Electronic Voting Platform, etc.

Benefits for Institutional Investors

There are four possible benefits of participation by institutional investors.

Centralized Portfolio Management

Institutional investors participating in the platform will use a dedicated screen to give instructions for the exercising of voting rights, as described above. The site allows institutional investors to access information on the AGMs of all participating issuing companies in which they hold shares with a single login, eliminating the need to repeatedly log in and log out. On the screen, only the issuing companies in which shares are held are listed, and by clicking on the company name, the number of potential shares can be confirmed and instructions for the exercising of voting rights can be given for each account held in relation to the issuing company's general meeting of shareholders.

In addition, institutional investors will be able to start the process of confirming their accounts and the number of potential shares ahead of schedule. Previously, these checks were conducted immediately prior to the dispatch date of the notice of convocation, but now they can be conducted using text files provided by the platform from approximately 10 days after the record date, enabling the workload to be spread out.

Extension of the Period for Reviewing the Agenda through Realization of STP

The platform allows institutional investors to start giving instructions from the day the notice of convocation is sent out. In addition, since the results of instructions for the exercising of voting rights are directly sent to the administrator of the shareholder register, instructions can be given until the exercise deadline set by the issuing company. Therefore, institutional investors have more time to consider proposals than before.

Ability to Confirm Exercise Status

Since instructions for the exercising of voting rights sent through the platform are recorded on the site, institutional investors can check the contents at any time. In addition, since the transmission status can be checked at any time to see if it was correctly processed by the system, the traceability aspect in particular has been greatly improved compared to conventional exercising of voting rights that were written.

Aggregation and Reporting Support

Institutional investors can aggregate the content of instructions for the exercising of voting rights according to conditions set at their own discretion. This report can be downloaded electronically (e.g., in Excel format) or printed out on paper.

Advantages for the Issuer

There are three possible benefits of participation by institutional investors.

Early Understanding of Exercise Results

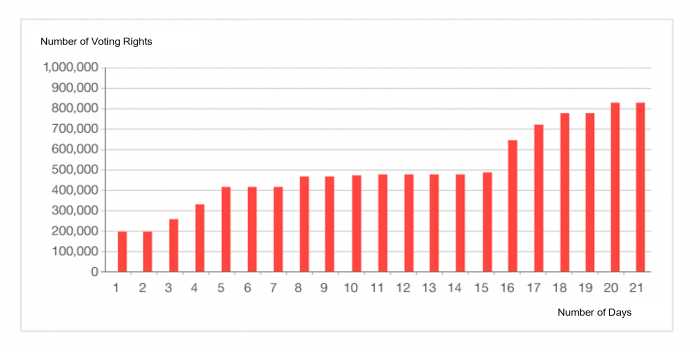

Although the rate at which institutional investor votes are collected on the platform, from the perspective of the issuer, varies depending on the shareholder composition of the issuer, in general it is as shown in [Figure 1]. When exercising voting rights in writing, most institutional investors' votes are exercised immediately before the general meeting, making it difficult for the issuer to understand the approval or disapproval trends at an early stage. The platform sends the results of instructions (progress) to Transfer Agent twice a day, making it possible for the issuer to, for example, check the daily increase in the number of times a particular shareholder has exercised their rights, and quickly understand the results at an early stage.

The platform transmits voting results to Transfer Agent, but in response to requests from many participating issuers to provide information directly to them, the ICJ launched "ICJ Online" from the March 2008 General Meeting to provide voting results directly on the Web as preliminary reports based on data processed independently from the platform.

The website provides twice daily information on the aggregate number of votes for and against each agenda item and each nominee shareholder, as well as the status of changes in the number of times voting rights are exercised. We have received positive feedback from institutional investors that the site is helping to improve the efficiency of shareholder meeting operations by making it easier for them to understand the approval or disapproval trends for each agenda item.

[Figure 1] Graph of the Change in Institutional Investor Votes on the Platform

Enhancement of Information Dissemination

The issuer has three main benefits. First, during the general meeting period, the issuer can publish additional information related to the convocation notice through the platform, its own website, or through TDnet on the stock exchange. In recent years, examples have been observed, such as supplementary explanations regarding opposition recommendations from advisory firms or views on shareholder proposals (Figure 2).

[Figure 2] Examples of Additional Information

| 1 | Supplementary Explanation on Proposal for Election of Directors |

| 2 | Supplementary Explanation on the appointment of audit committee members |

| 3 | Supplementary Explanation on the opposition recommendations from advisory firms |

| 4 | Supplementary Explanation on favorable recommendations from advisory firms on shareholder proposals |

| 5 | Supplementary Explanation on the independence of external directors (audit committee members) candidates |

| 6 | Supplementary Explanation on the stock compensation proposal |

- For handling on the platform, the title of each document has been modified.

Enhancement of Shareholder Services

As mentioned in the institutional investor benefits section, the platform will provide institutional investors with more time to consider proposals than ever before. In other words, the participation of issuers on the platform improves the environment for institutional investors to exercise their rights, and thus provides an opportunity to enhance shareholder services.

In recent years, due to the impact of individual disclosure of voting by domestic institutional investors, it has become common for reasonable justifications to be required when casting affirmative votes. Additionally, in cases where there is insufficient time or information to consider a proposal, institutional investors may be forced to abstain or cast dissenting votes. Therefore, enhancing shareholder services is important for the issuer as it can contribute to efforts to mitigate the risk of dissenting votes due to unfavorable reasons.