Overview (TPBM)

Benefits of using the TOKYO PRO-BOND Market

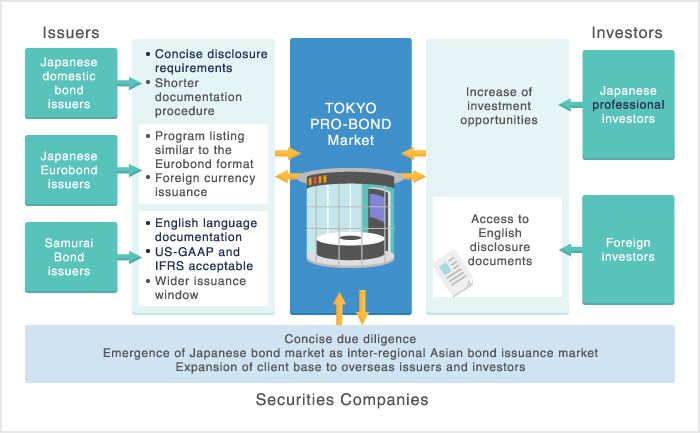

The TOKYO PRO-BOND Market offers significant benefits for market participants including issuers, investors and securities companies.

Benefits of the TOKYO PRO-BOND Market

Benefits for Japanese Issuers

Compared to public issuances in Japan

Greatly simplified issuance procedures

The TOKYO PRO-BOND Market is based on the “professional markets system” incorporated into the Financial Instruments and Exchange Act in 2008. The issuance procedures of PRO-BOND reduce the administrative burden for issuers by vastly simplifying legal responsibilities, necessary documentation and other procedures without compromising the quality of information for investors.

Fewer constraints on timing of issuances

Simplified legal and administrative procedures enhance the flexibility of bond issuances, resulting in a wider issuance window for issuers.

Compared to Euromarket issuances

Lower cost of issuances on Japanese market

The TOKYO PRO-BOND Market provides the same level of flexibility for issuances as other overseas markets including the Euromarket, and is particularly attractive for issuers targeting Japanese investors. Issuers can avoid the cost of translating documents into English, legal fees and other expenses necessary for a similar issuance on overseas markets.

Benefits for Overseas Issuers

Compared to Samurai Bonds

Overseas issuers can easily issue bonds in Japan, expanding opportunities for fund raising

The TOKYO PRO-BOND Market allows information disclosure in English. One of the major obstacles for overseas issuers before the establishment of PRO-BOND was the requirement to provide all necessary documentation in Japanese. Issuers are able to use international, U.S. or other accounting standards. Issuances can also be denominated in a variety of currencies other than yen.

Benefits for Investors

- The TOKYO PRO-BOND Market provides Japanese and overseas investors with a diverse range of investment opportunities available on the Japanese market.

- Overseas investors will gain access to a wider selection of investment-grade securities in form of issuances in the TOKYO PRO-BOND Market.

- The New Japanese Bond Income Tax Exemption Scheme for non–residents of Japan introduced in June 2010 also applies to bonds listed on the TOKYO PRO-BOND Market.

Benefits for Other Market Participants

- The TOKYO PRO-BOND Market gives issuers and investors wider access to Japan’s bond market, expanding the volume of the bond market overall.

- The expansion will increase business for securities companies involved in underwriting and selling bonds, as well as for legal specialists, accountants, and rating agencies.