Overview (Infrastructure Funds)

Infrastructure Fund Market

Tokyo Stock Exchange (TSE) established an infrastructure fund market on April 30, 2015 for listing funds that invest in infrastructure assets including renewable energy facilities, power grids, and transport and transmission networks.

In recent years, due to a combination of a harsh fiscal climate and an urgent need for maintenance and repair of existing infrastructure and new construction projects, there are increasing calls to tap into private sector funds and know-how for infrastructure development and management.

In addition, infrastructure investments are viewed as a stable asset class that is not easily affected by economic trends and drawing interest as a means to safely diversify investment portfolios.

Considering the social significance of infrastructure development and the increasing demand for infrastructure investments, TSE developed the necessary rules and launched the infrastructure fund market to address the needs for raising funds and investments.

Structure of infrastructure funds

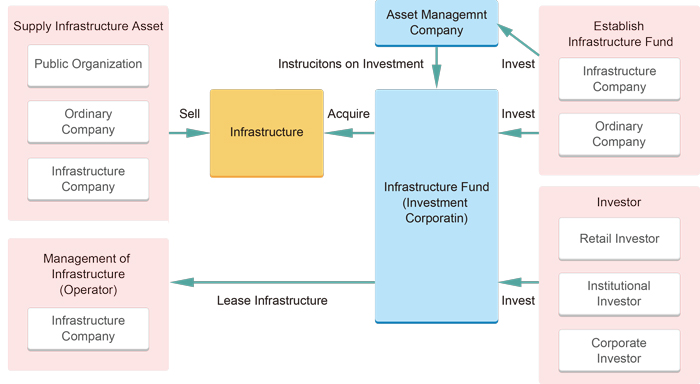

The infrastructure fund market allows investment corporations or investment trusts that invest in infrastructure, like renewable energy and port facilities, to be traded in the same way as REITs, which invest in real estate properties like office buildings and residential buildings.

The structure of infrastructure funds are basically similar to those of REITs, using funds gathered from investors to acquire assets and then sharing profits with investors.

Example of an Infrastructure Fund Scheme (for an Investment Corporation)

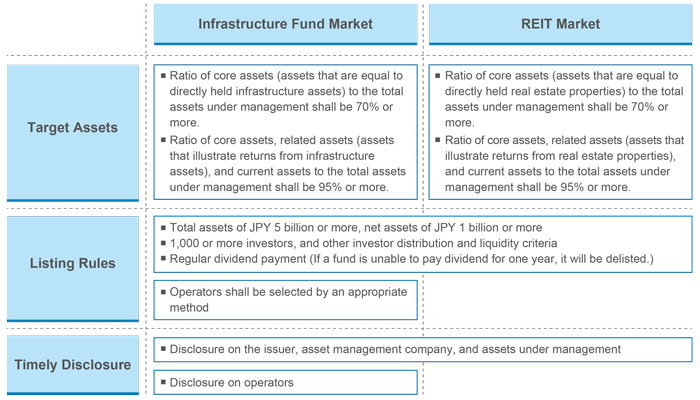

While the listing rules for the infrastructure fund market are generally based on the framework for the REIT market, there is a key difference in provisions that were added to reflect the nature of infrastructure funds. Since the profits of an infrastructure fund depend on how its assets are managed and operated, additional provisions were established to ensure adequate and stable management of infrastructure and timely disclosure on "operators" in charge of the management of the invested infrastructure assets.

Rules related to operators

- Infrastructure funds shall disclose information about operators.

- Infrastructure funds shall develop and disclose the basic policy for selecting operators.

In addition, to ensure regular dividend payouts, infrastructure funds must invest in infrastructure assets that can be expected to generate stable profits after construction is completed and are in operation, instead of those currently under construction.

Rules on stable profits from infrastructure assets

- Infrastructure funds shall invest in infrastructure assets that have been operating for one year or more and generate stable profits.

Differences between the infrastructure fund market and the REIT market

For more detailed information on the listing rules and timely disclosure standards for the infrastructure fund market, please refer to the following