Trading Rules of Domestic Stocks

Order types

Basically there are two types of orders available on the TSE equities market: limit orders and market orders.

| Market Orders | Market orders are orders by investors who want to "sell or buy at any available price" |

| Limit orders | Limit orders are orders at specific prices, meaning that investors have stated that they want to "buy at not more than XX yen, or sell at not less than XX yen". |

| On open | Orders to be executed only during the opening auction |

| On close | Orders to be executed only during the closing auction |

| Funari | Limit orders that become market orders at the closing auction if not already executed |

| IOC | IOC (Immediate or Cancel) Orders |

Principle of price priority and time priority

Price priority

Principle of price priority means the lower sell and higher buy orders take precedence over others. For example, when there are sell orders at JPY 100, JPY 101, JPY 102 and JPY 103 on the order book, sell order at JPY 100 have priority among those sell orders.

In addition to limit orders, market orders which are used to buy or sell regardless of price are available on TSE. Based on the principal of price priority, market orders take precedence over all limit orders.

Time priority

Principal of time priority means the order put the earliest takes precedence among orders at the same price. For example, when Broker A put 10 thousand orders at JPY 100 first and Broker B put 100 thousand orders at the same price after Broker A, Broker A take precedence over Broker B. Broker B has to wait until all orders of Broker A are executed or cancelled.

Simultaneous Orders

As previously mentioned, principle of price priority and time priority are the main methodology of TSE market. In some circumstances however, the principle of time priority is ignored such as orders placed before the opening price is determined during the morning and afternoon trading sessions. That is, all orders placed before the opening price is determined are regarded as simultaneous orders. Please note not only before the morning session but before the opening price of the afternoon trading session is determined, all orders are regarded as simultaneous orders.

Methodology of Individual auctions

Itayose method and zaraba method

At TSE, stock prices are determined by two methods; Itayose method (call auction) and Zaraba method (continuous trading auction).

| Itayose Method (call auction) | Zaraba Method (continuous trading auction) | |

| Timing | Used to determine prices in the following situations:

|

Other than listed in the left |

| Price | Single price which sell orders and buy orders match at | Price determined according to price priority and time priority |

Special quote

A special quote is indicated whenever prices look likely to jump beyond a certain price range (special quote renewal price interval) from the last execution price (e.g. the last execution price is JPY 1000, but the next execution price is likely to be less than JPY 970 or more than JPY 1030). In this way, special quotes are mechanisms to prevent short-term wild price fluctuations.

Special quotes can be indicated at any time during the trading session, whether it is before the opening price has been set or during Zaraba trading. They are indicated if there is any likelihood of inappropriate price fluctuations, for example, as a result of a major order imbalance between bids and offers. Special offer quotes are indicated when the next price is anticipated to be at a price lower than the given renewal price interval, and special bid quotes are indicated when the next price is anticipated to be at a price higher than the given renewal price interval.

Special quote information is disseminated through the TSE market information system, thus notifying investors of the order imbalance as soon as possible. A special quote displayed in the sell side of the order book is a special offer quote; one on the buy side is a special bid quote.

A special quote indicates to investors that there are orders beyond that price, and encourages them to place balancing orders on the other side of the order book. If such orders are placed, matched, and executed, market equilibrium will have been achieved and the special quote will be removed. If on the other hand, no orders are received the special quote will be renewed at three minute intervals until equilibrium is achieved.

For example, if a buy order is placed at JPY 1100 immediately after an execution price of JPY 1000 and there is no sell order below JPY 1100, a special bid quote of JPY 1030 will be indicated. If no offers are received at this price, the special bid quote will be raised to JPY 1060 after three minutes, and so on until equilibrium is achieved.

Through the use of a special quote, there will be no sudden fluctuation in prices and investors can pick a time to place an order. In addition, when a special bid quote is displayed and a counter-offer comes in, the investor who placed the bid will be able to get a price nearer to the previous execution price. In other words, execution would take place at a much lower price than the original bid.

Sequential trade quote

Special quote described above is indicated when price is anticipated to jump beyond a certain range without execution. In high-speed order matching and execution however, sequential buying-up or selling-down with execution may result in instantaneous and sharp price fluctuations without a special quote being displayed at all.

If there is sequential execution that is likely to go move beyond twice the special quote renewal price interval from the reference execution price, after execution up to the “reference price + (renewal price interval x 2)” (or in the case of offers, down to the “reference price - (renewal price interval x 2)”), a sequential trade quote will be displayed at this price for one minute. This quote informs investors of an instantaneous and sudden change in price and attracts opposing orders to counter this price movement. An explanation of the sequential trade quote mechanism follows.

[Sequential trade quote Display Condition]

(1) A single order is likely to trigger a series of executions that will move the price beyond twice the special quote renewal price interval from the reference execution price. (The reference execution price is the last execution price.)

(2) Regardless of whether it is a single order, there is likely to be a series of executions that will move the price beyond twice the special quote renewal price interval within one minute from the reference execution. (The reference execution is set as the first execution during the continuous trading session, and it is reset to the first execution after each time interval elapses.)

During the one minute period when the sequential trade quote is shown, the Itayose method is used. After this period, if there is an opposing order at a price within the special quote renewal price interval from the sequential trade quote, the order will be executed immediately. If this opposing order is at a price beyond the special quote renewal price interval from the sequential trade quote, the sequential trade quote will not be renewed, instead a new special quote will be shown at the price which is the "sequential trade quote ± special quote renewal price interval."

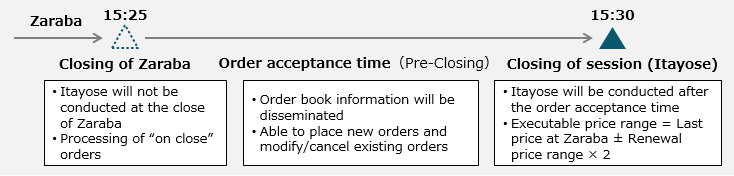

Closing auction session

TSE has introduced a closing auction session for trading at the close of the afternoon session to improve the transparency of closing price formation. Specifically, after a 5-minute order acceptance time (pre-closing session) from the close of Zaraba trading (at 15:25), an Itayose is conducted at 15:30.

First, orders that have not been executed by the close of Zaraba trading are automatically registered on the pre-closing session. At the start of the pre-closing session (15:25), on close orders and funari orders (limit orders that become market orders at the closing auction session if not already executed) will be registered in the order book. During the pre-closing session, only orders are accepted, and no trades are executed. New orders and modifications/cancellations of existing orders can be placed, but execution conditions cannot be modified.

The pre-closing session then ends at the close of the afternoon session (15:30), and an Itayose is conducted. The priority of orders at the same price is as follows.

(i) Orders accepted before the opening price for the afternoon session has been determined (treated as simultaneous orders).

(ii) Orders accepted during Zaraba after the opening price for the afternoon session has been determined (the principle of time priority will be applied).

(iii) On close orders and funari orders registered in the order book at the start of the pre-closing session and orders accepted during the pre-closing session (treated as simultaneous orders, as distinguished from (i) above).

The executable price range for the close of the afternoon session is twice the renewal price interval from the last price (the final price in Zaraba trading).

Closing auction at the limit price

Occasionally, the price of a stock may rise or fall to their upper or lower daily limit price as a result of strong positive or negative public sentiment. Due to investor decisions to "buy at any price" or "sell at any price", there may be cases of a large number of market orders which cause a major order imbalance.

Normally, Itayose is used during the closing auction to determine the closing price. It follows that all market orders and bids and offers at better prices must be executed. However, if there is a large volume of orders on either side of the order book, this condition cannot be fulfilled, there will be no order matching or execution, and the closing price cannot be set.

In order to match and execute orders at the daily limit price, instead of the normal Itayose method, TSE uses a special mechanism with relaxed conditions for closing auctions at the limit price to determine the closing price of the afternoon session.

[Requirements of Closing Auction at the Limit Price]

- All market orders are treated as limit orders at the daily limit price.

- In the case of a closing auction at the upper daily limit price, if there is a sell order of at least one trading unit, the allocation by the "closing auction at the limit price" will take place. (In the case of the closing auction at the lower limit price, there must be a buy order of at least one trading unit at the lower daily limit price.)

(Note) The "closing auction at the limit price" will take place if one unit is allocated to any securities company. As a result, some securities companies may not receive any units.

Special execution

To increase opportunities for closing price formation, even if trades are not executed through a normal Itayose or a closing auction at the limit price, TSE allows trades to be executed under the following conditions during Itayose at the close of the afternoon session. This is called a “special execution".

[Requirements of Special Execution]

If the cumulative total volume of buy orders* and the cumulative total volume of sell orders are at least 1 unit each at the upper (or lower) limit of the renewal price interval at the close of the afternoon session, trades will be executed at the upper (or lower) limit of the renewal price interval at the close of the afternoon session.

* Total volume of orders at the upper (or lower) limit of the renewal price interval and the price that takes precedence over said upper (or lower) limit at the close of the afternoon session.

Orders at the upper (or lower) limit of the renewal price interval and the price that takes precedence over said upper (or lower) limit at the close of the afternoon session have possibility to execute. The priority of orders in the special execution is determined based on the time at which orders were placed, regardless of prices or execution conditions.

For investors to understand the TSE trading methodology, TSE offers "Guide to TSE Trading Methodology", a guide book explains how transactions on the TSE market works. For specific examples and more detailed explanations, please click the following link