Application of XBRL to Timely Disclosure Information

XBRL

XBRL (eXtensible Business Reporting Language) is an XML-based computer language which is standardized for creating, distributing, and reusing financial information. In enabling investors at home and abroad, financial institutions, supervisory authorities, and stock exchanges, but also listed companies, to keep track of highly transparent financial information in a speedy and timely manner, it is expected to have a significant impact on corporate management as well as enhance the function of the securities market. Tokyo Stock Exchange, Inc. (hereinafter "TSE") has been implementing various initiatives to apply and advance XBRL, the next-generation standard language for financial data transmission, based on the conviction that it will enhance the accuracy and fairness of corporate information as well as convenience for investors.

The timely disclosure system plays important roles of supplementing the statutory disclosure system and providing information in a timely manner, and earnings information ("earnings reports") disclosed through this system is available earlier than securities reports. As such, investors, who use financial statements, are likely to use those in earnings reports first. With this in mind, in line with the introduction of XBRL to the statutory disclosure system, securities exchanges, etc. also fully applied XBRL when the third generation TDnet system launched in 2008. In order to meet a wide variety of needs of users in the securities market, TSE will continue advancing the application of XBRL with the goal of achieving sophisticated information reuse and enhancing investor convenience.

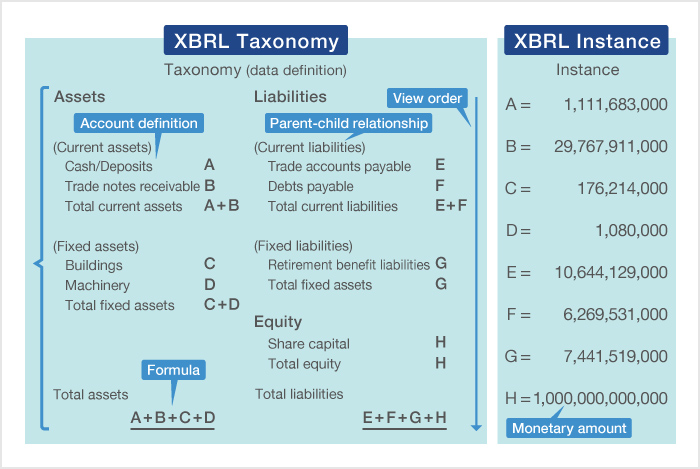

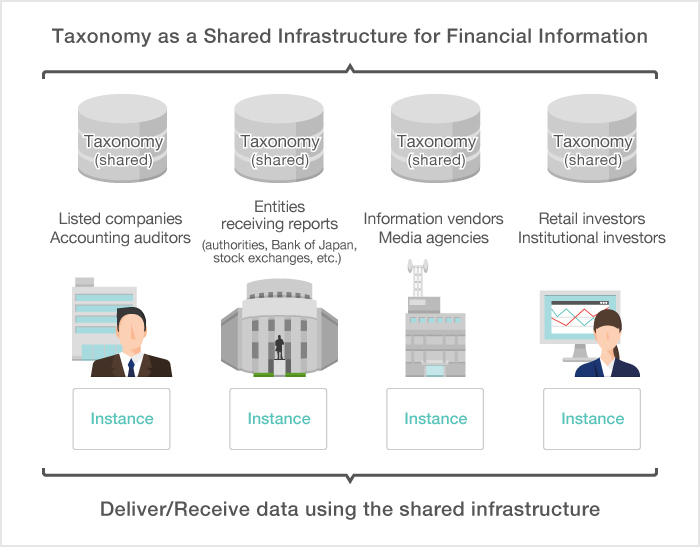

XBRL is composed of taxonomies that define financial data and instances in which actual numerical data are stored. A taxonomy allows not just definition of account titles used in financial statements, but also of the order of account titles and calculation formulas within those titles, among other things. This standardizes definitions of account names, parent-child relationships, view order, and formulas, etc. on XML. Defining these things within the specifications of a particular language can enable definition of data structure and calculation logic which does not depend on the system environment. As a result, since all financial data are produced in the common standard of XBRL, there should be a significant improvement in comparability and validity, which will lead to greater timeliness, accuracy, and transparency of information.

- While every effort has been taken to ensure the accuracy of the contents on this website, TSE does not guarantee that they are free from errors and/or omissions. The rules and numerical values indicated in these contents are based on information sources that TSE deems reliable, but this does not mean than TSE can guarantee their accuracy or completeness.