Interviews with Listed Companies Regarding English Disclosure

Oisix ra daichi Inc.

With food safety and the environment in mind, Oisix ra daichi Inc. provides a food delivery service that features organic and specially cultivated vegetables, additive-free processed foods, and other food products. It was established in 2018 through the merger of three companies: Oisix Inc., and Daichi wo Mamoru Kai Co., Ltd and Radish Boya Co., Ltd.. From its inception, the company strengthened its IR activities and committed to disclosing information in English. We asked Mr. Shoya Umemura, General Manager of the IR Department, Corporate Planning Division about their efforts with English disclosure and dialogue with overseas investors.

Strategically Expanding English Disclosure to Increase the Ratio of Overseas Investors

Please tell us how you came to increase disclosure in English.

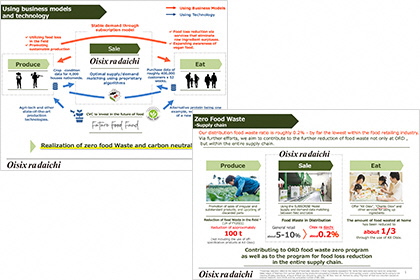

Since 2013, when the Company was listed on the Mothers market as Oisix Inc., the Company has disclosed summary information for earnings reports, three financial statements, and earnings presentations in English. In 2018, after rebranding as Oisix ra daichi Inc., the company established the IR Department. While discussing IR strategies, we determined that it was essential to increase the ratio of overseas investors, as they had been an untapped area with a large volume of investment money, in order to appropriately show our corporate value to the capital market. At that time, we had interviews with domestic investors to some extent to talk about our growth strategies, but few interviews with overseas investors, who carried a holding ratio of approximately 15 percent. Although recognition was relatively low in terms of the scale of the Company, we turned our attention to overseas investors in order to appropriately improve our corporate value along with future business growth.

One of our tactics to increase the ratio of overseas investors was to increase the amount of information disclosed in English. In addition to the documents we had previously disclosed, we expanded to include timely disclosure documents, Corporate Governance Reports, investor guides that provide an overview of the Company, scripts for earnings presentations, and sell-side reports. In 2021, we began disclosing notices of convocation of the annual general shareholders meeting in English.

Please tell us about the English disclosure system.

Two people in the IR department including myself are responsible. As earnings presentations are the most important, we outsource proofreading to a native speaker after using translation tools to create drafts in order to improve the accuracy of English translations. Other disclosure materials are translated into English using translation tools and checked within the company. This is the approach we have now adopted to meet cost and time requirements to disclose information simultaneously in English and Japanese.

Do you have any tips for making full use of translation tools?

There is still room for improvement. For now, we teach the translation tools proper nouns in advance and modify Japanese sentences by adding subjects or breaking up long sentences, so as to convert them into English with proper connotation. This will make it easier to translate Japanese into better English.

Have you come up with something to disclose documents in Japanese and English at the same time?

Since earnings presentation materials are completed just before they are disclosed, and because there are about 60 pages of explanatory slides, we translate them and outsource proofreading while Japanese materials are being created. When there are corrections or additions to the Japanese text, we add them to the English materials as needed. We don’t have difficulty disclosing other materials simultaneously, as we have time for translation beforehand with less volume.

(Non-financial information is also included in financial results in English to enhance dialogue with investors.)

Exchanging E-mails to Build Positive Relationships with Investors

Please tell us about your IR activities for overseas investors.

There are about 400 one-on-one interviews a year, and about half of them are with overseas investors. Some of them are held through securities companies, and others are held by us after we contact investors directly. We communicate with investors who have had interviews in the past but a long time has passed since then or whose funds are mainly invested in mid- and small-cap equities such as our company stock. Of course, not all investors will respond, but overseas investors tend to accept our interview invitations more often than Japanese investors.

In addition, as we now send investor guides and the most recent earnings presentation materials in advance, we are no longer often asked about our business models and other basic information in the first interview.

Do you arrange interpreters for interviews with overseas investors?

When an interview is conducted through a securities company, we will ask the securities company to arrange for an interpreter. However, when we approach investors for interviews directly, we ask for the same interpreter as much as possible, as we believe this will improve the quality.

How do overseas investors evaluate your company's information disclosure and IR activities?

Our Japanese earnings materials are intended to provide detailed information, for example, KPI and qualitative factors in the business status. We receive many comments that our information is properly disclosed both in Japan and overseas. With regard to English disclosure, overseas investors have commented that simultaneous disclosure and English transcripts for earnings presentations posted on our website are helpful.

The other day, a logistics center at the Company had a problem, so we directly approached domestic and foreign investors with whom we have regular contact through e-mail, informing them that we had made timely disclosure and to contact us if anything was unclear. They were grateful that we sent them an email immediately.

In terms of information disclosure, we thought that information would be conveyed to investors as long as it’s disclosed via the TSE’s Timely Disclosure Network. However, we have learned that when such a negative issue arises, it is also important to directly communicate with investors in a timely manner to secure trusted relationships.

Has dialogue with overseas investors alerted you to anything new?

Based on advice from overseas investors, we have expressed the total addressable market (TAM) more clearly in earnings presentations and improved descriptions of growth strategies and business models, among other things. With few opportunities to hear about business situations in Japan, overseas investors have little subjective bias and often ask from an objective and macro perspective about opportunities and risks in terms of TAM and competitions as well as long term growth. These varied questions give us new perspectives. We learn a lot.

What do you think are the benefits and effects of disclosing information in English?

We believe that disclosing information in English in a timely manner is the basis for building trusted relationships with overseas investors. What matters is that this will enable smooth communication after disclosure, provide a better understanding of our company in a short period of time, and lead to building trust between overseas investors and the management and IR members of the Company. For example, we can describe details more easily by displaying earnings presentation materials in English on the screen in online meetings and attaching images of these materials to reply to English inquiries by e-mail, which will surely allow investors to understand more efficiently than if we were to describe them verbally or with text only.

Your ratio of overseas investors has increased significantly over the past few years. What is your analysis of the factors that led to this increase?

Clearly, the business itself has grown significantly over the past few years, and our stock was transferred from Mothers to the First Section in April 2020, which had a major influence. I may add that in terms of IR activities, we have been promoting initiatives such as the increase in English disclosure, as well as smooth communication using English materials based on our strategy to increase the ratio of overseas investors. This was around 15% before improving our disclosure practices and has recently increased to about 30%. I think these efforts have contributed to some extent. As the other team member and I are not native English speakers, it is not easy to speak English fluently in interviews. Still, we have gradually gained confidence in having productive communication by using English disclosure materials. Email can also play an important role in building relationships. With preparation, the nuances we want to convey through email can be done so properly, even in English. For instance, we write thank you mails to investors for their interest after interviews.

English disclosure is not the goal

Are there any plans to further expand your disclosure of information in English in the future?

We do not have enough resources with only two non-native English speakers. Currently, we are conducting timely disclosure of materials in English that are considered to be a high priority for investors, but we would like to consider expanding this scope while assessing cost-effectiveness. In particular, I fully realize the importance of sustainability disclosure. As such, we would like to disclose integrated reports and sustainability reports in English in the future.

Do you have any advice for companies that are considering starting or expanding their English disclosure practices?

I think there are three elements in English disclosure: the speed of disclosure, the quality of English translation, and the scope of disclosure, as well as how much resources in terms of cost and manpower you can spend on these elements. As it would be difficult to respond to all the elements at once, I suggest that companies work on items based on their priorities first. We have aimed to disclose information in Japanese and English at the same time in favor of speed for the past few years. Therefore, there is a lot of room for improvement in terms of quality in the future. As for the scope of disclosure, we have not translated all materials disclosed in Japanese into English as mentioned earlier. I suggest that companies start with earnings presentation materials because they can be used as an effective tool to facilitate dialogue in one-on-one meetings with overseas investors. Nevertheless, English disclosure itself is not a goal. What matters is that English materials help customers have appropriate expectations for the growth of companies, facilitate better relationships between IR staff and overseas investors, and ultimately encourage investment and appropriate holding of company shares.