, Best quote, Multiple quotes, Regulatory info |

| Index Data1 | JPX JGB Futures Index, Nikkei-JPX Commodity Index, Nikkei-JPX Nearby Month Commodity Index, Nikkei-JPX Industrial Commodity Index, Nikkei-JPX Precious Metals Index, Nikkei-JPX Agricultural Product Index, Nikkei-JPX Gold Index, Nikkei-JPX Silver Index, Nikkei-JPX Platinum Index, Nikkei-JPX Palladium Index, Nikkei-JPX Rubber Index, Nikkei-JPX Soybean Index, Nikkei-JPX Azuki Index, Nikkei-JPX Corn Index, Nikkei-JPX Oil Index, Nikkei-JPX Crude Oil Index, Nikkei-JPX Gasoline Index, Nikkei-JPX Kerosene Index (including Leveraged Index and Inverse Index based on these Indices and Double Inverse Index based on JPX JGB Futures Index) | - |

| J-NET | J-NET trading data, etc. | - |

| Full Orders2 | - | Number of orders at every price point including size and others |

- Only the indices chargeable under the "Policies Regarding Usage of Market Information" is listed.

The use of each index for any purpose other than as an internal reference for futures and/or options trading on these indices requires the users to separately take licensing procedures with each index provider. - To use full order information for futures and options, a contract for futures and options information for auction trading is necessary (full order information for futures and options is not available by itself).

In case of receiving full order information for futures and options via J-GATE by directly connecting with OSE, "line for receiving multicast full order information" is required.

If receiving the information indirectly from the derivatives system by using an OSE Information Service Provider, full order information for either futures or options can be selected and used separately.

Acquisition of Information

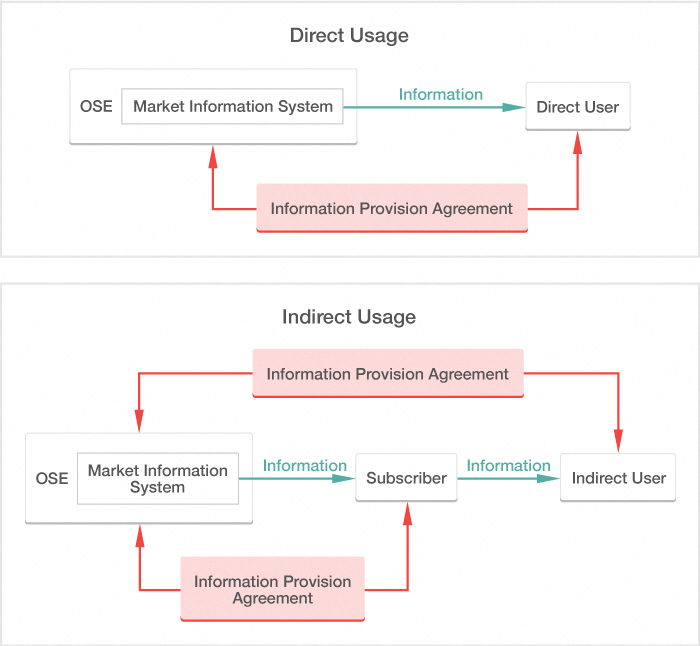

OSE market data can be acquired either directly, by connecting to the Market Information System in accordance with specifications and instructions from OSE (Direct Usage), or indirectly from market information providers (Indirect Usage). Both Direct and Indirect Users are required to enter into an "Information Provision Agreement" with OSE.

OSE provides real-time market data for Direct Usage, and real-time market data, 15 minutes delayed data and end of day value data for Indirect Usage.

Please note that redistribution of data acquired from OSE to any third party is prohibited without prior permission from OSE.

Inquiry/Contact

JPX Market Innovation & Research, Inc. Client Services (Contractor)

TEL:+81-050-3377-8650

E-mail:md@jpx.co.jp