Equities Trading Services

arrowhead

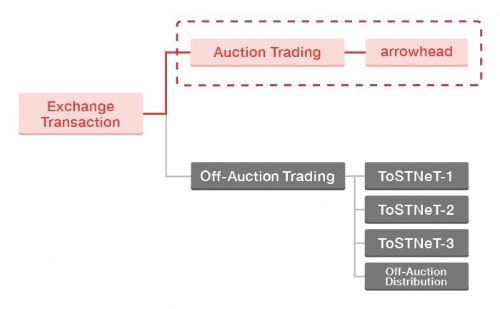

"arrowhead" launched on January 4, 2010 as a cash equity trading system that combined low latency, high reliability, and scalability of the highest global standard. The system handles auction trading of all cash products such as stocks and CBs.

On November 5, 2024, “arrowhead4.0” (fourth generation system since the first system launched in 2010) went live in order to further improve convenience for market users, global competitiveness, and resilience (ability to recover from system failures).

New functionality such as extension of trading hours and introduction of closing auction session have been added to arrowhead4.0.

System features

Low latency

| Items | Processing Capabilities |

| Order Response Time | Approximately 0.2 milliseconds |

| Information Dissemination Time | Approximately 0.5 milliseconds |

Reliability

Processes trading information such as orders, executions, and order books on synchronized 3-node data servers.

Scalability

System capacity is flexibly and swiftly scalable to accommodate an increase in the number of orders.

Overview

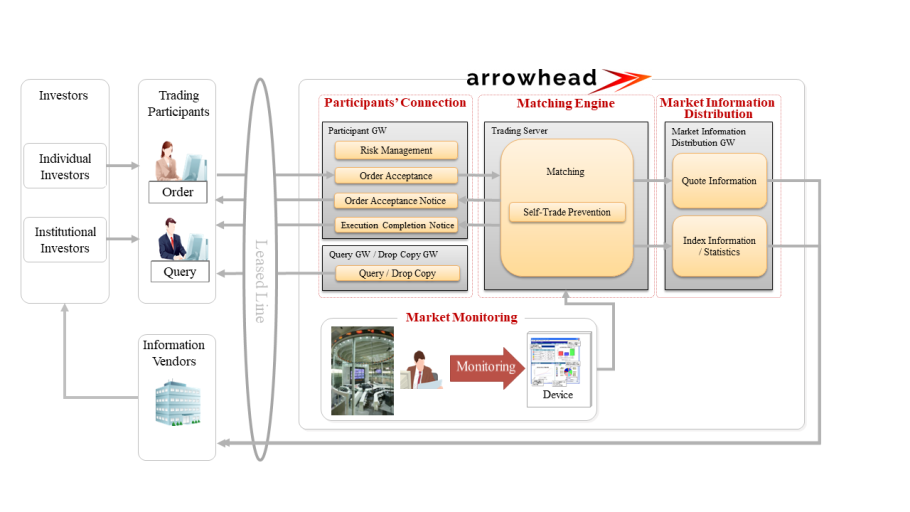

arrowhead processes orders, etc. in the following manner.

- Accepting orders from a wide range of domestic and foreign investors (securities companies), executing trades, and returning the results.

- The quote price and execution price (stock price) of the accepted orders are distributed to the market as market information.

In addition, the system has functionality to monitor the trading status in order to check if there are any abnormal trends (such as erroneous orders) in the accepted orders.

Main Functionality

The main functions provided by arrowhead are as follows. Some of the individual functions are illustrated in the document at the bottom of the table.

Participants' Connection

| Function | Explanation |

| Connectivity | As a basic function of the exchange trading system, arrowhead receives orders from trading participants and sends back notice messages. It also provides drop copy function which enables trading participants to let arrowhead send the same notices to multiple addresses and query function which enables trading participants to inquire about order status, stock information, etc.. arrowhead supports various order types as follows. - On Open: Orders to be executed only during the opening auction - On Close: Orders to be executed only during the closing auction - Funari: Limit orders that become market orders at the closing auction if not already executed - IOC: Immediate or Cancel Orders |

| Risk Management | - Cancel on disconnect Cancel on disconnect enables immediate and automatic order cancellation and order entry suspension upon detection of abnormal disconnection of the network between arrowhead and trading participants' systems. - Kill Switch Kill Switch enables trading participants to instruct arrowhead to forcibly suspend order entries and automatically cancel all orders from a specified Virtual Server/Virtual Server Group. - User-Designated Hard Limit User-Designated Hard Limit enables trading participants to set the threshold values (order value per single order, cumulative order/execution value per a certain time) on each Virtual Server/Virtual Server Group. |

Matching Engine

| Function | Explanation |

| Matching Engine | Matching engine is the core of the trading system and it determines prices based on orders from trading participants. Itayose method is applied when the market opens and closes and Zaraba method is applied for the rest of trading hours. |

| Closing Auction Session (Introduced in Nov. 2024) |

In order to improve the foreseeability of the closing price formation, a 5-minute order acceptance period (pre-closing) is provided after continuous trading (Zaraba) ends for the afternoon session (15:25). Itayose will be conducted at 15:30 after the pre-closing. At the closing auction session, even when orders are not executed under the current Itayose method conditions, these oreders will be executed on the upper and lower limit of the executable price range based on time priority (Special Execution). |

| Self-Trade Prevention | Self-Trade Prevention function prevents the execution of orders placed by the same user(*). arrowhead identifies the user of an order with STP account information. When matched orders are placed by users with the same STP account, STP function is triggered.

Two types of STP are available. |

| Mass Cancellation (Introduced in Nov. 2024) |

Mass Cancellation is a function that cancel multiple orders at once, for institutional investors who have accounts for arrowhead. (*) This function is assumed for use by institutional investors. |

Market Information Distribution

| Service | Explanation |

| FLEX Standard | Market information service that distributes Quote Quantities per price up to 10 quotes above and below. It also provides open, high, low and closing prices (per session), trading volume, turnover and index/statistics information. |

| FLEX Market by Order (Introduced in Nov. 2024) |

Market by Order type market information service that distributes all quotes information "by order". |

For more details of FLEX services, please refer to the link below.

Market Monitoring

| Function | Explanation |

| Market Monitoring | arrowhead's real-time monitoring function enables the market administrator to gain and comprehend what is going on in the market from various perspectives. It also offers data analysis function to further drill down the market activities. |

Please refer to an introduction to individual functions with figures.

System History

| Time | Events |

| January 4, 2010 | arrowhead (First generation) went live |

| August 16, 2010 | Awarded at IT Japan Award 2010 Grand Prix (Minister of Economy, Trade and Industry Award) |

| July 16, 2013 | Cash equity market of Osaka Securities Exchange (OSE) was integrated into Tokyo Stock Exchange (TSE) |

| September 24, 2015 | arrowhead renewal (Second generation) went live |

| November 5, 2019 | arrowhead upgrade (Third generation) went live |

| November 5, 2024 | arrowhead4.0 (Fourth generation) went live |