Outline

Trading participants act as intermediaries for investors to place orders to the exchange and they serve a vital role in maintaining confidence in the exchange market through their securities operations.

In accordance with exchange rules, Japan Exchange Regulation (JPX-R) and Tokyo Commodity Exchange, Inc. (TOCOM) conduct the following operations in relation to trading participants:

- Examining eligibility for admission as trading participant

- Inspection of trading participant compliance with laws and regulations

- Issuing warnings and deciding disciplinary actions as needed

Trading Participant Admission

In consideration of the importance of maintaining high standards in the exchange market, trading participants are expected to contribute to fair price formation and ensure smooth trading.

JPX-R and TOCOM conduct the examination based on documents, hearings, on-site inspections of internal management systems at headquarters and branch offices, and interviews with senior executives (president, CEO, etc.), in accordance with Trading Participant Qualification Criteria.

Inspection of Trading Participants

JPX-R and TOCOM conduct inspections of trading participants to assess their compliance with laws and regulations. This is an integral part of our efforts to ensure the fairness and integrity of the market.

As described in the table below, there are several types of inspections: general inspection, follow-up inspection and special inspection. These inspections are conducted on-site or through document-based inspections.

Types of Inspections

| Description | |

| General Inspection | Conducted sequentially, starting with those trading participants for which inspections are deemed highly necessary according to mainly the results of past inspections, the results of inspections by the SESC, and the time elapsed since the previous inspection. |

| Follow-up Inspection | Conducted as needed to check for improvements within approximately one year after an inspection. |

| Special Inspection | Focus on specific issues based on a range of information. |

Inspection Methods

| Description | |

| On-site Inspection | Conducted by visiting the headquarters and selected offices of the trading participant; most inspections are conducted in this manner |

| Document-based Inspection | Conducted without an on-site inspection when it is determined that the materials submitted by the trading participant are sufficient, based on the items subject to inspection and other circumstances |

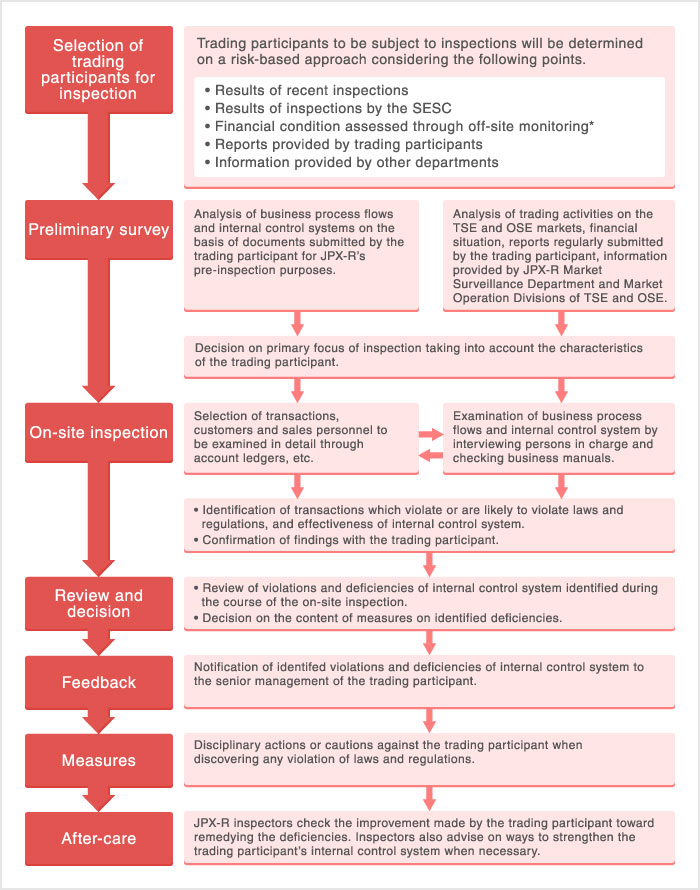

Inspection Procedure

The inspection process consists of the following steps: selection of trading participants - preliminary survey - on-site inspection - review and decision - feedback - measures - follow-up.

- Off-site monitoring

JPX-R and TOCOM gather and analyze information pertaining to trading participants (information on on-exchange trading activity, various statements and reports submitted by trading participants, disclosed information, and information on clearing, etc.).

Appeal System

JPX-R and TOCOM provide an appeal system in order to maintain and improve the transparency of the inspection process.

Under this system, if the trading participant subject to the inspection disagrees with any findings, it may submit a written appeal to JPX-R or TOCOM regarding the matter in question.

Disciplinary Actions

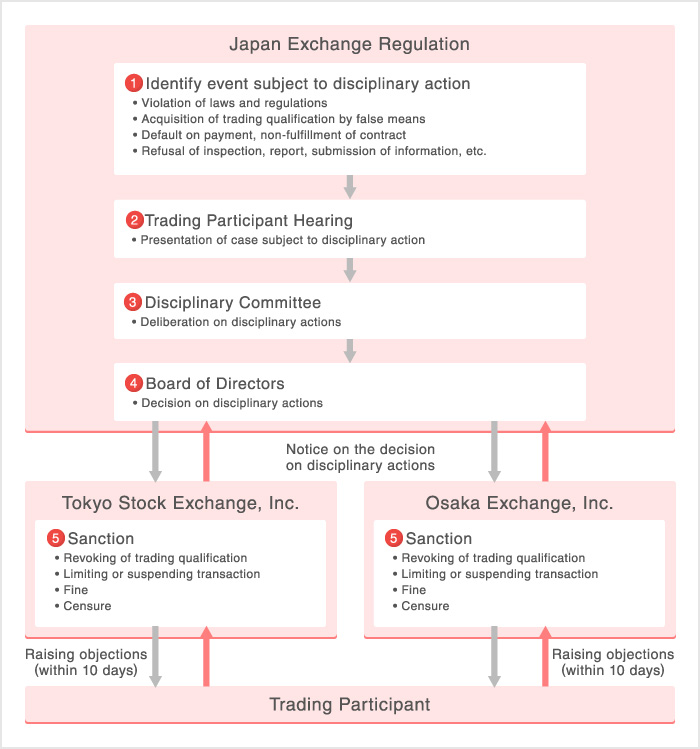

JPX-R and TOCOM determine exchanges' disciplinary actions against trading participants for violations of laws and regulations. These actions include fines, censure, trading suspension, and limiting or canceling trading qualifications.

Disciplinary Proceedings

JPX-R

JPX-R determines disciplinary actions after consultation with the disciplinary committee, an advisory body to the JPX-R board.

- Click here for Points of Consideration in Deciding Disciplinary Actions.

TOCOM

The Board of Directors of TOCOM will decide the specific sanctions to be imposed based on the contents of deliberation by the advisory Self-regulatory Committee (*) after following the due procedures such as the provision of the opportunity to provide explanation.

- Self-regulatory Committee

As an advisory body to the Board of Directors, TOCOM has established the Self-regulatory Committee to deliberate on the matters concerning self-regulatory activities. TOCOM has also established a department in charge of self-regulatory activities to support the execution of duties by the Self-regulatory Committee. - Click here for Points of Consideration When Deciding on Sanctions.

Compliance Support

JPX-R and TOCOM perform various activities to support trading participant compliance with laws and regulations.

| Seminars for Inspection Staff at Trading Participants | JPX-R and TOCOM hold seminars to explain the cases of violations identified during inspections. These seminars are targeted to inspection staff at trading participants. |

| Compliance Seminars | In response to trading participant requests, JPX-R and TOCOM send staff to hold information sessions on compliance. These sessions are designed to help achieve compliance with laws and regulations. The contents of the seminars are determined based on the individual request of the trading participant. The sessions are targeted at trading participant executives and employees and provide specific examples of violations and how to prevent them. |

| Publication of the Case Study Handbook | JPX-R gathers information on compliance through inspections and questions from trading participants. These examples are summarized and compiled in a question-and-answer format into the Compliance Case Studies. |

Cooperation with Other Regulators

In order for effective inspections, JPX-R and TOCOM cooperate with several regulators to exchange information related to inspections.

| Reports to regulatory authorities |

|

| Regular meetings for information exchange |

|

| Joint inspections with other self-regulatory organizations |

|