Overview (TOKYO PRO Market)

What is "J-Adviser"?

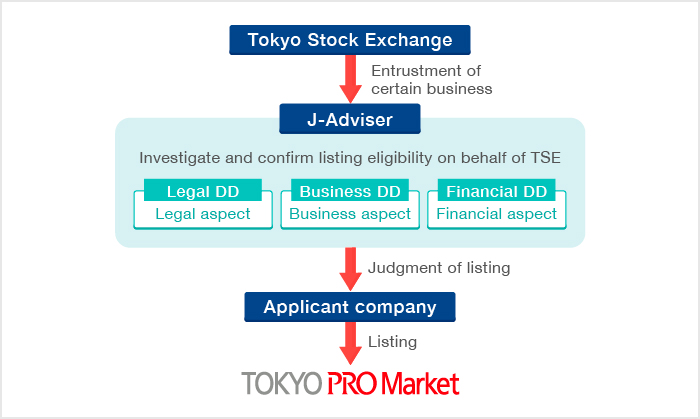

TOKYO PRO Market adopts the "J-Adviser system" based on the Nominated Advisers (Nomads) system of AIM market established by London Stock Exchange. The 2008 amendments to the Financial Instruments and Exchange Act enabled the development of the J-Adviser system, and TSE entrusts certain business (investigation of compliance with the criteria for listing/delisting and with listing eligibility requirements) to an approved J-Adviser that meets certain qualifications. A J-Adviser investigates/confirms the listing eligibility of a company it supervises before listing, provides advice and guidance concerning timely disclosure after listing, and examines the status of compliance with requirements to maintain a listing. Please note that the J-Adviser system does not exempt a company listed on TOKYO PRO Market and its directors from obligations as a listed company.

List of approved J-Advisers

Bridge Consulting Group Inc.

Daiwa Securities Co. Ltd.

Funai Consulting Incorporated

G-FAS Corporation

IR Japan, Inc.

Japan Investment Adviser Co., Ltd.

J Trust Global Securities Co., Ltd.

Kyushu FG Securities, Inc.

meinan M&A co.,ltd.

MITA SECURITIES Co., Ltd.

Mitsubishi UFJ Morgan Stanley Securities Co., Ltd.

Mizuho Securities Co., Ltd

Nihon M&A Center Inc.

Nomura Securities Co., Ltd

Phillip Securities Japan,Ltd.

SBI SECURITIES Co.,Ltd.

SMBC Nikko Securities Inc.

TAKARA PRINTING CO.,LTD.

TANABE CONSULTING CO.,LTD.

THE BANK OF SAGA LTD.

(Alphabetical order)

Sanction of a J-Adviser

As detailed in the Special Regulations of Securities Listing Regulations Concerning Specified Listed Securities and the Enforcement Rules for Special Regulations of Securities Listing Regulations Concerning Specified Listed Securities, Tokyo Stock Exchange may take sanctions against J-Advisers.

| Date | J-Adviser | Contens |

| - | - | None |