Summary

Summary

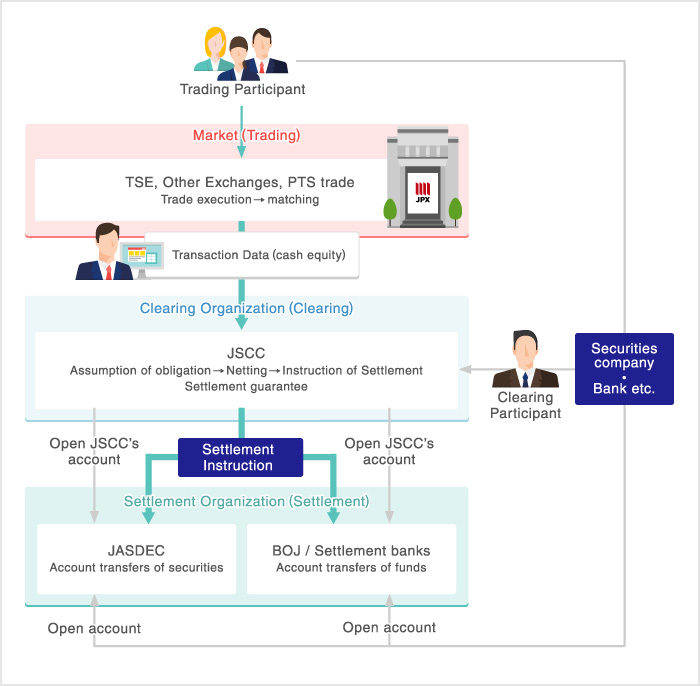

The operational procedure from trading to settlement is divided into three phases; 'trading in markets,' 'clearing at the clearing organization' and 'settlement at settlement organizations.'

In Japan, there are four financial instruments exchange markets for trading securities, one of which is Tokyo Stock Exchange, Inc. (TSE). Clearing services for all securities transactions on these markets are provided by Japan Securities Clearing Corporation (JSCC).

Trades cleared by JSCC are settled at the following organizations:

- Japan Securities Depository Center, Inc. (Stocks and convertible bonds etc.)

- The Bank of Japan (Japanese government bonds)

- The Bank of Japan or commercial banks which JSCC designates as fund settlement banks (Funds)

Functions / Roles of Organizations related to Trading, Clearing and Settlement (Example of cash equity)