Credit Default Swaps (CDS)

How do I trade credit risk?

Credit risk is most broadly defined as the risk of a debtor not being able to meet its obligations. Debt guarantees or default insurances have been hedging tools for corporate credit risk. Credit Default Swaps (CDS) are globally standardized means of transferring credit risk between two parties.

About CDS Trading

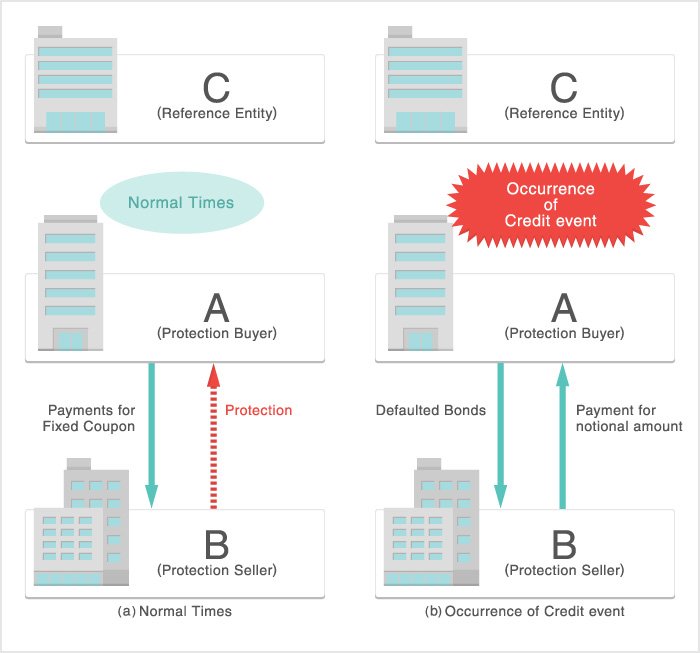

CDSs are traded over-the-counter (OTC) mainly between financial institutions. Under a CDS trade, the party which wants to short credit risk (referred hereafter as "Protection Buyer") makes fixed periodic payments (referred hereafter as "Fixed Coupon"), while the party who takes the risk (referred hereafter as "Protection Seller" ) receives the coupon. In case of certain corporate events including bankruptcy, failure to pay, and debt restructuring (referred hereafter "Credit Event") recognized by third parties, the affected CDS contract is settled between the two parties. If a Credit Event does not occur during the term, the CDS contract terminates without any other cash flow other than fixed coupon payments made from Protection Buyer to the Protection Seller. After Credit Event has occurred, the settlement price is generally determined in an auction organized by International Swaps and Derivatives Association, Inc. (ISDA). The auction results administrated by Creditex and Markit, and is published on the following website:

About Credit Index Trading

General Information on Credit Index Trading

Credit index trading is similar to bond trading in that the coupon and maturity are fixed before the roll. For credit indices, Fixed Coupon is paid from the Protection Buyer to Protection Seller on a quarterly basis. The rate of the Fixed Coupon is determined for each index before the roll and remains same until the maturity (For example, the coupon for the iTraxx Japan Series 30 is 100bps). Upfront payments are made at initiation between the Protection Buyer and Seller, and close of the trade to reflect the change in spreads. The price (referred hereafter as "Index Price") is par minus the present value of the spread differences. (Please see the trading example below for more details.) Market participants use calculation tools provided by external vendors to calculate Index Price. Markit also offers a free calculation tool for CDS indices trading which can be accessed from the link below.

Example of CDS Indices Trading

Here is an example of how CDS Indices are actually traded in the market.

Over the period of the contract in which Protection Buyer A buys the protection from Protection Seller B, there are three kinds of cash flows i.e. upfront payment, coupon payments and settlement payment. The sequence of dates for the trade is briefly summarized as follows:

- Index Roll Date: On 21Sep2010(20sep2010 is a national holiday) the credit index launches with a price of 100%, 5 year term and a fixed coupon of 100bps.

- Trade Date: On 30Nov2010 Protection Buyer A buys JPY 100 Million notional protection on the index when the spread has moved to 110bps.

- Trade Settlement Date: 03Dec2010 (=Trade Date + 3 business days)

- Fixed Coupon Movement: On 20Dec2010 Protection Buyer A pays Protection Seller B the fixed coupon.

- Trade Termination Date: On 14Mar2011 Protection Buyer A closes the trade when the spread goes up to 130 bps.

- Trade Settlement Date: 17Mar2011 (=Trade Termination Date + 3 business days)

1-3: Start-up Trade: "Upfront" and "Accrued Interest" payments

The Protection Buyer A pays the Protection Seller B an Upfront (par minus the present value of the spread differences) and Accrued Interest Differences to trade credit indices. In this example where the index spread is 110bps on the trade date, the price is 99.52 % (calculated by the price calculation tool offered by Markit). The payments are calculated as follows and are made three business days after the traded date.

- Upfront = Notional * (the index price at the index launch date (100%) minus the one at the traded date (99.52%)) = JPY 100 Million * (100-99.52) = JPY 480,000.

Please note that if the index price is over par (The fixed coupon is over the spread on the traded date), the Protection Seller pays the Protection Buyer for the difference. In this example in which the price is less than 100% (the fixed coupon is less than the index spread at the traded date), the Protection Buyer A pays the Protection Seller B for the price difference.

- Accrued Interest = actual days (from the previous coupon payment date or the index launch date to the trade date) /360 * Notional * the Fixed Coupon = 70/360 * JPY 100 Million * 0.01 = JPY 194,444. The Protection Buyer A receives accrued interest accumulated from the payment coupon payment to the trade date. Please note that the Fixed Coupon accrues on a Actual/360 basis.

- In short, the Protection Buyer A pays Protection Seller B for the difference of the payments above, JPY 285,556 (=JPY 480,000- JPY 194,444).

4: Quarterly Fixed Coupon Payments

Fixed Coupon = Notional * Fixed Coupon *90/360= JPY 100 M * 0.01*90/360 = JPY 250,000 The Protection Buyer A pays the Protection Seller B the fixed coupon. Please note that coupon(Number of the days until payment ,90 for example, /360) is paid periodically(quarterly). Please note that the fixed coupons are quarterly made on 20Mar, 20Jun, 20Sep and 20Dec. If the payment date falls on a holiday or a weekend, the payment is made on the following business day.

5-6: Trade Termination

Assume that Protection Buyer A unwinds the trade by selling protection. On the termination date when the spread is 130bps and the equivalent price is 98.63%, the Protection Buyer A pays the accrued interest accumulated up to the trade termination date and receives the Index Price difference (the Index Price at the launch date (100%) minus the one at the traded date(98.63%)).

The Index Price Difference = JPY 100 Million * (100-98.63)/100 = JPY 1,370,000.

The Accrued Interest = JPY 100 Million * 0.01 * 84/360 = JPY 233,333.

The Protection Buyer receives the difference in the payments above, JPY 1,136,667 (=JPY 1,370,000-JPY 233,333).

| Date | Event | [Protection Buyer A]Cash Inflow (+ ) | [Protection Buyer A]Cash outflow (-) | [Protection Buyer A]Net Cash flow |

| Sep. 21, 2010 | Index Roll Date, Fixed coupon: 100bps |

- | - | - |

| Nov. 30, 2010 | Protection Buyer A buys JPY 100 M notional protection on the index. | - | - | - |

| Dec. 3, 2010 | The settlement date for the trade entered on 30Nov2010. | Accrued Interest JPY194,444 |

Upfront JPY 480,000 |

JPY -285,556 |

| Dec. 20, 2010 | Coupon Payment | - | Coupon Payment JPY 250,000 |

JPY -250,000 |

| Mar. 14, 2011 | Protection Buyer A unwinds the trade when the spread is 130bps. | - | - | - |

| Mar. 17, 2011 | The settlement date for the unwind trade done of 14Mar2011. | Index Price Difference JPY 1,370,000 |

Accrued Interest JPY 233,333 |

JPY 1,136,667 |

| Total Cash Flow | JPY 1,564,444 | JPY 963,333 | JPY 601,111 | |

Credit Event in Constituents of Credit Indices

When a Credit Event occurs in any of the constituents of a credit index, the Protection Seller pays the Protection Buyer for the loss caused due to the affected entity. After the Credit Event, a new version of the index will be issued with the defaulted entity removed. The notional amount used for calculations would be reduced by an amount corresponding to the weight of the entity in the index (assuming 40 names in the index, the new version will contain 39 entities and will have a revised notional). International Swaps and Derivatives Association, Inc. (ISDA) administers the determination of Credit Event and settlement methods.

Disclaimer

The data has been provided on an "as-is" and "as-available" basis. Neither Japan Securities Clearing Corporation, Markit Group Limited, its affiliates nor any data provider shall in any way be liable to you or any third party for any inaccuracies, errors or omissions, regardless of cause, in the data, content, information and any materials on the site or for any damages (whether direct or indirect) resulting therefrom. Without limiting the foregoing, Both Japan Securities Clearing Corporation and Markit Group Limited shall have no liability whatsoever to you, whether in contract (including under an indemnity), in tort (including negligence), under a warranty, under statute or otherwise, in respect of any loss or damage suffered by you as a result of or in connection with any opinions, recommendations, forecasts, judgments, or any other conclusions, or any course of action determined, by you or any third party, whether or not based on the data, content, information or materials contained on the site.

The data displayed is for viewing purposes only and shall not be copied, redistributed, transferred, or used in any manner, including without limitation in the provision of services to third parties, without the appropriate license from Markit.