Treatment of Rights in Standardized Margin Trading

In a case where subscription warrants (shinkabu-yoyakuken) are granted or a stock split, etc. under which new shares are to be allotted in non-integral multiples of the trading unit is carried out with respect to an issue for which standardized margin trading is conducted, treatment of rights will be carried out by adjusting the contract price by using the rights treatment price determined through an auction for rights conducted by the securities finance company.

The specific mechanism of the auction for rights is illustrated in the following example.

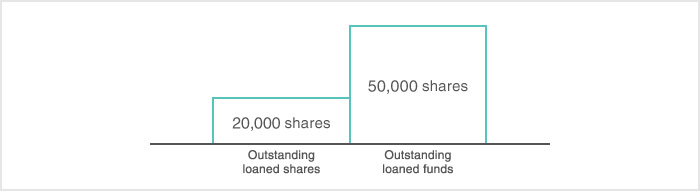

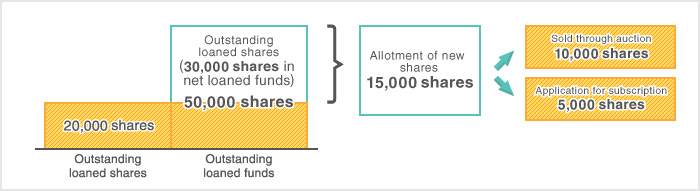

For example, assume that the outstanding loans by the securities finance company with respect to Issue A on the last day before the ex-rights date consists of 20,000 loaned shares and loaned funds equivalent to 50,000 shares and a stock split with a split ratio of 1:1.5 will be carried out. In this case, the securities finance company will process 15,000 shares, which will be allotted to the 30,000 shares corresponding to the difference between the amount of outstanding loaned funds and the amount of outstanding loaned shares.

- Before conducting an auction for rights, the securities finance company received applications for subscription of 5,000 new shares.

Before an auction for rights, by the last day before the ex-rights date of Issue A, the securities finance company will receive applications for subscription of new shares from securities companies to whom money is loaned with respect to the purchase of Issue A in amounts which are within the number of shares equivalent to the money loaned to each company. In addition to the securities companies, customers who bought shares in standardized margin trading will also be able apply to subscribe for new shares through the securities company they deal in amounts within the number of shares they bought. In a case where the number of shares pertaining to said applications exceeds the number of new shares to be allotted, the new shares will be allotted on a pro rata basis in accordance with the number of shares applied for by each securities company.

- As a result, the remaining 10,000 shares will be sold through an auction conducted by the securities finance company on the ex-rights date determined by the Exchange.

- With respect to the 10,000 shares to be offered for sale in the auction on the ex-rights date, customers (those who did not trade the relevant issue on margin are also eligible) will submit an application for bidding to the securities finance company through a securities company. The application must indicate the bid price and the number of shares pertaining to the bid (in general, the bid price is set at a discount from the closing price of the morning session on the ex-rights date, which serves as the benchmark price).

- Bids will be successful in descending order of bid price, within the number of shares for auction.

- Adjustment will be made based on the rights treatment price derived using the method below.

Value of successful bids / Number of shares for auction = Average successful bid price;

Average successful bid price x Stock split ratio = Rights treatment price - The example above represents a case of a "sale auction" which is conducted when the amount of outstanding loaned funds exceeds the amount of outstanding loaned shares at the securities finance company. When the amount of outstanding loaned shares exceeds the amount of outstanding loaned funds at the securities finance company, the securities finance company will conduct a "purchase auction" through which new shares, etc. will be purchased.

- Information on treatment of rights – Partial amendment to the rules for treatment of rights for standardized margin trading