Overview (ETNs)

The mechanism of ETNs

ETN Mechanism

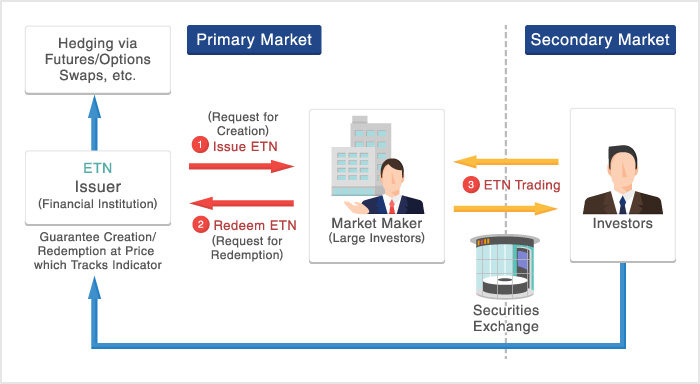

The mechanism for ETNs overseas is generally as below.

In the primary market, (1) financial institutions with credit (major securities companies, banks, etc.) issue ETNs at a price tracking an indicator in response to request for creation from large investors. (2) The large investors may request redemption of the ETN at the price tracking the indicator from the issuer at any time.

In this way, the correlation between the ETN’s price and the indicator is ensured by the possible creation/redemption of the ETN at a price tracking the indicator by the issuer financial institution.

(3) The large investors, which are market-makers, provide the issued ETN to the market, allowing investors to trade ETNs on the secondary market.

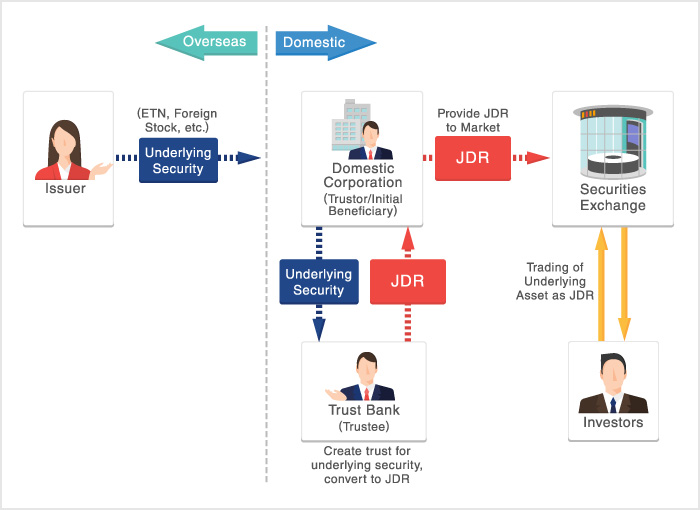

- ・Furthermore, because ETNs eligible for listing on the TSE market are JDR-type ETNs, the ETNs being actually provided and traded are JDRs. As such, requests for redemption are submitted to the domestic corporation acting as JDR trustor.

JDR

JDRs (Japanese Depositary Receipt) are a type of depositary receipts in Japan. JDRs are the beneficiary certificates of a beneficiary certificate-issuing trust issued as entrusted securities which are foreign securities domestically in Japan pursuant to the Trust Act. This mechanism, like the ADR (American Depositary Receipt) in the US and the GDR (Global Depositary Receipt) in Europe, allows for the smooth transaction of foreign stocks, bonds and ETFs within Japan.

European and American depositary receipts (DRs), such as ADRs and GDRs, have experienced growth and are actively traded due to being used by foreign companies which wish to conduct fund-raising in foreign securities markets, but cannot list in such markets due to a variety of reasons, including restrictions in their country and trading/settlement concerns. In November 2007, TSE prepared listing rules for JDRs for foreign stocks and ETFs coinciding with revisions to the Financial Instruments and Exchange Act in September 2007. These rules were prepared with the aim of allowing foreign companies to conduct fund-raising through the Japanese financial and capital market, thereby invigorating the market in the same way as US/European DRs, as well as providing a wider range of investment options to Japanese investors. In April 2011, the range of products eligible for JDRs was expanded to include ETNs.

JDRs differ from ADRs and GDRs, which are issued according to a deposit agreement, and are issued pursuant to the Trust Act. As such, JDR beneficiaries are subject to protections pursuant to the Trust Act and trustees (trust banks, etc.) are subject to rules, such as trustee's responsibility under the Trust Act. However, because the same risks exist as when directly acquiring securities issued by such foreign company, the trustee (trust bank, etc.) does not act to supplement credit. Additionally, because JDR owners indirectly own the issuer's securities through trusts, they may not exercise the same rights as if they directly held such securities.

In listing of ETNs as a new product, various adjustments to the existing trading infrastructure would be required. Using the JDR format presents the merits of being able to utilize the existing system infrastructure, etc. without change and handling specified accounts of securities companies. Because of this, ETNs were limited to listing of JDRs. Furthermore, ETNs are subject to the same taxation as stocks.

The transaction structure of JDRs domestically is as indicated below.