Nikkei 225 VI Futures

About Nikkei 225 VI Futures

Nikkei 225 VI Futures are futures contracts based on the Nikkei Stock Average Volatility Index (Nikkei 225 VI), which is an index, calculated by Nikkei Inc., estimating the degree of expected fluctuation in the Nikkei Stock Average.

Risks

In addition to common risks of futures trading, a short position of Nikkei 225 VI Futures contracts has specific risks based on the characteristics of fluctuation in Nikkei 225 VI. Therefore, investors who do not have sufficient assets and experiences should avoid taking a short position in Nikkei 225 VI Futures contracts.

- Nikkei 225 VI may soar, when markets decline. In such case, a short position of Nikkei 225 VI Futures contracts will cause much greater loss than that in stock index futures contracts.

- Also, Nikkei 225 VI has a tendency to regress to a certain range (around 20pt to 30pt) after a rapid increase.

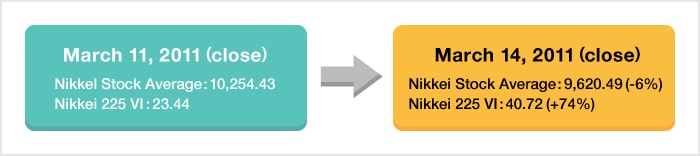

- In the following actual case, Nikkei 225 VI rose by approximately 74 %, while the Nikkei Stock Average fell by approximately 6 % in a day. As shown, Nikkei 225 VI extremely moves in a short period. Therefore, it is not recommended to trade Nikkei 225 VI Futures in a circumstance where it is not possible to obtain the real-time price information.

The fluctuation of Nikkei 225 VI has characteristics different from that of a stock index such as the Nikkei Stock Average. Please fully understand the characteristics of Nikkei 225 VI before trading Nikkei 225 VI Futures.