Interviews with Listed Companies Regarding English Disclosure

AVANT CORPORATION

Under the corporate mission of "Spreading Accountability," AVANT CORPORATION has been in business for 25 years, with group companies that provide products and services to support organizational operations such as corporate management and settlement of accounts. The stock was first listed in 2007 on the "Hercules" of Osaka Securities Exchange. Their business performance has steadily increased and their operations have expanded since then. The stock was transferred to the 1st Section of Tokyo Stock Exchange in 2018.

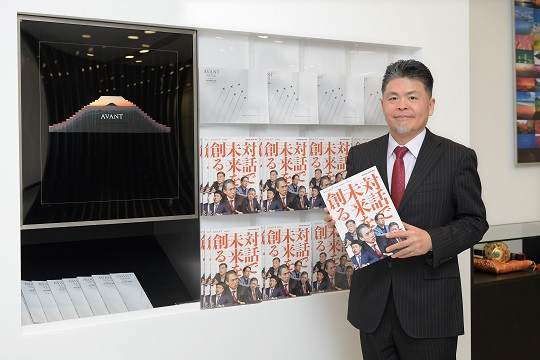

The Company also actively discloses IR information in English to respond to growing demands from overseas investors. We asked Mr. Kenji Nishimura, Head of Corporate Communication, about how the Company came to increase disclosure in English, specific methods, and the benefits of doing so.

Focusing on English Disclosure to Active Investors Overseas

Please tell us about how you came to increase disclosure in English.

In the past, the Company did not actively work on IR and disclosed minimal information. However, after an outside director suggested that we commit to IR to increase our corporate value, the Company began IR activities on a full scale in July 2019 with me, as I had been in charge of IR elsewhere before joining the Company.

First, we considered two courses of action to raise our value. One was to appeal to the remaining active investors, although the trend was towards passive management. The other was to distinguish ourselves from other companies and be valued by passive investors, as passive investing was on the rise.

After comparing the two, we decided to take the first option. As many active investors were from overseas, we prioritized appealing to them by creating an environment in which all information disclosed in Japanese would be disclosed in English, considering that it was inappropriate to overseas investors if only some information was available in English. We began disclosing press releases of earnings reports and IR presentation materials in English, and then disclosed full translations of securities reports and convocation notices of the annual general meeting of shareholders a year later, trying to avoid any discrepancies in the content between Japanese and English.

Were there any concerns about resources and costs needed for translating documents into English?

The volume of earnings reports is not large, and IR presentation materials describe performance based on numbers, so there was not much work. Even for large volumes, we use machine translation tools to reduce the administrative burden and cost of English translation. The usage fee for machine translation tools is about tens of thousands to 300,000 yen per year.

Proactively Utilizing Machine Translation Tools without Spending Extra Money and Time

Please tell us about the English disclosure system.

We have two people in charge and rarely outsource.

As both of them are non-native English speakers, we sometimes outsource proofreading to a native speaker to a limited extent, such as messages from the president to be posted on the website. However, since machine translation tools have recently become more accurate, proofreading by a native speaker may not be necessary in the future.

When disclosing information, we include a disclaimer indicating that the Japanese documents are official, and those translated into English are not.

How do you use machine translation tools?

There are some tips to use them. Even when a subject or verb is unclear in a Japanese sentence, the sentence is understandable to some extent. As such, before using a machine translation tool, we first add a subject or extra information to the verbs in the Japanese sentence. This usually produces better English. Some tools allow you to change the order of words and sentences, transform sentences from active to passive voice or vice versa with ease, and make the length of English documents the same as those of Japanese.

Your company also translates securities reports into English. They are large and require a lot of work. How do you translate them into English?

As sentence structures of securities reports are relatively well organized, we find it easy to translate. The notes on the financial statements in the second half of the report have subjects and verbs, and I get the impression that 80% are completed by machine translation tools with no additional adjustment. On the other hand, we pay attention to the first half, especially the description in the MD&A. We began disclosing securities reports in English in FY2020, and in FY2021 we were able to make them with half of the effort compared to the first year.

Other companies have commented that it is impossible to disclose information in Japanese and English at the same time. Have you come up with something to achieve this?

We start translating the second version of the earnings reports when the draft has been mostly finalized with fewer corrections needed. Then, when there are further revisions to the Japanese text, we add them to the English text according to the revision history. If you translate as much as possible beforehand, it will take only a few minutes to make some corrections and finalize documents such as earnings reports.

Steady Increase in Overseas Investors through Active IR Activities and English Disclosure

In addition to English disclosure, what IR activities have you done for overseas investors?

We started working on providing the same information in the Japanese and English texts. When we began considering what we could do for overseas investors, COVID-19 became widespread. We had conducted interviews mainly with domestic and passive investors in the past but decided to approach overseas investors to increase our value. As such, we asked advisory companies to arrange meetings with active investors overseas by using money for IR activities abroad that we had been unable to spend since 2020 due to the impact of COVID-19. We now have about 130 meetings a year, and in 2021, the number was about the same but the ratio of overseas investors has recently increased to 60%. I think more investors tend to hold stocks over the long term.

Have these efforts alerted you anything new?

Just because a company discloses information in English doesn’t mean that overseas investors will invest in its stock. However, when communicating with overseas investors, we often receive comments how they wished they had known that we were such a good company sooner. This is because we did not focus on IR activities in the past, and we wish we had done that earlier. With our proactive IR activities, overseas investors have included us on their watchlists or have become shareholders.

What do you talk about in interviews with overseas investors?

When we meet investors for the first time, we describe our business using basic information available on our website to draw their attention. We arrange interviews with the president based on their requests. As for the interview process, I explain our basic business model first, and then the president talks about strategies for their better understanding.

How have your disclosed materials and IR activities been evaluated?

We are often viewed as a small company offering a lot of useful information in English. When I was an analyst looking at Chinese companies, information that was available in Chinese was not available in English. In such instances, investors seemed to be less willing to research. We disclose the same amount of information in English as we do in Japanese to keep overseas investors interested.

Please tell us about the benefits and effects of disclosing information in English.

The number of overseas investors is steadily increasing. Our stock price temporarily rose when we were mentioned in an article as being a company whose stock price increased tenfold over the last ten years. The financial results were not so good this fiscal year, so individual investors sold our shares. However, overseas investors picked up these shares and the ratio of overseas investors increased, which improved the balance. Now, if we improve our fundamentals, we will attract shareholders who will increase our value with large investments.

What do you want to improve to attract such investors?

We are considering improving our information disclosure practices with respect to ESG and sustainability. We are praised for our governance practices as we have been actively working to build our governance system, including the composition of directors. Some may say that we will be praised even more if we focus on the environment. As we are a small company, we don't know how much we can contribute to the environment. Still, we would like to carefully plan and implement measures and disclose what we achieve.

Do you have any advice for companies that are hesitant to disclose information in English?

There is no need to be worried about starting. You may be concerned that the translations will be inaccurate, but my view is that you can disclose that the English translation is only for the convenience of overseas investors and that the Japanese version is the original. If high quality information is available in Japanese but no information is provided in English, overseas investors feel neglected. Therefore, we should try to disclose the same information in Japanese and English. Companies work hard to raise their stock prices. Since prices are determined by supply and demand, if there is not enough demand in Japan, it is natural that companies would turn to overseas. If you compare the cost and the rise in market capitalization, the cost-effectiveness is enormous. I suggest comparing your stock prices with others to see where your company stands. The PBRs of companies that have major overseas investors often exceed those of others in the same industry, although their ROEs may be the same.