Overview (Venture Funds)

Method of utilization of Venture Funds

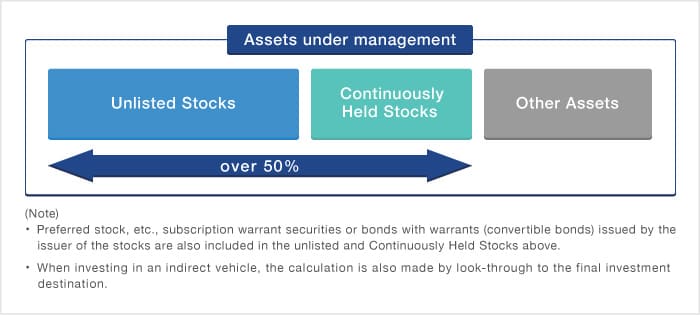

To keep the characteristic of Venture Funds, listing criteria requires the applicant for initial listing of Venture Funds to reach the investment ratio above or to be expected to reach the ratio within 6 months after listing.