Explanation of Indices/Indicators (ETFs)

Currency Fluctuation Risk

ETFs traded at TSE are all JPY-denominated. When investing in foreign currency-denominated assets, investors need to consider not only factors giving rise to changes in prices, including stock indices, but also currency fluctuations of local currencies and JPY.

Assuming no price movements, consider the following scenario: you have invested in USD-denominated assets when the exchange rate is JPY 100 against USD; the exchange rate then shifts with USD strengthening and JPY weakening to JPY 110 against the USD; this means that you can profit with that exchange rate by converting the invested USD-denominated assets into JPY. Conversely, if the exchange rate were to shift with USD weakening and JPY strengthening to JPY 90 against USD, you would incur a loss when the invested USD-denominated assets are converted into JPY.

As such, there are always currency fluctuation risks attached to investment in foreign currency-denominated assets.

A Closer Look at Currency Hedge

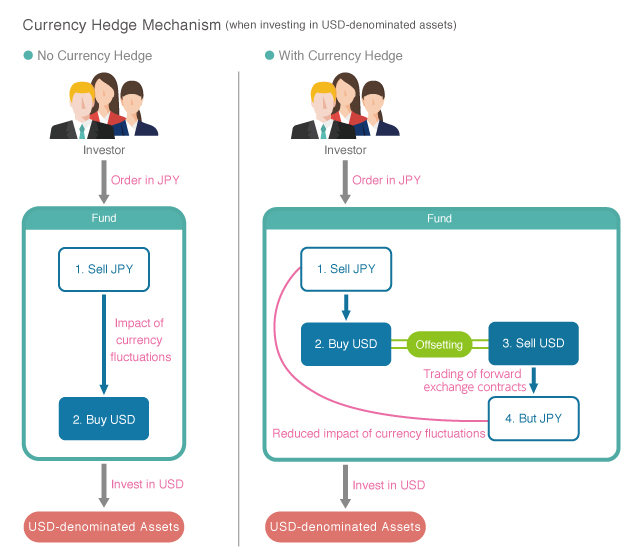

A currency hedge is a method for reducing the impact of currency fluctuation risks. ETFs tracking currency-hedged indicators and ETFs incorporating currency hedge strategies are currently available on the market. Such currency-hedged ETFs are incorporated into typical investing in foreign-currency denominated assets. At the same time, by incorporating currency-hedged ETFs in such trading as that of forward exchange contracts where foreign currencies are purchased and JPY sold, investors can expect to see less price movements resulting from the impact of currency fluctuations in terms of the performance of JPY-denominated investments. However, this will not eliminate such impact completely.

Hedging costs for interest rate gaps, etc. between the relevant currencies are also incurred when employing a currency hedge. For instance, when the interest rate of JPY is lower than that of the relevant currencies, the interest rate gap becomes a hedging cost. Higher than expected hedging costs associated with currency hedge may be incurred depending on movements in currencies, interest rates, etc. Investors need to understand such contract specifications before investing.

ETFs tracking currency-hedged indicators and ETFs with currency hedge

For the presence of currency hedging, please refer to the name of the ETF, the securities registration statement, the management company's website, etc.