Overview of Margin Transactions

A margin transaction is a transaction which uses funds or securities that the customer has borrowed from a securities company after making a deposit of collateral (margin) to said securities company. Repayment is made mainly through reverse trades within a predetermined time frame. The main advantages of margin trading are the ability to buy and sell up to approximately three times the amount of the margin deposit and the ability to sell on margin.

Please note: While margin trading is highly convenient, there are inherent risks and costs involved, so please use it only with a proper understanding of the system and the requirements.

Standardized Margin Trading and Negotiable Margin Trading

There are two types of margin trading: standardized and negotiable. Each have the following characteristics. Customers select either standardized margin trading or negotiable margin trading when they entrust a margin transaction.

| Standardized margin trading | Negotiable margin trading | |

| Eligible Issues | Selected by TSE | In principle, all listed issues |

| Settlement Deadline | Up to six months | Determined between the customer and securities company |

| Premium Charge | Announced by TSE | Determined between the customer and securities company |

| Treatment of Rights | Method specified by TSE | Determined between the customer and securities company |

| Loan Trading | Available | Not available |

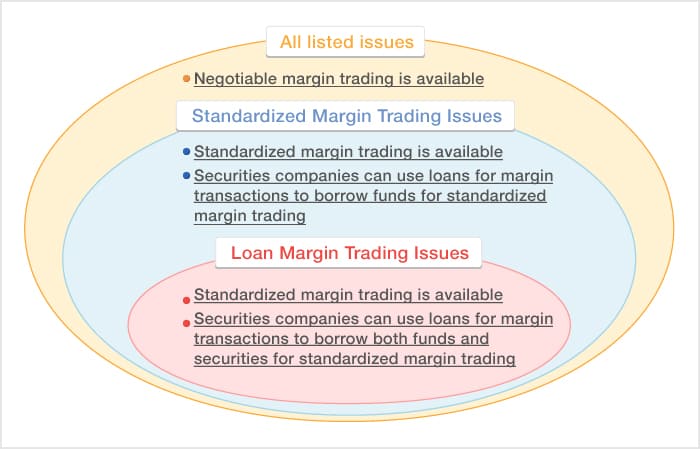

Margin Trading Issues and Loan Margin Trading Issues

Standardized margin trading is permitted for Standardized Margin Trading Issues and Loan Margin Trading Issues, which are listed issues that meet certain criteria. These are selected by TSE based on its rules.

For more information on Standardized/Loan Margin Trading Issues, please see below.

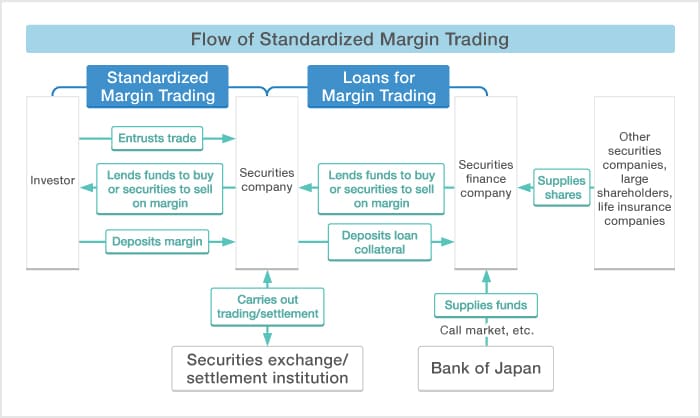

Loans for Margin Trading and the Role of Securities Finance Companies

Securities finance companies act as a provider of funds and shares to ensure the smooth execution of standardized margin trading by lending to securities companies the funds and shares necessary for settlement of standardized margin transactions (this is known as "loan margin trading" or "loans for margin trading").

TSE has designated Japan Securities Finance Co. Ltd. (JSF) as its designated securities finance company.

Costs related to Margin Trading

The buying customer pays the securities company interest on the borrowed funds, and the selling customer pays the securities company a fee for the borrowed securities sold. In addition, depending on the supply-demand situation of the stock, a premium charge may be applied.

Document on Overview of Margin Trading

For an overview of the margin trading system and risks, please refer to the document below.